By James Plastow

.jpg)

Japanese Manufacturing

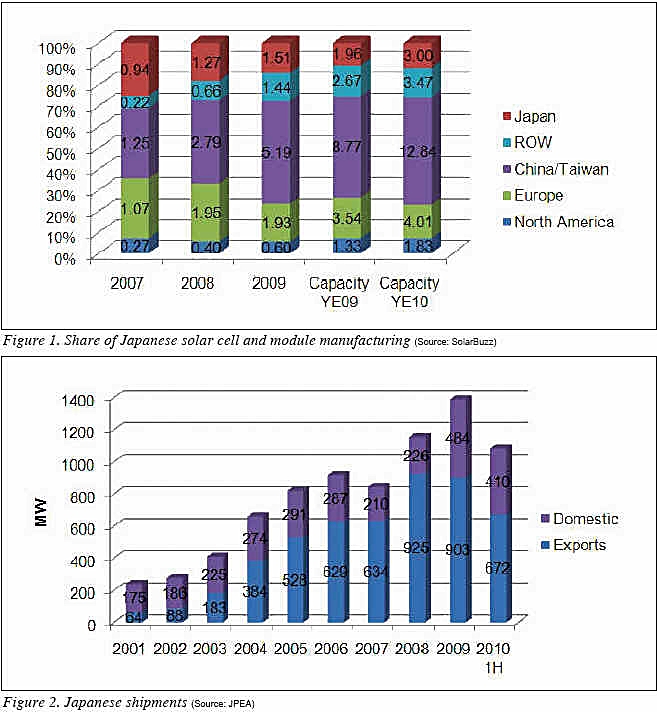

Japan has been a key country for the manufacture of solar cells and modules for many years. In the 1990¡¯s, Japan led the world in terms of shipments. In recent years, the rapid growth of Chinese manufacturing has reduced the global market share of Japanese manufacturers, but Japan remains an important manufacturing location. As shown in Figure 1, Japan¡¯s share of global solar cell and module manufacturing has fallen in recent years, but 2010 shows a slight increase in declared capacity up to 12%. Japan has been a key country for the manufacture of solar cells and modules for many years. In the 1990¡¯s, Japan led the world in terms of shipments. In recent years, the rapid growth of Chinese manufacturing has reduced the global market share of Japanese manufacturers, but Japan remains an important manufacturing location. As shown in Figure 1, Japan¡¯s share of global solar cell and module manufacturing has fallen in recent years, but 2010 shows a slight increase in declared capacity up to 12%.

Japan is home to pioneering manufacturers of mono and polycrystalline manufacturers as well as some of the earliest companies to develop thin-film modules such as amorphous silicon and CIS. For example, Solar Frontier is a global pioneer in CIS technology, which is expected to become one of the most competitive PV technologies due to its combination of high efficiency and low manufacturing cost.

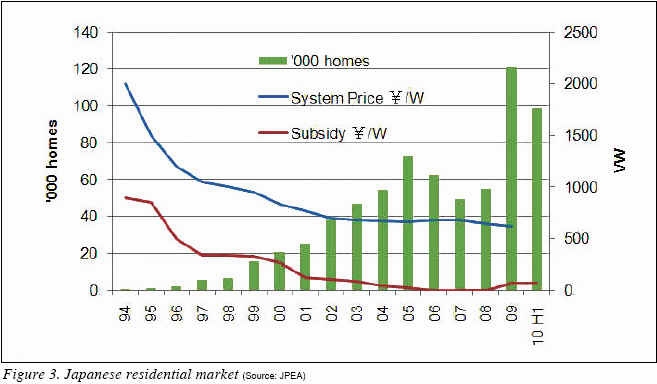

As indicated in Figure 2, for Japanese manufacturers, shipments to the domestic Japanese market outweighed exports until 2003. However, with growth in overseas markets, especially in Germany, exports outweighed domestic shipments from 2004. Although exports still account for the majority of shipments from Japanese solar manufacturers, the proportion of domestic shipments has been growing as Japanese companies have focused on the home market in 2009 and 2010. If the first half shipments of 410 MW are repeated in the second half of 2010, then Japan¡¯s market volume will reach 820 MW this year (+69% over 2009).

Japanese Market

The growth of the Japanese residential market (which accounts for around 90% of the total market) is shown in Figure 3. It can be seen that there was steady market growth up to 2005 as subsidies declined along with system prices. However in 2006, the subsidy scheme was halted and the market fell. It is noteworthy that a significant market existed even without government subsidies. From 2009, new incentives were put in place and the market grew significantly.

Crystalline is the dominant technology in Japan although thin-film modules also hold an important share and offer superior aesthetics to crystalline modules which is of high importance in Japan. For example, Solar Frontier¡¯s CIS modules have won ¡®Good Design¡¯ awards in Japan due to their integrated appearance on the roof.

The market in Japan has many features which make it unique compared to other countries.

Products

-Triangular modules--a common option available for most manufacturers to enable modules made better use of small roofs.

-Advanced color monitors--monitoring systems which allow end users to see their system¡¯s performance in real time are highly advanced and feature large color screens.

-Branded array bottom covers--a Japanese innovation whereby a black metal profile is installed along the bottom of the solar array to improve aesthetics. Often this cover piece features the logo and company name of the module manufacturer.

-BIPV from homebuilders--in Japan if you wish to build your own house you can go to a large homebuilder who will have a catalog of options from which you can design your own home. One common option offered by most of the major homebuilders is a BIPV roof.

-10 year warranties (system)--in Japan 10 year, not 25 year, warranties are the norm. However, this is a warranty not just for the modules but for the whole system.

-No foreign inverters, few foreign modules (for now)--where are no imported inverters and few imported modules in Japan currently, although Suntech has a well established presence following its purchase in 2006 of the Japanese module maker MSK. Other Chinese brands such as Trina, Canadian Solar are beginning to enter the market and Sunpower has tied up with Toshiba to market its panels in Japan.

Marketing

-Mass TV and billboard advertising--it has long been a common sight to see adverts for PV systems on TV in Japan, and you may also see billboards in train stations or in the street.

-Door to door sales--a common sales technique used in Japan is to knock on doors and try to convince the homeowner of the benefits of a solar system.

Distribution Channels

-Retail electronic stores--in Japan it is increasingly becoming common for large electronic outlets to display solar modules, enabling consumers to buy a solar system and even arrange for financing simply by visiting their local electronics store.

-Manufacturers act as system integrators--a key difference in Japan is that the module manufacturers themselves also sell BOS components and undertake training of installers.

.jpg) Incentives in Japan Incentives in Japan

Subsidies for residential PV began in Japan in 1994 and were followed by a Renewable Portfolio Standard launched in 2003. After redesigns in 1997 and 2002, the residential PV subsidy ended in October 2005. This led to a significant drop in the market and so the residential subsidy was restarted in January 2009. It was set at ¡Í70 per Wp (¢æ0.53/Wp) and stipulated a maximum system price of ¡Í700/Wp (US$5.3/Wp). In 2009 a budget of ¡Í20bn (¢æ153m) was made available, enough for 84,000 houses (286 MW).

In November 2009, a Feed-in Tariff of ¡Í48/kWh (¢æ0.40/kWh) was introduced. Although this is a high level, the period was set at 10 years and the maximum system size was set at 10 kW. For larger systems up to 500 kW a FiT of ¡Í24/kWh (¢æ0.20/kWh) was introduced. Unlike European FiTs, only surplus power generated (i.e. that not used in the home) received the FiT. In addition to the FiT the ¡Í70/W (¢æ0.58/Wp) subsidy continued but the maximum system price was reduced to ¡Í650/W (¢æ5.42/Wp) In FY2010 a budget of ¡Í40bn ( ¢æ333m) for 150,000 houses (571 MW) was made available.

In addition to the national program, 532 additional local subsidies (all 47 prefectures and city level subsidies) are also available in Japan.

As well as the subsidies for residential homes, a range of subsidies exist for public and commercial buildings, offering 50% of initial costs for schools and ¡®mega solar¡¯ plants and 33% of initial cost for public, commercial and industrial buildings.

For FY2011, it appears that the incentives will continue in a similar form, although it is likely that some details will be altered. The Japanese government remains highly supportive of PV technology.

System Costs in Japan

Figure 4 shows average system prices in Japan. It can be seen that these are somewhat higher than in Europe. However Japan is a country in which typhoons and earthquakes are common and, therefore, installations must be of extremely high quality.

Outlook for Japan

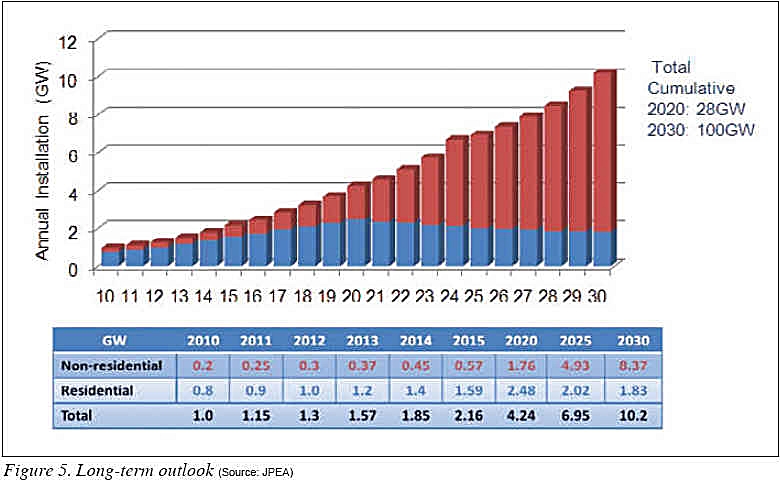

The government¡¯s future plans for PV are shown in Figure 5. A target has been set of some 100 GW of cumulative installations by 2030. It can be seen from the graph that residential systems are expected to peak in 2020 (by which time most available roofs will have been used up) and further growth will be for non-residential systems.

The market for PV in Japan is currently booming and there is strong potential for future growth with long term government support for the industry. There are a number of characteristics which make the Japanese market unique, and up to now, foreign manufacturers have had limited success in Japan. However, there is likely to be a trend of increasing imports into Japan in future years. The current strong Yen and high system prices also make Japan an attractive market for foreign firms.

James Plastow has worked in the PV industry based in Tokyo since 2002, first at MSK, then Suntech before joining Solar Frontier (www.solar-frontier.com). His first degree is in Electrical Engineering from Imperial College, London and he holds a Master¡¯s degree in Renewable Energy Systems Technology. Plastow has presented at numerous solar exhibitions around the world and has published a variety of articles on solar.

For more information, please send your e-mails to pved@infothe.com.

¨Ï2010 www.interpv.net All rights reserved. |