With the Spanish market limited by regulatory hurdles, Italy and France are moving the European Photovoltaic (PV) industry forward by contributing significant growth in the near term. Meanwhile, southern Europe’s long-term growth prospects, with 38 GW of new projects expected by 2020, are expected to help pull the global PV industry out of its current slump, according to a new study from Emerging Energy Research, one of the leading providers of clean and renewable energy market analysis.

Figure 1. Grid-connected PV systems in Italy by year (MW) (Source: Emerging Energy Research, Southern Europe Solar PV Markets and Strategies, 2009-2020)

Southern Europe was expected to account for approximately 25% of 2009 additions in Europe behind Germany, the leading European PV market at 67%. In Domino-like fashion, PV development is scaling across southern Europe, with 47 GW of capacity forecasted through 2020, significant growth from the 9 GW installed to date. Central to the surge is increased regulatory clarity regarding Feed-in Tariffs (FiTs), long-term national targets dedicated to PV, and volatile electricity prices, according to EER’s new study.

Newfound interest in PV by established European utilities and independent power producers is lending greater credibility to Southern Europe’s PV sector. State-owned EDF and Enel have already begun to impact the markets with their own project development strategies. “Increasing utility involvement, more focus on rooftop systems, the importance of a stable incentive regime, and clear and easy permitting are key to long-term growth of Southern Europe’s PV sector,” says EER Solar Research Director, Reese Tisdale.

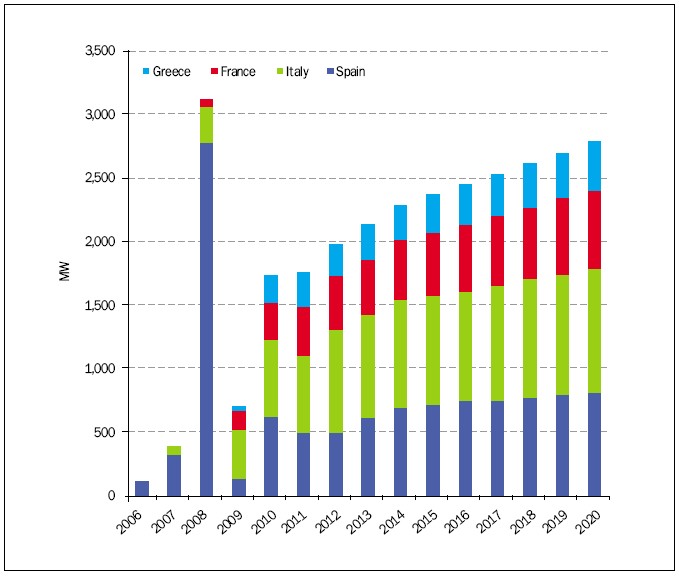

Figure 2. Grid-connected PV additions (Source: Emerging Energy Research, Southern Europe Solar PV Markets and Strategies: 2009-2020)

EER projects Italy to be the strongest of the Southern European markets in the near term. “Italy’s robust FiT has ignited the Italian PV market and attracted significant attention from players along the supply chain. An increasing number of domestic and international developers are scaling their activities to advance the rooftop and ground-based segments,” says Tisdale.

Alongside Italy, clear regulatory initiatives in France are rapidly aligning to turn France into one of the more stable markets in Europe. France is transitioning from a relatively inactive market, with 128 MW of installed capacity as of June 2009, to one that may surpass 800 MW per year by 2012, driven by a stable and transparent incentive system. Spain, the largest PV market globally in 2008 with 2.8 GW installed, fell back to a more pedestrian 125 MW in 2009. Less than a year ago, Spain was the fastest-growing solar PV market in the world, accounting for more than 40% of the world’s total PV installations in 2008. However, the government’s revisions to the PV FiT regime in September 2008, coupled with the global financial crisis, radically reined in the booming Spanish PV market. Still, opportunities exist on a broader level for larger players to pick up permitted projects unable to be developed by existing permit holders, and longer-term policy changes are expected to get growth back on track in the medium term.

The solar PV industry’s success in Europe hinges on FiT regimes and developers’ visibility into tariff changes going forward. As seen in the mercurial Spanish market, and more positively, in France and Italy, sudden FiT rate changes by regulators have significant impact on PV development activity,” says Tisdale.

Greece, still struggling to get past its permitting constraints, is on the cusp of joining the other growing southern European countries, but at a smaller scale. While the PV sector and its disparate technology solutions are in their infancy, legislators are exploring a number of strategies to encourage the sector’s growth without repeating the mistakes of Spain. The long-stagnating Greek PV market is set to scale rapidly in 2010, pending the government’s ability to sort through 3.7 GW of permits currently in the queue.

“The Greek market is at a pivotal juncture--it will either open up for more aggressive development in 2010 or remain hobbled by the Greek bureaucracy,” says Tisdale.

Further Information: Emerging Energy Research (www.emerging-energy.com)

For more information, please send your e-mails to pved@infothe.com.

© www.interpv.net All rights reserved

|