By Michael S. Davies

As a general economic rule, price is often established according to the market dynamics of supply and demand. However, in the real world there are many factors that contribute to price change including cyclical events, marketing strategies, and secular trends producing both long- and short-term pricing impact. Pricing for solar PV is being influenced by several factors including changes in government incentives, inventory buildup, technological innovation and advances in manufacturing processes. We believe that some of the drivers impacting solar PV prices will provide long-term benefits enabling solar PV to achieve parity with grid pricing.

The primary driver of solar PV prices is declining production costs achieved through expanding production, improving efficiencies, and advanced materials. The more notable events impacting solar PV prices include:

● The inventory buildup among large manufacturers;

● New sources of additional capacity coming online;

● Price competition; and,

● Innovative materials and production processes.

Let’s review the cyclical and secular trends that have shaped the PV market and identify the key trends that have a more sustainable impact on solar PV prices.

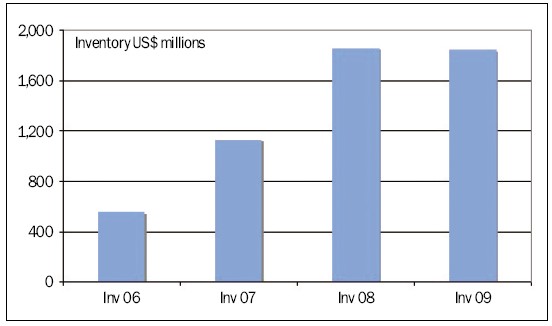

Figure 1. Solar PV inventory (Source: Company reports, Green Econometrics research)

Cyclical Events

The most visible cyclical event to impact PV prices was a buildup in inventories. The largest suppliers expanded production while demand began to slow as government subsidies were scaled back, only to be exacerbated by a global economic recession. The explosive growth in PV sales as seen in Germany and Spain from 2007 until 2008 has abated. The restructuring and changes to feed-in tariff programs dramatically slowed solar PV installations across Europe. In addition, new PV suppliers entered the market while the larger suppliers increased production. These government policy changes combined with an ensuing global economic crisis culminated in rising inventory, an important and visible financial metric. The confluence of these events exacerbated inventory buildup and pricing pressure, hence the careful attention to changes and direction to inventory levels. From Figure 1, aggregate inventory levels for the 11 largest publicly traded PV suppliers increased 236% from 2006 to 2008. The rapid rise in inventories was driven by demand as revenues for these 11 PV suppliers increased 492% over this same period. However, the changes in government incentives for solar and the global economy slowing, inventories were left elevated. Latest data suggests inventory levels are back in line with revenue expectations as measured by Days Sales of Inventory (DSI) that is now down to 82 days in 3Q/2009 as apposed to 107 days in 2008. With inventory at leaner levels, further impact on PV module pricing should be negligible.

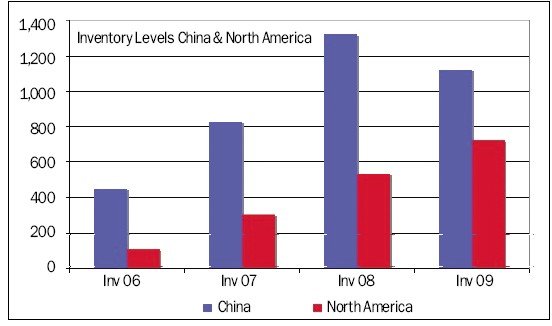

Figure 2. PV inventory: China and North America (Source: Company reports, Green Econometrics research)

On a geographic basis, the rise in PV module inventory levels was most noticeable in Asia. Most of the increases in PV module inventory levels were among large PV suppliers in China. Among the six largest PV module suppliers in China, inventory levels increased from US$448 million in 2006 to US$824 million in 2007 and to US$1.3 billion in 2008. As seen in Figure 2, the most dramatic inventory increase was in China comprising over 70% of the PV module inventories. Inventory levels among PV suppliers domiciled in North America increased over 400% from 2006 to 2008, due in part, to their lower base of less than 30% of the aggregate PV inventories, while inventory levels among PV suppliers located in China increased 195%. The inventory buildup was justified considering that revenues increased nearly 500% from 2006 to 2008 for these leading PV suppliers.

With the global economy in recession, the elevated inventory levels together with rising productions, resulted in heightened pricing pressure. In addition, pricing emerged as a useful marketing tool for PV suppliers to build distribution channels. Declining production costs associated with volume, experience, and process, enabled PV suppliers to gain advantages as low cost suppliers. Inventory buildup and pricing to establish distribution acted to accelerate price declines.

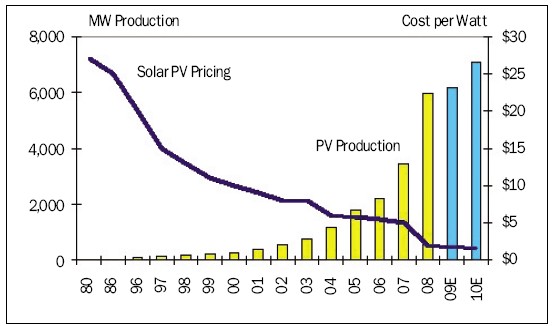

Figure 3. Solar PV price/watt and production (Source: O’Meara, Prometheus Institute, Solarbuzz, and Green Econometrics research)

Secular Trends

As solar PV installations slowed in Europe, suppliers used pricing to penetrate the U.S. market. PV suppliers designed marketing strategies using price to build distribution channels in North America. With price as a marketing tactic, PV supplier’s resources are directed towards lowering production costs. Low-cost production emerges as the key competitive advantage driven by scale, innovation, production processes, and advanced materials.

Often suppliers develop pricing models based on competition, variable costs, and demand elasticity in setting price points. Both suppliers in Asia and North America invested into building distribution channels, and in particular, given the low market penetration of solar energy in the U.S., building U.S. distribution often relies on using price to gain market entry. As a consequence of PV suppliers determined to expand their distribution channels, competitive pricing has lead to further solar PV price reductions.

The effective use of price in marketing depends on the elasticity of demand, the measure of changes to units sales to price change. Elasticity of demand can be influenced by competitive pricing, relative cost of substitutes, perceived value, and available incentives that bring solar closer to grid parity. Changes in the relative price of hydrocarbon fuels may also have a financial impact on solar purchasing decisions. Because there are many factors influencing demand, demand elasticity is more difficult to measure. In addition, demand is inextricably tied to the economy, which although tenuous, shows some signs of improvement.

In the latest round of PV price declines, it appears that competitive pricing played a significant role in setting price for the industry. Although the solar PV suppliers have driven production costs lower, gross margins for the eleven largest players have declined from 2006 to 2008. With the exception of First Solar, SunPower, and Energy Conversion Devices, there was a noticeable degradation in gross margins for PV suppliers declining from 25% in 2006 to 20% in 2008. The fact that gross margins for these suppliers declined in the face of lower production costs suggests that competitive pricing to build distribution played a significant role in setting solar PV prices.

According to the U.S. Department of Energy’s (DOE), Energy Efficiency and Renewable Energy program, the cost of producing PV modules, in constant dollars, has fallen from as much as US$50 per peak watt in 1980 to as little as US$2 per watt peak.

What is most compelling about Figure 3 is the precipitous decline in PV module prices since 1980. The rapid decline in PV pricing is, in the long-term, attributable mainly to technological innovation such as advances in production processes and new materials that enable lower cost and improving efficiencies. Perhaps the most viable technology in the solar space is thin-film PV. First Solar is a leading thin-film player and has reduced production costs significantly by breaking the US$1 a watt barrier to US$0.87 per watt in Q2/09.

With the PV inventory buildup abating and less incentive for PV suppliers to cut price, perhaps solar PV prices could stabilize. However, it is the secular trends that tend to impact price in the long-term and two key trends are advances in PV materials and improvements to production processes that should continue to drive PV prices lower.

The smart money is following innovative new thin-film materials, multi-junction, PV approaches, and energy storage technologies. Leading venture capital firms are funding companies such as Stion that is focusing on reducing material and processing costs by offering the same power in a smaller package and eSolar enabling energy storage through concentrating solar. The value proposition relies on improving the economics of solar energy by lower costs. Still the PV module cost is only half the cost of solar and efficiencies are gained by improving the labor, time, and cost of installation.

Solar production is akin to semiconductor production with efficiencies and cost improvements tied to production scale and experience. As new technologies and approaches in PV materials evolve and manufacturing processes improve, we can expect economies of scale and experience to lower further the cost of solar PV making solar a viable alternative to hydrocarbon fuels.

Some of the most interesting developments in the solar PV space include advances in new materials, multi-junction layering, integration of inverters into modules, and energy storage technologies. The cost per watt of solar PV modules could be driven lower through continuing research and advances in production processes. Therefore, we expect these secular trends that have been incubated through research and analytics to continue to influence PV prices.

The bottom line is falling prices could substantially enlarge the market opportunity for solar PV. Further advances in solar PV will come through advances in science and technology that are driven by research.

Michael S. Davies, CFA, is founder of Green Econometrics (http://www.greeneconometrics.com/) and provides research and analysis on the economics of alternative energy. Davies is an analyst with a career spanning Wall Street and Silicon Valley.

※ The listing of publicly traded companies referenced in this article include: First Solar (FSLR), SunPower (SPWRA), Suntech (STP), LDK Solar (LDK), JA Solar (JASO), Evergreen Solar (ESLR), Energy Conversion Devices (ENER), Trina Solar (TSL), Solarfun (SOLF), Canadian (CSIQ), and ReneSola (SOL)

For more information, please send your e-mails to pved@infothe.com.

ⓒ www.interpv.net All rights reserved

|