By Simone M.P. Arizzi, Ph.D.

In the last decade, Photovoltaic (PV) systems have emerged as a key renewable energy technology. There is no dispute that sunlight represents one of the cleanest and most abundant forms of energy. However, there are many challenges in delivering large quantities of power economically and on a global scale. In the last decade, Photovoltaic (PV) systems have emerged as a key renewable energy technology. There is no dispute that sunlight represents one of the cleanest and most abundant forms of energy. However, there are many challenges in delivering large quantities of power economically and on a global scale.

One of the most critical milestones for PV is reaching grid parity with existing electricity sources. The greatest challenges to this goal are increasing the lifetime and efficiency of PV components (cells, modules, inverters, etc.) and reducing total system costs. Significant cost reductions must be achieved before PV reaches cost parity with traditional electricity sources in most mainstream markets across the globe without the aid of government subsidies.

Given the rapid pace of PV industry innovation, which is driving up performance and driving down cost, the goal of grid parity across the globe is achievable within this decade. PV materials are an important element in the industry’s cost-down roadmap. As one of the largest materials suppliers to the PV industry, DuPont is aggressively investing in materials innovations and working closely with industry partners to help drive PV costs to grid parity in the next three to five years.

Before examining the critical role of materials in achieving grid parity, it is important to look at the current state of the PV industry following the global recession that began during the third quarter of 2008.

State of the PV Industry Today

Despite the recent global economic downturn, growth in the PV industry has shown remarkable resiliency, even with wrenching changes in pricing and incentive markets, and global capacity shifts towards Asia. While estimates vary, growth in 2009 on a unit volume basis was as much as 25% above 2008 levels.

The combination of lower-than-expected demand, higher polysilicon and module manufacturing capacity, and significant cutbacks in incentive policy in Spain caused a severe pricing downturn in 2009. Module prices in 2009 dropped approximately 40% year-over-year, and experts predict that module prices will decline another 10 to 20% in 2010. Even though demand increased due to lower prices and the acceleration of German installations in advance of that country’s anticipated 2010 feed-in-tariff reduction, module prices remain weak, a factor that is helping to accelerate the drive to grid parity.

For 2010, installations are expected to increase by 50% or greater as a result of growth in, or changes to, government stimulus programs. The most significant growth is being seen in Germany, China, Italy and the United States of America (USA). Expanding incentives and cost reductions are expected to drive significant growth in countries around the world through 2012, increasing total installation volume on a Gigawatt (GW) basis from an estimated 6.5 GW in 2009 to 17.6 GW in 2012.

Despite all this growth, bank-financed PV projects remain focused on proven or ‘bankable’ technologies. As a result, bank lending for emerging technologies such as CIGS and Concentrated Photovoltaics (CPV) is much more difficult to obtain. Consequently, these technologies are developing more slowly than incumbent crystalline silicon and thin-film (cadmium telluride and amorphous silicon) technologies.

Why Materials Matter

To reach grid parity in most mainstream markets across the globe without the aid of government subsidies or incentives, overall PV system costs must experience further significant reductions--on the order of 50 to 60%. Materials play a unique and critical role in making this happen.

The first thing to consider is cost. Materials represent approximately 30% of total PV system costs, which is much higher than the percentage of material costs for other electronic products such as displays (23%) and semiconductors (13%)--two industries with many similarities to PV that have already gone through their rapid growth phase and are now maturing. PV materials, therefore, have a much greater impact on system costs than in other large-scale electronics industry segments.

Figure 1 shows a breakdown of the cost of materials for a typical crystalline silicon module and a typical thin-film module. The data here assumed a silicon metal price of US$50-60/kg, which is typical for contract prices in the first quarter of 2010.

The second thing to consider is the role that materials play in the design and performance of the module. It is important to remember that each material chosen for a PV cell or module contributes to the overall power output, longevity and cost of the system; and these materials must work in harsh and varied outdoor environments for decades without fail.

Materials innovations can enable new cell or module designs that are more efficient, longer lasting, less expensive to manufacture and easier to install. Simply stated, selecting the right materials is crucial to bringing solar power into the mainstream.

Three Levers to Achieve Grid Parity

There are three levers that can be pulled to achieve grid parity--improved efficiency, increased lifetime and reduced system cost. The challenge is how to use science and technology to find more effective ways to pull each of these levers. Let’s look at some examples.

Improving Efficiency

Higher module efficiency delivers more power from the same module, improving performance without significantly increasing cost. By working together, materials suppliers and module manufacturers can deliver substantial upgrades in how well modules turn sunlight into electricity.

Some of the materials innovations scientists are currently developing to improve efficiency include: higher aspect ratio metallization, blue light transparent materials, materials for back contact cell designs, and high temperature polymeric substrates. These innovations allow more light capture, more conversion of that light to electrons, and better conductive pathways for electrons.

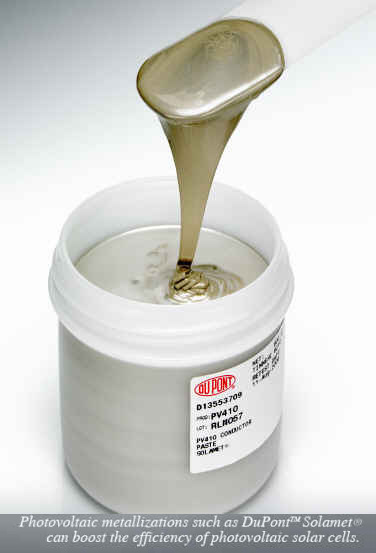

New and improved PV metallization pastes are a prime example of a materials innovation that delivers substantial efficiency improvement for crystalline silicon solar cells. Over the last six years, these metallization pastes have enabled efficiency improvements of approximately 0.2-0.3% absolute per year. New innovations in high aspect ratio metallizations and new cell architectures will deliver even higher efficiency gains in coming years.

Increasing Lifetime

Longer-lived solar cells and modules are key to improving return on investment, thereby making PV power a more cost-effective alternative. Today, 25-year module warranties are becoming standard, due in large part to the durability of the backsheet material.

DuPontTM Tedlar짋 polyvinyl fluoride films are the industry standard for PV backsheets, providing 25-plus years of proven performance, with long-term durability in all weather conditions. These films have the longest performance history in the PV industry, and provide the assurance of module life in the field needed to reassure cautious investors who finance PV systems.

To further extend the lifetime of PV modules, scientists are developing high-performance moisture barriers and even more durable backsheet and frontsheet materials. These more robust materials could help to extend module lifetimes from the current 20- to 25-year warranted life to upwards of 40 years. The implications of this type of long-term performance are significant; we estimate almost a 20% reduction in PV energy costs from extending the productive life of a module from 25 to 40 years.

Reducing Cost

.jpg) To continue the decline in overall system costs, industry experts are focusing their efforts on areas such as: faster lamination cycle times, simpler mounting and racking systems, and new innovative encapsulant films. These efforts are designed to improve manufacturing output, decrease system installation costs, reduce material consumption, or even eliminate the need for some materials altogether. To continue the decline in overall system costs, industry experts are focusing their efforts on areas such as: faster lamination cycle times, simpler mounting and racking systems, and new innovative encapsulant films. These efforts are designed to improve manufacturing output, decrease system installation costs, reduce material consumption, or even eliminate the need for some materials altogether.

For example, earlier this year DuPont introduced a new white reflective solar PV encapsulant sheet that eliminates the need for reflective paint on the back side of thin-film amorphous silicon modules. Developed in collaboration with equipment maker Oerlikon Solar, this new photovoltaic encapsulant increases light reflectivity by more than 50% versus paint, to an almost perfect 94% reflectivity. It delivers stronger adhesion than clear PVB sheet materials, translating into tougher, longer-life modules. And, it is more than 40% lighter in weight than traditional PVB encapsulants.

Another good example is provided by new ionomer encapsulant films, which can eliminate the need for edge sealing in thin-film glass-glass modules, saving module makers US$3.00 per panel compared to traditional encapsulants which require edge sealing. These ionomer encapsulants are inherently more resistant to both water and oxygen permeation into the module.

These are just two examples of how recent materials innovations are helping to reduce costs. Undoubtedly, dozens of materials innovations will come to market in the coming years from a variety of sources that will enable the closure of the ‘grid parity gap’.

.jpg)

Meeting the Challenges

Materials suppliers must make significant investments to deliver the innovations that the PV industry needs to achieve grid parity. They must also make significant capital expenditures to keep pace with the rapid growth that is expected--over 25% average annual growth in module production between 2010 and 2020, as shown in Figure 2.

We have estimated that between now and the end of this decade, capital expenditures for materials suppliers to the PV industry will exceed US$80 billion. The largest fraction of this expenditure will come from silicon metal producers.

Simone M.P. Arizzi, Ph.D., is Global Technology Director for DuPont Photovoltaic Solutions (http://photovoltaics.dupont.com). He is responsible for accelerating the introduction of the next generation of DuPont materials and offerings in this rapidly expanding market. During his 19-year career with DuPont, he has held a variety of technology and business management positions. He holds a chemical engineering degree from the ETH in Zrich, Switzerland, and a Ph.D. in chemical engineering from MIT.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2010 www.interpv.net All rights reserved.

|