A projected Q/Q rise of 22% in the Q4’11 European photovoltaic market is providing a welcome temporary boost for downstream solar companies. However, this growth rate still leaves significant corporate challenges in the management of the tumultuous slowdown this year in the world’s largest regional photovoltaic market. The downstream challenge in 2012 will be effective management of a new pricing environment, against a backdrop of declining incentives and still-to-be-realized grid parity economics.

Although up 22% Q/Q, Y/Y growth is forecast to drop 25% in for several reasons: major cuts in solar incentives, a weak project financing environment, and a module price path collapsing so fast that it has left downstream companies needing to offload inventories or face significant write-downs.

The trend of rapidly falling module prices, down 32% Y/Y at the distributor level at the end of Q3’11, has provided a compelling rationale for many downstream companies and end-customers alike to defer purchases in the expectation of further price cuts. In Germany, the prospect of a 15% tariff cut due at the start of 2012 has finally given the market a large enough boost to secure the largest share of the Q4’11 European market. However, it will be overtaken by Italy as the largest European (and global) market in 2011, despite tight bank lending constraints in Italy.

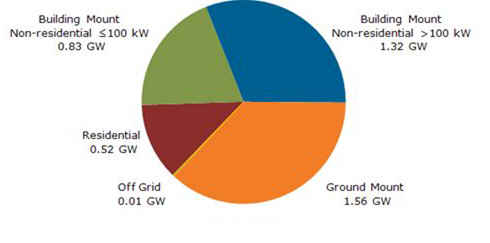

Ground mounted installations, while down 27% in 2011, took over one-third of the European market in H2’11 following a largely seasonal pattern of rising share towards the end of the year. Non-residential building mounted systems will take 55% share in 2011.

The European markets are constrained, to varying extents, by tightening of PV incentive policies, bank lending restrictions, and utility concerns over electricity grid stability as PV deployment spreads. Additionally, policy changes made by various European governments, including the United Kingdom last week, have had some significant and largely unintended consequences.

“Falling prices have compensated for major cuts in government solar incentives to leave PV investment returns still sufficiently attractive in almost all markets. However, the more important consequence of frequently changing incentive policies across Europe has been greater uncertainty and therefore higher risk for project financiers. This has come at the worst time for banks also suffering under macro-economic and currency crises,” noted Alan Turner, Vice President of Solarbuzz Europe.

Figure 1: Q3’11 European Market Segmentation (Total Quarterly Market 4.24 GW)

Source: Solarbuzz European PV Markets Quarterly

Downstream Companies Will Need to Develop Highly Selective Market Segment Strategies

The Q1’12 market in Europe is projected to be down 72% Q/Q, with the ground mount segment the hardest hit (down 81%) and residential least affected (down 41%). At the country level, Greece, Spain, and the UK provide the highest incremental market share growth opportunities. The German market is forecast to fall 11% Y/Y in 2012. Installed system prices are forecast to decline by an average of 17% in 2012.

The successful realization of the benefits of grid parity will require grid management concerns to be overcome as developers, especially in Southern Europe, start to plan projects financed on the basis of power purchase agreements. Meanwhile, downstream companies in France and Italy are receding from the high risk project business to focus on the small roof sector or distribution.

Smaller markets offering the most stable volumes or growth potential over next 1-5 years are Austria, Belgium, Bulgaria, Greece, Romania, Spain, Ukraine, and the UK. Although the latter is facing severe proposed tariff cuts, its residential segment will retain attractive returns with prices continuing to fall. In the major markets, residential is the strongest segment in Belgium and the UK, while ground mount is strongest in Greece and Spain. The other major markets have a more balanced segment mix. France and Italy present the largest forecast quarterly variations in segment mix through 2012.

The new Solarbuzz European PV Markets Quarterly report addresses the challenges and opportunities facing downstream companies in the face of slowing growth and falling prices to help them focus their marketing activities on the specific segments in certain countries that remain attractive in the near term.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2011 www.interpv.net All rights reserved.

|