By EuPD Research

Preliminary Thoughts/Introduction

¡°How a former USP becomes the Achilles¡¯s heel for a whole branch¡±

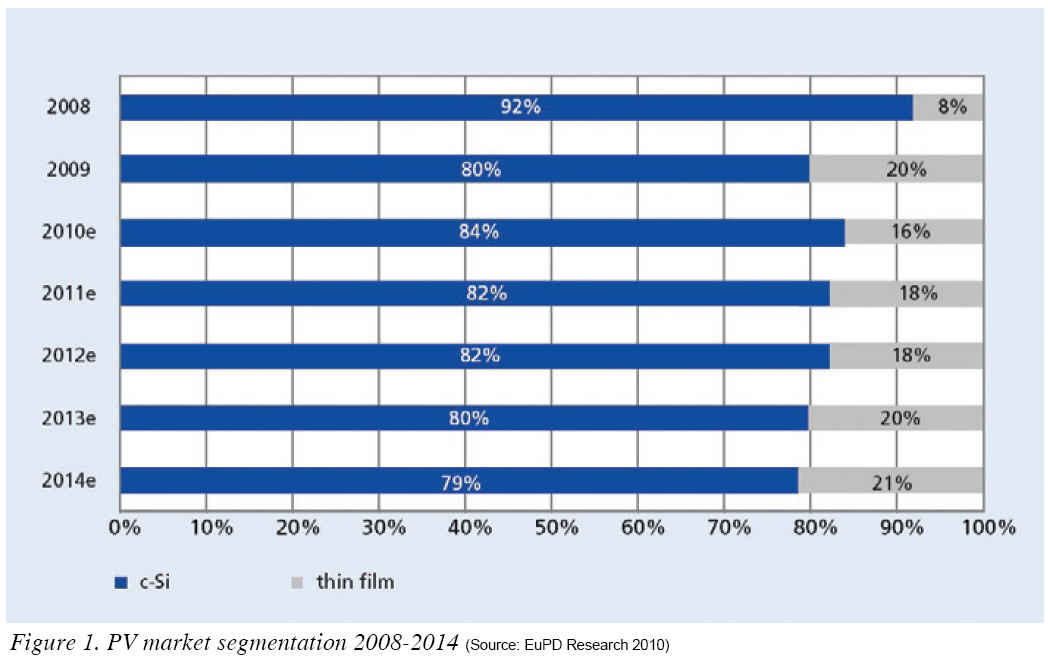

The lower cost of manufacturing solar modules has until recently been one of the thin-film industry¡¯s advantages. However, with prices of conventional silicon-based PV falling, this advantage has been significantly reduced or even removed altogether; taking with it an important argument when negotiating with banks for investment capital. Additionally, there are many small companies which are still in the development and piloting phase of their innovative technologies which have yet to prove their return on investment. As financing costs are rising, financial institutions would prefer to invest in technologies that have been proven, and currently there are only a few manufacturers who have made the successful transition to mass production. Capital procurement for thin-film companies¡¯s complete production lines is becoming increasingly difficult because of the higher investment costs for thin-film factories which is many times more than for conventional silicon-based production lines. In comparison to the more mature PV technology, crystalline silicon cells, the PV thin-film industry is still a very young and entrepreneurial branch. Despite some extremely impressive development towards becoming a mass-market application in the last few years, the thin-film industry is still in its early stage. However, first developed as a cost-effective alternative to the first and second generation of conventional crystalline silicon cells, the thin-film segment rapidly expanded from 8% market share in 2008 to 20% market share in 2009.

The reason for this substantial growth could be attributed to the global lack of suitable solar-silicon in 2007/2008, also known as the ¡®silicon bottleneck¡¯, caused by the enormous growth in the international PV markets concurrently with a significant shortage of the solar-silicon.

While within these framework conditions, the shortage of raw materials on the one hand and an unchecked global demand on the other led to an excess demand for crystalline cells, and the search for inexpensive and less silicon consuming alternatives provided a boost to the emerging thin-film industry.

In the past, the competitive disadvantages of the newly emerging thin-film applications--such as lower energy output, inferior conversion rates and problems due to the initial learning curve--could be absorbed by significantly lower production costs due to the lower material usage and easier roll-to-roll production processes.

These market conditions have completely changed within the last year: Large sales areas, such as Spain, totally collapsed in 2009, other white hopes did not perform as expected. Even though the German market outperformed all expectations in 2009, this cannot hide the fact that other markets are growing much more moderately than estimated. However, at the same time the producers of solar-silicon started running their ramped up production sites, now producing more silicon for crystalline semi-conductors.

This led to a drastic decline in prices for conventional, silicon-based solar cells and brought them abruptly within reach of the less expensive thin-film cells. This cost advantage is now dwindling, while the disadvantage of lower yields and energy outputs is not yet fully equalized. Aggressive pricing, once the thin-film branches¡¯s advantageous USP, is now becoming its very own Achilles¡¯s heel.

PV Thin Film Industry 1.0--2007 to 2009

¡°The Nike Strategy: Just Do It!¡± Nevertheless, the boom times of 2007 and 2008, when the demand for PV modules seemed almost boundless, countless start-ups, spin-offs and new market entrants have emerged, especially in the thin-film sector. Currently, more than 140 thin-film players are operating in the global PV industry. While only few of them are first movers with an already established market position and proven mass production, most of the companies entered the market during the ¡®gold rush¡¯ of 2008/2009.

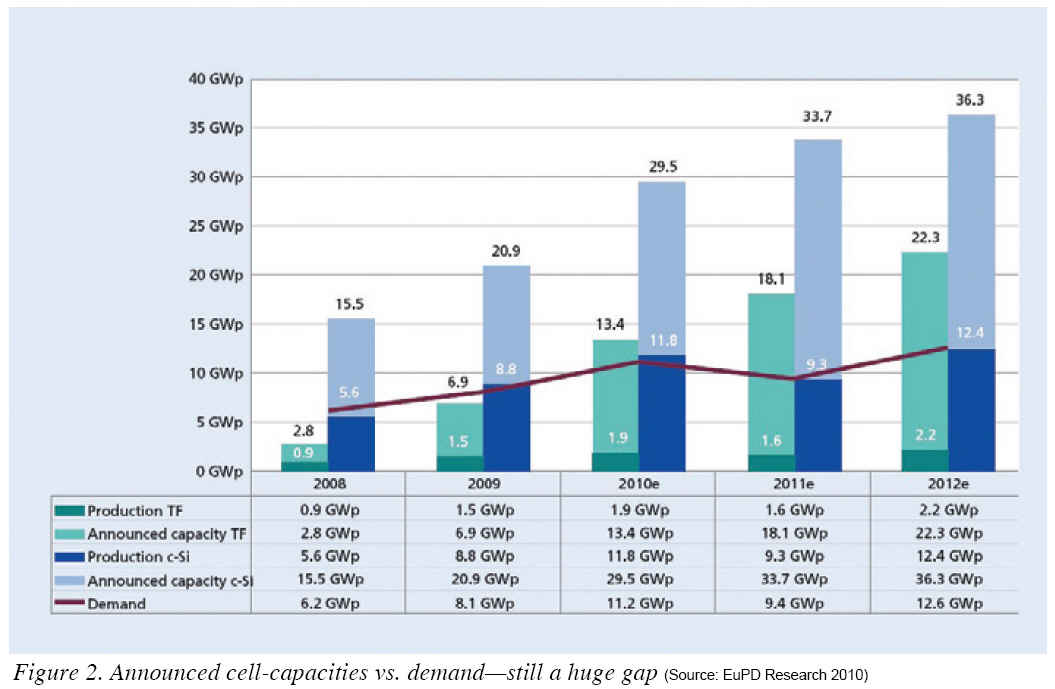

At that time, the amorphous silicon (a-Si) sector alone, recorded no less than 40 manufacturers initiating production and a further 42 manufactures announcing production. These announced capacities amount to 13.4 GWp for 2010.

These output rates have stunned market experts as such capacities are far beyond the current demand and outnumber even optimistic expectations. Even considering the significant gap that always exists between the announced and actual capacity, these numbers reflect the ambitious goals of the branch. Nevertheless, most of these companies are still in a very early phase of development and have at best launched small-size productions, if not only pilot lines.

Considering the often-cited factor of the ¡®economies of scale--meaning that only large-scale production or volume throughput will significantly decrease the costs of the production process--it is even harder to understand why there are so many companies producing only small lots of mostly double-digit MW in a tightening sales market. This raises the question of how these companies will survive in an increasingly competitive market environment.

Several strategies and some of the most likely future scenarios will be briefly outlined in the following:

-Oversupply leads to market consolidation: As a consequence of the rapid expansion on the manufacturers side within the last few years and the collapse of the Spanish market on September 30, 2009, the supply side has since outnumbered the demand by far. This development has transformed the market from a sellers¡¯ to a buyers¡¯ market. In addition to that, even the ¡®white hopes¡¯ (FR, IT, GR, US, Eastern-EU) have developed at a much slower pace than expected. Given this situation, a massive market consolidation is one very likely scenario.

-From thin-film 1.0 to thin-film 2.0: The prospects of a tightening market and a consolidation process at hand will lead to a fundamental rethinking within the branch. While the technical aspects--such as handling the production processes, getting the foundations ready for mass-production and overcoming the pilot production phase--were the branches¡¯ focus for too long, the market-economic factors are gaining more and more importance. From now on market development is the determining variable for future growth.

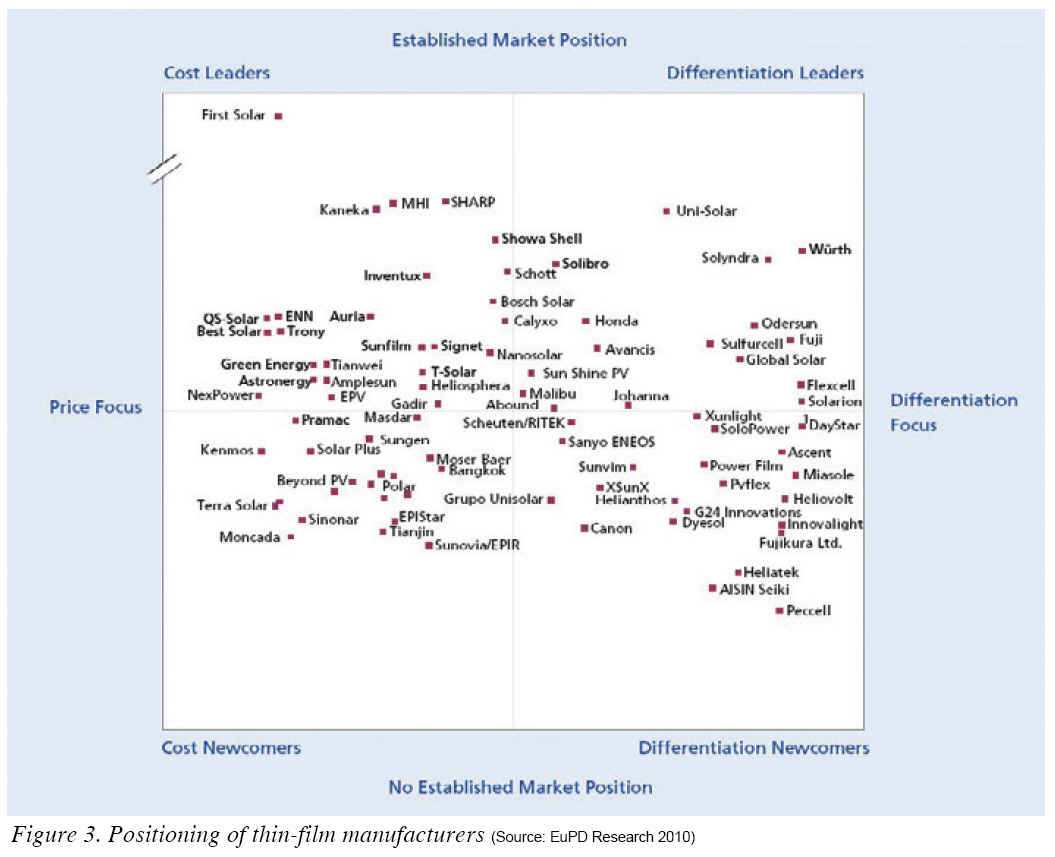

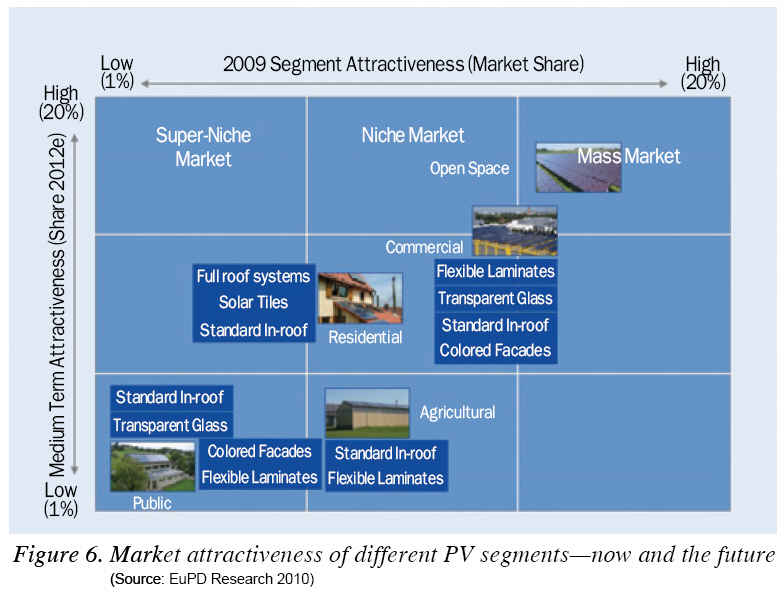

-Differentiation--niche vs. mass-market: Given the future scenarios outlined above, thin-film producers will not be successful in the future by just following the beaten path of cost reduction or scale-up processes at any costs. A single-sided focus on either cost leadership or economies of scale by ramping up Giga fabs will not lead to the desired results for most companies. Therefore, a differentiation by identifying one¡¯s own USPs will be key, especially for market newcomers. Special applications, higher efficiency, a unique design or a strong corporate brand could be some of the possible approaches to strengthening market position.

-Furthermore, companies need to identify their market position: Are the products suitable for the mass market, e.g., large open-space plants, or are the products more suitable for a niche or a super-niche segment, such as solar tiles, in-roof solutions or e.g., flexible laminates where lower efficiency can be absorbed by a foolproof installation process.

-Heavyweights Weighing in: As more and more global corporations, multi national companies and recognized brand names enter the market, they are able to quickly shift market segmentation, introduce new pricing and business models and affect market growth. For example, the announced support for the thin-film branch by merely a handful of global corporation that has taken place since the second half of 2009, may be generating a shift in acceptance and bankability of this branch, in anticipation of rapid maturation of technologies and ramp up of large-scale production facilities

PV Market Development

¡°Grid Parity is a Milestone, not the Target¡±

The above mentioned output rates recently announced by the thin-film players show very clearly that there is once again a significant imbalance between the forecasted demand for PV components--both crystalline and thin-film--and the producer¡¯s expectations according to their output. While earlier it had been mainly the technical feasibility or the raw material supply that determined global PV market expansion, market-economics factors will gain significance in the future.

Even the hope of achieving grid parity, meaning that solar electricity can soon be produced at the price of conventional electricity, cannot be seen as the all-embracing remedy. Grid parity, achieved by further cost reductions on the production side, is in fact one important milestone on the technology¡¯s way to competitiveness but this alone will not be sufficient for an ¡®explosion¡¯ of the market or a skyrocketing increase of demand.

At the moment, the demand for PV systems is mainly driven by the rate of return, regardless of the sales area. This raises the question of how high the rate of return is going to be in the future, assuming that the generated electricity from solar power plants can be sold at a price level comparable to conventional energy. This would mean that the revenues and the expenditures would be in balance and spending would equal income.

A massive effect on the demand is foreseeable.

While the achievement of grid parity will significantly loosen the branch¡¯s dependency on political incentives, it will not generally overcome the need for further political promotion. Other milestones, being as significant as grid parity, can be seen in further improvements concerning the storage problems, in the promotion of Smart Grid or in technological innovations in the field of localized self-consumption. Real energy self-sufficiency could be a tremendously attractive sales argument for all PV applications in the future.

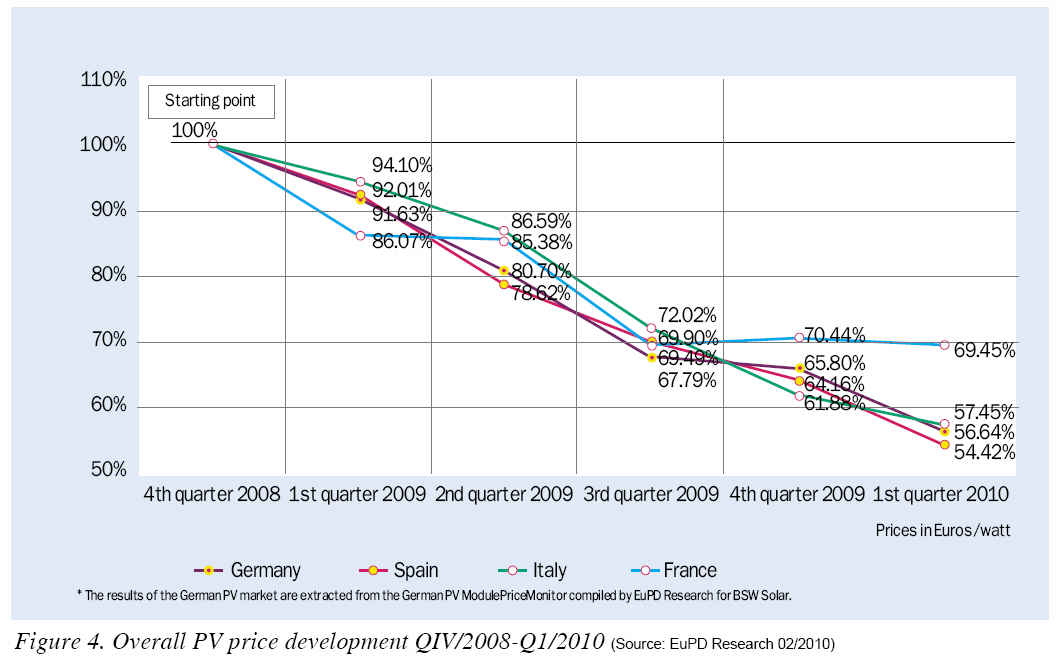

Although the branch has shown its impressive potential regarding cost reduction over the past year, the future outlook is overshadowed by shrinking margins on the one side and higher sales throughput on the other. The massive decline in module prices, by about 40% within the last 15 months, shows that some suppliers are already operating at their marginal costs. This development has hit the ¡®youngsters¡¯ of the thin-film industry especially hard. While by now only First Solar seems to be able to profitably mass-produce in this price corridor, other players still suffer from their late start and their backlog with regards to the technological life cycle.

The predominance of First Solar is best reflected by the industry figures, such as their current market share. While the global thin-film market share has increased significantly over the years to at least 20% in 2009, the number of thin-film players has increased even more rapidly. Currently 35% of all module producers are active within the thin-film segment, producing one fifth of the global supply. In real figures this corresponds to nearly 1.5 GW of modules in 2009 whereof 1.1 GW has already been produced by the market leader, First Solar. This results in a highly intensive crowding out where 140 players are fighting hard for their piece of the action in an overall market segment of less than 5%.

The Impact --PV Thin Film Industry 2.0

¡°The Future is the Giga Fab--but not for 150 Companies¡±

Aside from the general market growth, consolidation pressure is going to increase significantly in the near future. Companies that are not ¡®best-in-class¡¯ will face uncertain times, regardless of whether they are from the thin-film industry or from the conventional crystalline segment. Offering a competitive, cost-effective and high-performance product will still be a necessity in the future, but focusing only on product competitiveness will no longer be a sufficient strategy. Besides the above mentioned diversification, e.g., finding an individual market niche or developing a special application to satisfy a particular need, an efficient and powerful sales channel architecture as well as suitable distribution channels will be essential to further penetrate the market. This is where established players, once again, are in the lead. Therewith suppliers which are not able to launch their products successfully or place them in the right markets are doomed to failure, even if their cells are highly cost-effective and the performances are outstanding.

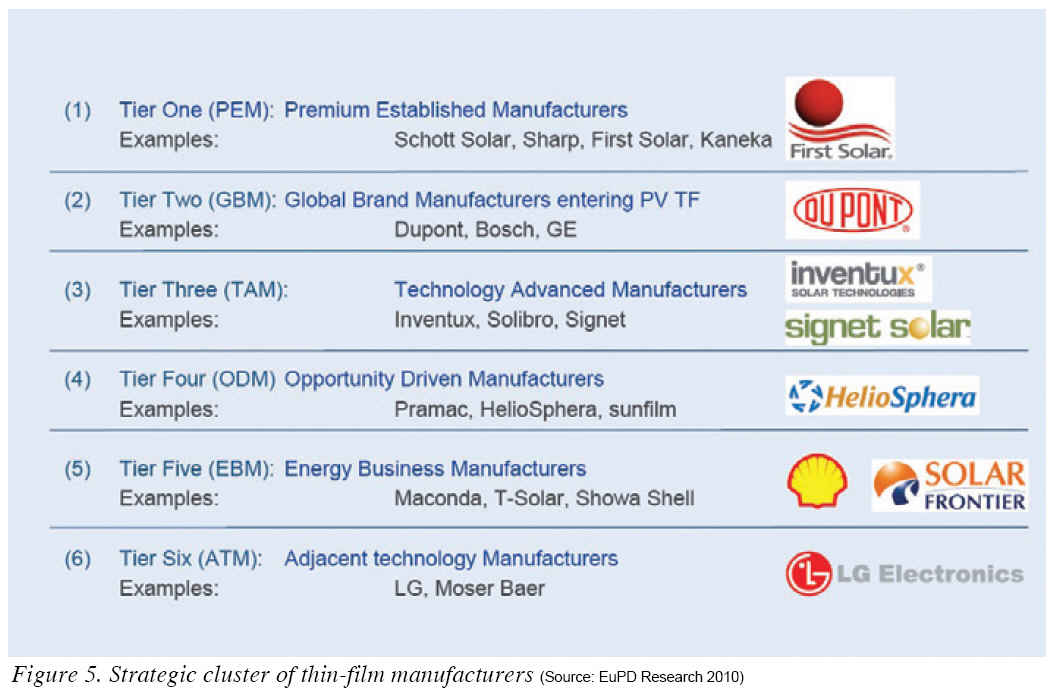

This leads to the question, which strategic clusters can actually be identified in the thin-film industry so far. If one classifies the current players, at least six ¡®classes¡®--the so-called tier groups--can be identified. Tier One, the premium established manufacturers have the clear advantage of their very early market entrance.

These companies are typical ¡®first movers¡¯ with the greatest experience in terms of production and with strong, established market shares. The Tier Two group consists of large global brand manufacturers which entered the thin-film industry due to the promising development in the past. Most of these companies do not have a strong PV background, but their sheer financial capacity makes these players very attractive and persistent. Furthermore, most companies have already built up a strong and reliable brand and most Tier Two firms are experienced in market penetration and mass-production.

In contrast, the Tier Three companies, PV suppliers with a strong technological focus, see their USP in maintaining a strong and innovative research and development department. The Tier Four group is dominated by opportunity driven manufacturers. These companies have recognized the potential of the thin-film industry and pin their hopes on turnkey solutions. This strategy is also known as the persecutors strategy. Similar to the global brand manufacturers of Tier Two, the Tier Five group consists of manufacturers from the conventional energy business. These suppliers enjoy the same advantages in terms of financial capacity and brand awareness as the global brand manufacturers do. ¡®career changers¡¯, meaning those companies from neighbouring industry segments which are joining thin-film production now, build the last group of the adjacent technology manufacturers. These Tier 6 companies are mainly from the LCD or flat-panel industry and have proven skills in cheap mass-production and distribution.

This raises the question--which strategy would be the best to withstand the turbulences of an upcoming shake out within the branch. Either a company is already in the lead, e.g., by being ¡®best-in-class¡¯ or a company has a serious backlog due to various reasons, such as its late start, a low cash-flow or an inferior technology. In both cases competitiveness in all four dimensions--price, product, place and promotion--is the key to gaining new market shares.

Especially the newcomers, if they are not part of the financially strong Tier Two or Tier Five group, could face serious trouble if they cannot quickly identify a suitable niche. While some big players are already announcing to postpone their thin-film activities in the case of a moderate development of the markets, some of the smaller companies have already put all their eggs in one basket.

Nevertheless, the consolidation process--which has not yet occurred--will seriously separate the winners from the losers in the near future. In the long term, only a few specialists with highly specialized solutions will maintain their place in the market and only a few market leaders are going to be able to handle the mass market segment. Therefore, further investments and scale-ups will only make sense for those companies that are trying to develop in the highly cost-competitive open space segment.

Smaller companies should consider their initial strength as that of being more flexible than the bigger players and should therefore intensify the niche or even super-niche strategy.

To successfully react to the changing photovoltaic market environment in the future, cost reductions are inescapable. Product differentiation plays a role alongside this to tap into new markets and applications with innovative products. One of the most interesting fields is Building-Integrated Photovoltaics (BIPV). This niche application is still at a relatively low development level. With the comparably high system costs, the global market shares are still minimal. Only the countries which offer particular subsidies for BIPV have been able to achieve mentionable shares--such as France. In the future, this niche technology could become a lucrative playing field in other national markets.

Outlook 2010--The Photovoltaic Industry Will Become More Global

¡°The thin-film product life cycle--from introduction to growth stage?¡±

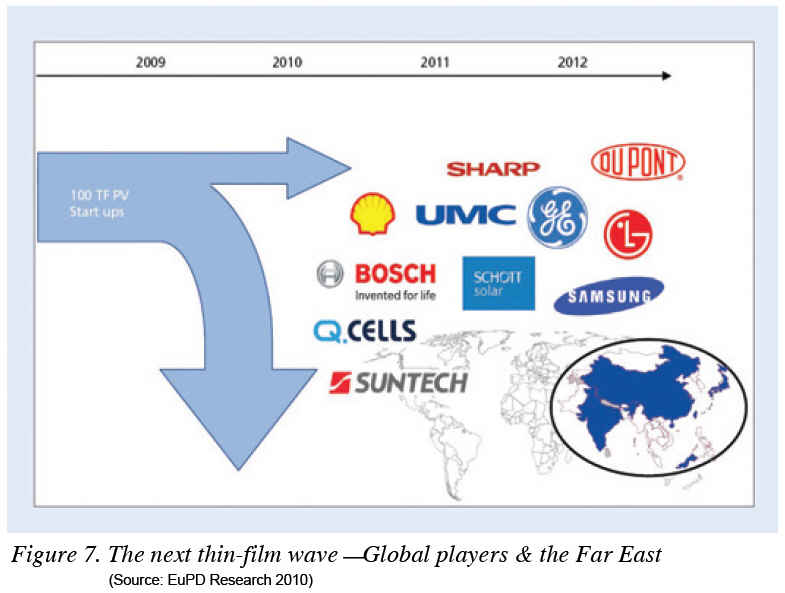

Global-scale manufacturers are already stepping into the thin-film branch, with multinational companies from both energy and technology sectors either active or announcing plans to engage. This movement, together with the consolidation of small manufacturers or their specialization in niche markets, will help this industry to overcome its childhood instability and gain the critical mass that will result from multiple sources for large-scale production at competitive pricing, in contrast to the current situation of a single large-scale manufacturer flanked by many small manufacturers.

To stay competitive, both, small manufacturers with specialized products and large-scale manufacturers competing on large projects, will need to maintain their edge in all fronts and offer improvements in cost, quality and long-term product durability. Process improvements and innovations will be introduced periodically, somewhat similar to ¡®Moore¡¯s law¡¯ in the semiconductor industry, allowing each generation of thin-film panels to achieve an incremental improvement in performance. Process control, and state-of-the-art in-house engineering, or cross-licensing, will be one of the key enablers to this.

In the coming years, the photovoltaic industry is likely to develop into an even more global branch and will free itself from dependency on individual national markets like Germany. However, it has to be assumed that the German market will remain the driving force behind the worldwide PV industry in 2010. This will be the case despite recently announced reductions in subsidy levels. In Europe, the relevance of other markets will increase, like Italy or France which are likely to grow in the three-digit MW range. Looking across the Atlantic shows that the United States will continue on the road to becoming one of the largest PV markets in the world with an estimated newly-installed capacity of over one GW for the first time. In Asia, the relevance of China, in particular, will increase for the photovoltaic industry.

To date the country has mainly been a manufacturer and exporter of PV goods, as manufacturers upped their world market shares continually and the output of crystalline cells and modules has obviously moved from Europe and North America to China. Despite this, China has not had an established domestic market before now, but the introduction of two promotional tariffs last year could change the market. The programs should not be seen as much more than the first steps towards support for photovoltaics, but in the future they could be the basis of rapid market growth as the energy requirements and solar potential of the country are both enormous. The long-term commitment of the Chinese government to PV is showing signs of finally initiating a rapid market growth. It is our belief that the market is currently underestimated by most analysts.

2010-2011 has the potential to show rapid and steady growth, influenced by long-term government policies which are less sensitive to fluctuations in oil prices or silicon feedstock prices. Along with China, Japan is another country of interest on the solar map. Once the motherland of PV promotion, the sales market lost most of its significance after the promotional program ran out in 2005. This could rise again with a new program as money is available to subsidize around 500 MW of PV systems, although this will probably run out very quickly. In the light of the strong domestic photovoltaic industry it has to be assumed that the program will be expanded in years to come.

Despite the crisis in 2009, the future of the global photovoltaic industry is not bleak, and falling module prices as well as the need for clean electricity production are likely to stimulate constant demand for photovoltaic systems over the next few years. However, for each company there is a strategic need to define its individual position in a very competitive market environment.

EuPD Research (www.eupd-research.com) is a B2B market researcher for public and private companies and the media. As an international service provider, EuPD Research offers a wide range of qualitative and quantitative research services based on many years of experience, particularly on global PV markets. For e-Paper, visit http://www.eupd-research.com/ePaper/thinfilm/epaper/

For more information, please send your e-mails to pved@infothe.com.

¨Ï2010 www.interpv.net All rights reserved.

|