By Christian Grundner

.jpg)

Policy and Legal Framework

The German government has finally approved the new Energy Concept for the country, foreseeing 10 main measures to be implemented until the end of 2011. The PV lobby is disappointed because the concept mainly focuses on other technologies including. nuclear energy and announces further massive reforms of the EEG law. As a positive sign the auto-supplier model for consumers shall be promoted even more effectively than today, whereas the introduction of an optional market premium and a bonus for stable energy supply for virtual power plants is currently under review. The upgrade of the grid as foreseen in the Energy Concept rather focuses on the transport infrastructure and not on the power grid which plays the most important role for PV installations. The German government has finally approved the new Energy Concept for the country, foreseeing 10 main measures to be implemented until the end of 2011. The PV lobby is disappointed because the concept mainly focuses on other technologies including. nuclear energy and announces further massive reforms of the EEG law. As a positive sign the auto-supplier model for consumers shall be promoted even more effectively than today, whereas the introduction of an optional market premium and a bonus for stable energy supply for virtual power plants is currently under review. The upgrade of the grid as foreseen in the Energy Concept rather focuses on the transport infrastructure and not on the power grid which plays the most important role for PV installations.

The actual review of the EEG is scheduled for 2011. Changes will be valid from 2012 on, these changes most likely will include further Feed-in Tariff cuts. A market cap is discussed as well and is aiming to keep PV installations in line with government goals of around 3.5 GW per year. Whether a market cap is included in the new EEG revision or not depends largely on market developments in 2011.

Photovoltaic Sector in Germany Suffers from Worsened Image Photovoltaic Sector in Germany Suffers from Worsened Image

Currently, the image of the PV sector is suffering from bad press because the installed PV capacity is accountable for the main share of the EEG levies granted by the Renewable Energy Sources Act (EEG). The EEG levies is the sum of Feed-in Tariffs payed for renewable energy generation in Germany. Photovoltaic plants benefit from a significantly higher Feed-in Tariff per kWh compared to other technologies such as wind energy. The wind energy industry and others start to complain PV undermines the good image of renewable energy sources due to the disproportionate higher costs incurred by PV in the EEG levies.

To solve this issue, the German Solar Industry Accociation (BSW Solar) together with Roland Berger Strategy Consultants recently elaborated a detailed roadmap for the German PV industry until the year 2020. To regain trust, the roadmap sets ambitious goals for the PV sector and presents a vision of PV being one main contributor of a future 100% renewable energy mix. Starting from this vision, the following 9 objectives were defined:

1. Reduce system prices by >50% until 2020

2. Between 52 and 70 GW newly installed PV capacity until 2020; this will result in a contribution of approx. 10% to electricity generation in Germany

3. Investing at least 5% of turnovers in R&D

4. Limit allocation of PV costs to approx 2c/kWh (EEG levies)

5. Build-up module production of 8.5 GW ¡®Made in Germany¡¯

6. 12% world market share in a fast growing global market

7. At least 25 billion contribution to the German economy by 2030

8. Employ at least 130.000 people in the German PV industry

9. Be an essential part of the future energy system

In order to realize the 9 objectives, the study proposes in essence the following:

-Strengthening decentralized energy generation by continuing and increasing auto consumption of PV generated electricity

-Improving the regional distribution of PV by introducing regional factors into the support schemes

-Changing the volatile character of renewable electricity by integrating PV with other sources of renewable electricity in virtual power plants

-Facilitating the grid integration of PV by offering smart system solutions and improved possibilities to interact with other smart grid components and technologies

-Increasing cost competiveness

-Achieving a high export quota to reduce dependence on German market through strong internationalization

Slowdown of German Market Growth Expected for 2011

The German Federal Network Agency has published PV installation data for the third quarter of 2010 and in total over 5.2 GW has been installed from January to September 2010. Towards the end of the year German developers where in a rush to complete PV parks under construction because of the planned Feed-in Tariff cuts and the termination of the Feed-in Tariff for ground-mounted PV plants on farmland valid from January 1st on. Due to this rush a total of 8 GW seems realistic for the whole year of 2010. As a consequence to this massive boom in 2010 a further decrease of the Feed-in Tariff by 13% is valid since January 1st, 2011. Depending on the system size & type, PV installations earn between 21.11ct and 28.74ct. As a result, the industry expects a significant contraction of market volume in 2011. But despite these severe cuts the German market will still remain to be the biggest PV market worldwide in 2011. Industry experts estimate the volume of new installations in 2011 to be around 5 GW.

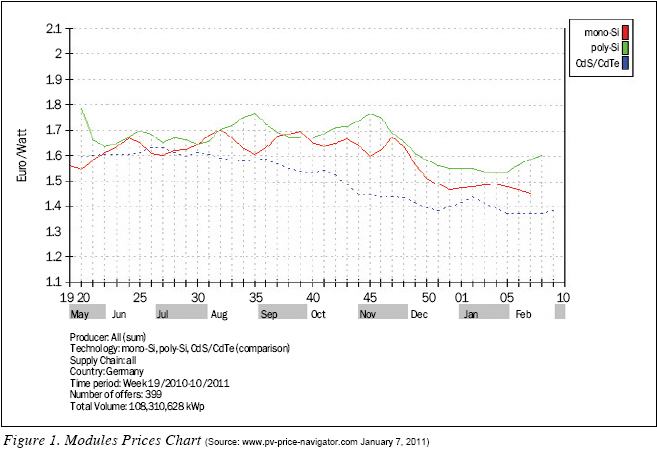

As a consequence of the reduced incentives, increased pressure on project economics will pull down module prices in 2011. The supplier market of 2010 will shift towards a more balanced market or even turn into a buyer market if emerging markets do not take over demand. The intense price competition will increase the chance that PV reaches price levels that are competitive compared to other sources of electricity. If PV manufacturers and developers manage to reduce system prices, certain PV markets with favorable irradiation conditions (e.g. Italy) will take a huge step towards a sustainable mass market that is able to survive without support schemes like Feed-in Tariffs. As Figure 1 shows, module contracts for the first weeks of the year 2011 are already traded at lower prices.

To partly offset the decreasing demand, small scale residential projects (>5kW) and industrial roof-top projects (>200kW) combined with auto-supplier model could potentially take over. Due to the special support by the German EEG the auto-supplier model (e.g. 70% Feed-in Tariff + 30% auto-supplier bonus + 30% saved electricity from utility) slowly starts to pay off economically for investors, in comparison to the full feed-in option (100% FiT). Pundits expect that the model will gain relevance in the near future because the potential to optimize economics by a smart configuration of the system is still untapped. Increasing utility rates as well as an even more attractive auto-supplier option in the EEG (as foreseen by the government) potentially could further improve project economics.

For the end of the year 2011 a new rush for installations is likely because for the beginning of 2012 the next Feed-in Tariff cut is scheduled. That¡¯s why market experts expect the market to accelerate again towards the end of 2011.

IndustryTrends

German PV Companies Need to Take Measure in Order to Survive the Expected Market Consolidation in 2011.

German PV companies most likely will need to deal with overcapacity and inventories due to increased price competition from Asian manufacturers throughout 2011. As a result, significant cost reductions are necessary in order to compete on price. In the past, companies adopted inefficiencies due to strong growth. Poorly managed companies were still successful due to strong demand that exceeded supply, which was caused by an attractive Feed-in Tariff scheme. Thus, cost reductions can be achieved through implementing a professional management and M&A activities to boost economies of scale. However, despite cost reductions, German PV companies will not be able to reach Asian price levels and also need to increase R&D spending from currently around 2% to 5% in order to come up with new and innovative products. For example, modules with higher efficiency, building integrated PV modules, innovative roof-top systems, storage technologies and smart grid integration technologies can provide the German industry with a competitive edge. German PV companies most likely will need to deal with overcapacity and inventories due to increased price competition from Asian manufacturers throughout 2011. As a result, significant cost reductions are necessary in order to compete on price. In the past, companies adopted inefficiencies due to strong growth. Poorly managed companies were still successful due to strong demand that exceeded supply, which was caused by an attractive Feed-in Tariff scheme. Thus, cost reductions can be achieved through implementing a professional management and M&A activities to boost economies of scale. However, despite cost reductions, German PV companies will not be able to reach Asian price levels and also need to increase R&D spending from currently around 2% to 5% in order to come up with new and innovative products. For example, modules with higher efficiency, building integrated PV modules, innovative roof-top systems, storage technologies and smart grid integration technologies can provide the German industry with a competitive edge.

Another way to utilize capacity and replace decreasing demand in Germany will be to significantly increase the export share. Through internationalization (Italy, U.K., U.S.A., India, China) German PV manufacturers and project developers can reduce their dependence on the German market. But internationalization strategies need to be implemented with caution because other European markets showed high volatility in the past (Spain, Czech Republic). Additionally, higher risks are especially involved in emerging markets in East Europe and Overseas. These markets should be penetrated with flexible business units and a low commitment of company assets. Countries with local content rules (Canada, India) might be avoided if they are characterized by higher volatility (e.g. policy risks), because these local content rules usually require an increased commitment of assets like manufacturing facilities. Additionally, German PV companies will need to penetrate various markets because currently international markets are operating at significantly lower volume levels compared to Germany. With a well thought through and well implemented internationalization strategy German PV companies can survive a market consolidation in 2011.

Italian Market

One of the most promising markets for German PV manufacturers is Italy. Due to eased licensing procedures, attractive Feed-in Tariffs and high solar irradiation Italy might be the market that first achieves grid parity in Europe.

Policy

One of the major bottlenecks in Italy in the past has been the regionally very inconsistent and lengthy licensing procedures. For example, the simplified licensing (30 days) procedure for PV plants below 1 MW in Apulia caused a massive deployment of plants just below 1 MW in that region, whereas in other regions this segment is still very small due to complicated licensing. Recently, the Italian government approved a long awaited decree to ease and unify these licensing procedures in order to solve this bottleneck. The ministerial decree 387/2003, debated in parliament since 2003, has finally been passed and shall streamline the delay for licensing of PV plants requiring an Autorizzazione Unica (AU) authorization (>20kW). The new decree shall ensure the completion of the AU licensing procedure in maximum 180 days. In case of delay the responsible authorities can be charged and sued for financial damages. The year 2011 will prove whether this approach will lead to significantly shortened licensing procedures. Once the license is obtained, the applicant is given fixed period of time to complete the project in order to avoid speculation. Additionally, a law similar to the simplified licensing in Apulia, that shall facilitate the licensing procedure for ground mounted PV arrays smaller than 1MW is being prepared and waits for approval by the Ministry for the Environment.

Market Cap of 3 GW Will Probably Be Reached before 2013.

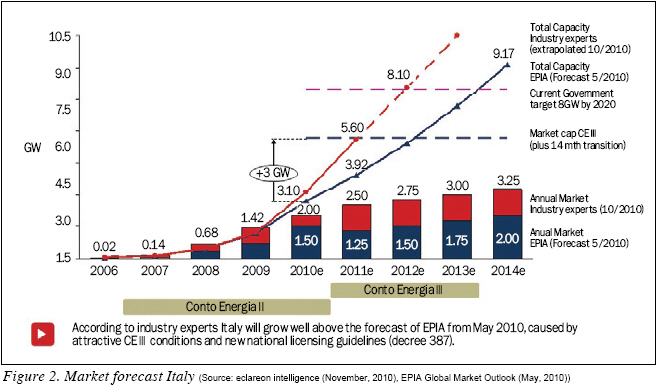

The growth prospects for 2011-2013 are good and the market cap of 3 GW will probably be reached earlier than planned. In 2010, the Italian market showed a volume of approx. 1,5-2 GW. Due to the still attractive feed-in-tariffs provided by Conto Energia III, the market cap will most likely be reached before 2013. Based upon estimates from different sources, Figure 2 shows the development of the total installed capacity and the annual market volume until 2014.

Large-Scale Plants Will Experience Further Growth due to Overcoming of the Most Imminent Bottlenecks.

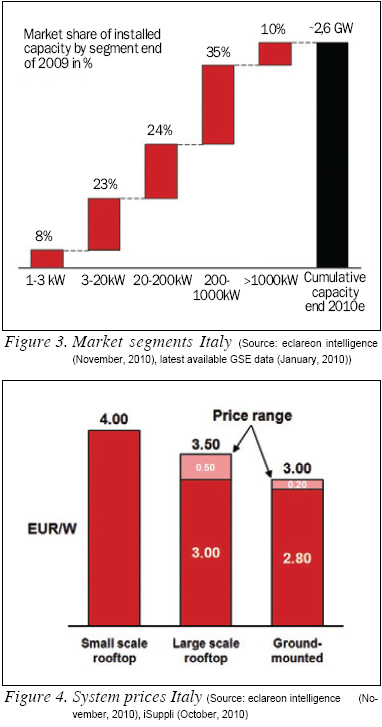

The main market segments are well balanced in Italy. Large-scale systems (>1 MW) played a minor role until 2009, but since 2010 this segment has experienced strong growth by overcoming the most imminent bottlenecks.

Figure 3 illustrates the segmentation which is based upon the latest available data from Gestore dei Servizi Energetici (GSE) by the end of 2009. Industry representatives confirmed that this segmentation was almost stable in 2010.

According to the Italian industry association (GIFI), the >1MW ground-mounted park segment is an exception because returns on investment of around 10% are currently feasible and caused strong growth in this segment.

In 2011, the segment just below 1 MW might also experience strong growth given the simplified licensing procedure (30 days) which was the main growth driver in Puglia. It will most likely be extended to the whole country in 2011.

Another growing segment is large scale rooftop installations on industrial halls. This segment benefits from less time consuming construction license procedures and from existing grid connections. Additionally, the majority of industrial halls are located in northern Italy where the grid is stable and can handle a number of megawatt systems.

In General, Italy Supports the Trend of Declining System Prices.

Although system prices in Italy are still among the highest in Europe, Italy is no exception from the global trend of declining prices. According to iSuppli, module prices in Italy dropped by 42.2% between the fourth quarter of 2008 and third quarter of 2010. As a result, systems prices reached the levels shown in Figure 4. However, from a short term perspective, prices were also notably driven by short-term peak demands in 2010. Reasons are bureaucratic hassles and a less efficient installer segment compared to Germany. This short term volatility does not necessarily affect project returns. Large-scale ground-mounted systems still achieve 8 to 9% returns and systems on agricultural or commercial buildings achieve up to 11.9% returns.

Northern Italy was very attractive for industrial and commercial roof-top installations. PV companies operating in Italy are expecting continued long-term growth in this sector and are positioning themselves accordingly. For example, a multi-year sales agreement has been announced recently by Solyndra, a manufacturer for cylindrical Photovoltaic (PV) systems for large industrial and commercial rooftops, and Sika Services AG, a manufacturer of roofing materials from Switzerland.

The Italian power park segment was booming in 2010 as well. Several large-scale projects were constructed or have recently been announced. As an example, SunEdison managed to complete and interconnect a 70 MW plant within 9 months. The array, which is located in Northeast Italy, near the town of Rovigo is now the largest single-operating PV solar power plant in Europe.

Christian Grundner is Project Manager of eclareon Management Consultants (www.eclareon.com). He is also responsible for Country Reports (most recent Italy, France), Monthly Trend Reports (Europe), and www.pv-price-navigator.com (daily updated online analytics tool for photovoltaic module prices). Grundner holds a Diploma in Business Engineering from University of Rostock and an International Diploma in Global Business Mgmt from University of California, Berkeley.

For more information, please send your e-mails to pved@infothe.com.

¨Ï2010 www.interpv.net All rights reserved.

|