By Jesse Tippett, Albert Fong

Vertical integration--which is taking the form of joint ventures, strategic partnerships and consolidation--has become a necessity, borne of market conditions rather than individual company preference. But by all accounts, a vertical integration strategy has the power to separate the pretenders from the contenders in the solar market. Through these business arrangements, the companies have better prospects for success today, and in the future, because the result is a dedicated pipeline for manufacturers¡¯ PV products and a path by which project developers can optimize system design to deliver more aggressively priced energy to utilities.

The Evolution

The solar PV boom began in Europe around 2004, as incentive feed-in tariff programs spurred 5,500 MW of worldwide PV installations within four years. But, at that time, worldwide PV manufacturing capacity had not developed to the level needed to support the demand being generated in countries like Spain and Germany. As a result, project developers would have to accept prices in a seller¡®s market for their PV equipment, and source the equipment only after all the permits and approvals were in place.

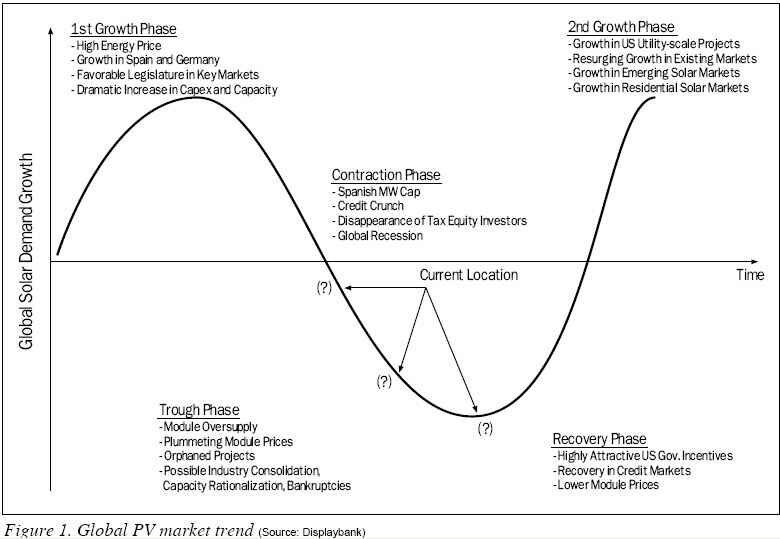

By the time manufacturing ramped up, however, the European market began to lose momentum as Feed-in Tariffs (FITs) became less generous. This, in turn, slowed project development and led to an overall softening in demand for PV installations. Momentum began to build in the United States shortly thereafter. But even though the U.S. market is poised for growth, companies still face numerous obstacles in the permitting stages, which are delaying project development. As a result, the supply-demand equation has flip-flopped from just seven years ago, and there is a glut of PV equipment waiting for projects to mature. The pattern of growth and contraction, as well as projections for the future of the PV market, is illustrated in Figure 1.

The Current State

Vertical integration, in the purest sense, is when a firm or firms have tighter control over their upstream suppliers and downstream buyers. This business strategy offers a number of benefits, including lower transaction costs, better synchronization of supply and demand, less uncertainty and the ability to develop a stronger revenue stream.

The trend of vertical integration is not unique to the solar industry. In fact, this trend has been evident in many industries as they mature, the supply and demand fluctuates because of market changes, and companies want to take advantage of economies of scale. For example, in the Internet retail industry, there was Ebay¡¯s 2007 acquisition of StubHub, which extended the online marketplace¡¯s reach into resale of event tickets. Along the same lines, there was Amazon.com¡¯s July 2010 purchase of Woot.com, which offers a deal of the day.

Other facets of the sustainability industry are also experiencing vertical integration. There have been some significant deals that have enabled companies to strengthen their position in the ethanol market. For instance, U.S. oil refiner Valero Energy Corp. purchased two plants and a silo owned by ethanol maker VeraSun Energy Corp. in early 2009. This was followed in June 2010 by similar integration in Brazil, when a new ethanol joint venture was formed between the state-run oil company Petroleo Braileiro SA and sugar producer Sao Martinho SA.

The wind energy market also has experienced vertical integration. Illustrative of the trend, in 2008, Alstom, the world¡¯s third-biggest power plant builder, announced plans to buy parts suppliers and makers of equipment for wind, solar, and biomass energy in Asia, after entering the wind market in 2007 when it purchased Ecotecnia, which had five factories that manufacture wind turbines.

In the solar market, cheaper electricity prices and the softening demand for PV equipment are creating a broader opportunity for companies at all stages of the solar value chain to partner in the early or mid-stage of project development.

Looking for a market for their products, PV equipment manufacturers are now becoming more active in forming strategic partnerships, joint ventures, or even merging with project development firms in order to effectively and quickly penetrate maturing and emerging markets. Project developers are entering into these arrangements with PV equipment manufacturers to help optimize their system design with a consistent technology and benefit from economies of scale. And for PV manufacturers, this is an aggressive move to ensure that there is a pipeline for their products¡¯sasically ensuring that they can make a market for their products instead of waiting for the market to come to them.

In the first half of 2010, there were two prominent consolidations that highlight this vertical integration trend. First, in February, SunPower Corp., a designer and manufacturer of solar technology, acquired SunRay Renewable Energy, a solar power plant developer in Europe and the Middle East. Then in late April, solar panel manufacturer First Solar announced that it was purchasing U.S. solar project developer NextLight Renewable Power, along with their 1,100 MW project pipeline.

Joint ventures between solar product manufacturers, development companies and utilities are becoming more commonplace now, as well. In late 2008, Sharp, Japan¡¯s top PV supplier, and Enel Green power, the renewable energy subsidiary of Italy¡¯s largest power company Enel, the two companies joined forces develop a number of solar PV power plants with a total capacity of 189 MW by the end of 2012. As part of this joint venture, the companies will partner with STMicroelectronics to build a photovoltaic panels plant in Sicily. In addition, Sharp and Enel have set up an equally-shared joint venture for developing solar energy plants across the Mediterranean region using the panels produced in Catania.

There are a number of joint ventures between technology manufacturers and project developers or financers. These joint ventures include:

-Suntech Power Holdings Co., which makes solar cells and panels, and MMA Renewable Ventures (now FRV), which finances, owns and operates commercial solar projects;

-Albiasa Corp., a PV project developer, and Upsolar, a designer and manufacturer of solar PV modules; and

-Grape Solar Inc., a provider of solar PV module solutions and President Solar, which will be an exclusive distributor of Grape Solar¡¯s technology in the Washington, D.C., metropolitan area.

How a Joint Venture Works

A merger of PV manufacturers and solar project developer is straightforward, bringing all the work under the umbrella of a single entity. However, there are different ways that joint ventures or strategic partnerships can be structured. In this model, the work will still be split down the partnering companies¡¯ lines of expertise--be it the underlying technology or project development. Project developers can enter into agreements to use their partner¡¯s PV technology for a financial consideration, typically a developer¡¯s fee in the low single digit percentage of project¡¯s net cost. In return, the project development company will finance the project through its conventional outlets, using only the technology from its manufacturing partner.

In this joint venture structure, it is common for the PV module company to enter into an agreement to supply technology for a specific existing project for a developer. Alternatively, a project developer can agree to develop projects up to a pre-determined amount of MW using products from the PV manufacturer, even at a greenfield or undefined project location. No matter the structure of the joint venture, the arrangement provides both the PV module manufacturer and the project developer greater control over their downstream risks, which ultimately result in a more efficient project, from start to finish, and stronger revenue growth over the long term.

Why a Project Pipeline is Needed

With newer technology coming into commercialization and efficiency gains changing so rapidly, PV equipment manufacturers need to be proactive in ensuring that they have an effective way to bring their product to market. That can be achieved by working with experienced project developers who understand the intricacies involved in the development process--from land use and permitting to power contracts, engineering and construction management.

The benefits to this type of vertical integration are numerous. For example, it results in greater transparency between organizations that bring different perspectives and experience to the PV value chain, enabling them to better understand each other¡¯s business and to make a more fluid transition from manufacturing to project implementation in the field. Additionally, the joint coordination between technology vendor and project developer has the potential to reduce deployment costs and enable systems to deliver better value to meet the competitive electricity prices that utilities are procuring through their PPA contracts.

In today¡¯s solar market environment, vertical integration can help businesses grow over the long-haul in a way that may not have been possible should they try to stand alone. This business strategy can drive efficiencies in project development, speeding time to market and time to revenue, and it enables PV equipment manufacturers to have greater control over their long-term revenue growth, rather than relying on project developers who may ultimately select a different technology once a project reaches the stage for equipment procurement.

Jesse Tippett is Managing Director and Albert Fong is Chief Project Engineer, both at Albiasa Corp. (www.albiasasolar.com).

For more information, please send your e-mails to pved@infothe.com.

¨Ï2010 www.interpv.net All rights reserved.