Reported by Jeanny H. Lim (swied@infothe.com)

.jpg)

Trina Solar in 2010 saw its revenue explode to US$1.86 billion, up 119.8% from 2009. And the total module shipments in 2010 were 1.06 GW, an increase of 164.8% from 2009. What contributed to achieving this outstanding performance?

The PV market saw unprecedented growth in 2010, with roughly 18 GW of installations worldwide. Our growth in 2010 was driven largely by the growing acceptance of Trina Solar as a tier 1, bankable module supplier, as well as the successful execution of our strategy to expand sales across distribution segments and geographic end markets in Europe, North America and other exciting emerging PV markets such as India, Australia and China. We also initiated the Renault F1 Team sponsorship since 2010, which helped to increase our brands awareness and global recognition.

Will Trina Solar introduce any new technologies during the remainder of the year?

We are introducing our CoMax mono c-Si cells with smaller corners, which enlarge the module’s energy generating surface by approximately 4%. Additionally, the surface of each cell now has 54 gridlines, which improves energy flow.

I believe Trina Solar will continue to focus on increasing the efficiencies of its new and existing products. What are your efficiency goals for your solar cells this year and how will you achieve them?

Trina Solar has developed a liaison program with MIT that gives us access to MIT and its resources, as well as access to technology conferences and opportunities to collaborate with MIT researchers, helping us to remain at the forefront of advanced technological developments. Trina Solar also collaborates with SERIS, Singapore’s National Institute for Applied Solar Energy Research, to develop cell processing technology, targeting a milestone 20% cell efficiency in the middle of 2012 and target cell efficiency of 21.5% in 2013, based on a test production. Finally, Trina Solar has signed a research agreement with Australia National University (ANU), which will help us attempt to develop 20% n-type monocrystalline solar cells, and increase the efficiency of Trina Solar’s solar multicrystalline cells to approximately 19%.

.jpg)

.jpg)

Taking a high-technology, high-efficiency solar cell and mass-producing it at low cost is key to mainstream adoption of solar. How are you innovating your way down the cost curve? What are you doing to bring the cost down to the mass-market rates?

Vertical integration on a single campus is essential to our recognized low-cost manufacturing platform. By also maintaining the highest standards of quality, we are able to offer our customers competitively-priced products.

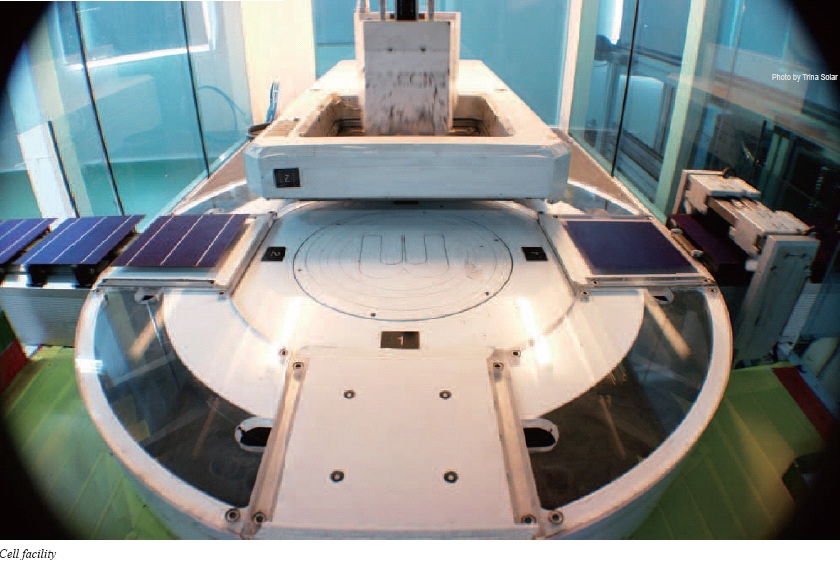

The Trina Solar PV Park is also designed to allow key suppliers to co-locate their manufacturing next to our facilities. This allows us to cut down on costs, as well as establish an R&D and manufacturing cluster effect by allowing multiple companies to share research capabilities and testing lab equipment.

What do you think is the next challenge facing you for further growth?

Over the last five years, the price of solar PV has declined dramatically, making solar more affordable than ever before. However, we are still a few years away from grid parity in most locations, and we see it as part of our responsibility to continue to drive prices down so that sooner rather than later, solar PV can be competitive with other energy sources without the support of governement subsidies.

Who are you partnering with in the U.S. to expand sales the local market? Who are you partnering with in the U.S. to expand sales the local market?

Trina Solar has always been developing long-term partnerships with large distributors. In the North American region, we are currently working with companies like Essco and Sunwize.

The market in the United States is also shifting towards more utility-scale projects. Trina Solar has worked with utilities accross the country since 2010, like Southern California Edison, to ensure we are at the forefront of this new and exciting market segment.

From your point of view, how Asia’s solar market is different from those of Europe and North America?

Generally speaking, with the exception of the Japanese market, the Asian solar markets are still in their infancy. Countries like China, India and Thailand have great potential, but very little has been acheived as of yet. One of the driving factors of market growth remains government support, and those places with the most sound policies are seeing the healthiest growth.

China is considered the leading PV manufacturing hub in the world. What will the PV manufacturing landscape look like in China this year?

There are hundreds of PV manufacturers in China, and last year more than 50% of the value chain existed in China, from silicon mining all the way down to module production. As the market tightens and price pressure intesifies, we anticipate greater industry consolidation to happen, starting with smaller companies being acquired or going out of business.

What about China as the end market for PV?

The Chinese government has recently raised its solar target from 5 GW to 10 GW by 2015. This is great news for all Chinese PV manufacturers. Currently, all lights are green for the domestic market to take off: Financing is available, manufacturing capacity is local and plentiful, prices are lower than ever, and local companies now have substantial project development experience. I am confident that China will become one of the world’s largest solar markets within the next two years.

Jeanny H. Lim is Editor-in-Chief of InterPV. Send your comments to swied@infothe.com.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2011 www.interpv.net All rights reserved. |