By Franco Traverso

A preliminary report published earlier 2010 by the Italian Department of Energy estimates that in 2009 the renewable energy market in Italy grew more than 13% over 2008, reaching an overall capacity of 66 Terawatt hour--number largely corresponding to one fifth of the country--gross energy consumption. In this scenario, the growth of Italian photovoltaic industry has played the lyon’s share with gross sales of 1.2 billion euros, up by 300% in comparison to the previous year.

In terms of energy output, by the end of 2009 the overall installed power of Italian grid-connected PV systems monitored by GSE (Gestore dei Servizi Energetici, a publicly-owned company promoting and supporting renewable energy sources) almost reached its first gigawatt. At the current pace, the total photovoltaic power installed by December 2010 is estimated to climb to 2 GW, reinforcing Italy--leadership as the second world--photovoltaic market in terms of annual growth, second only to Germany. Although these numbers may already be considered impressive, they represent tiny steps in a larger plan. According to the current government goal, Italy is set to reach 15 GW by 2020--an objective that testifies the commitment of the Italian central authority to gradually but steadily shift the focus on renewable energy as a sustainable resource to power the future of the country.

Unsurprisingly, now that the ‘big PV rush’ has started, a legion of domestic and international investors are putting their bets on the highly-prized perks offered by the Italian marketplace, namely the worlds best Feed-in Tariffs (FiT), sun irradiation levels above average, and local technology partners that have perfected the art of profitable turnkey PV system installation.

Figure 1. Sun irradiation levels in Italy

A Matter of Location

Inspired by the German government incentives model, the Italian support scheme includes high aggregate FiT of 42 euro/kWh for new PV projects for the first 20 years of their life cycle. The program, which was implemented in February 2007, is aimed to provide tariffs until a cap of 1.2 GW is reached (unofficial government sources say that a new cap of 3 GW may be under way).

As the current support package will complete its cycle on December 31, 2010, a new draft of the incentive plan is currently under discussion and is scheduled to be approved in the next few months. To this end, last fall, the principal Italian PV industry associations, APER/GIFI/ANIE and Assosolare, have submitted a proposal of revision to the Ministry of Economic Development that asks to reduce the current incentives by 25%. Minor adjustments affecting PV sub-fields have also been suggested to avoid rough market decreases. Preliminary talks on the ongoing negotiation seem to suggest that the government may decide to decrease the incentives only gradually, with lower reductions applied in the short term and more important cuts to be adopted over the next few years. However, until the new decree is officially issued, no one can really tell how the new Conto Energia will look like.

Investors interested in the Italian photovoltaic market should consider a number of crucial aspects that are shaping the growth of the industry. First of all, not only does the actual FiT approval process vary from region to region, but also authorization procedures and sun irradiation levels are subject to change locally.

For instance, a number of regions require additional building permits, environmental impact studies and right of way issues that, thus far, have dramatically limited PV installations. As a result, to avoid tangled bureaucratic burdens, PV investors usually favor areas that require “Autorizzazione Unica (A.U.)” a secure, expedite regional authorization procedure that clearly outlines the requirements for final award of the license and therefore the ability to sell the electricity to the Gestore Servizi Elettrici (GSE).

In terms of solar radiation averages, a plant installed in a northern region of the peninsula can provide radically different performances in comparison to a solar plant built in the south. For example, each kWp installed in Lombardia on average produces 1,150 kWh in one year in comparison to 1,500 kWh produced in the south of Italy.

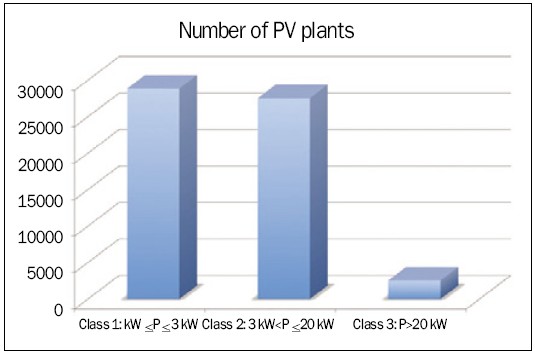

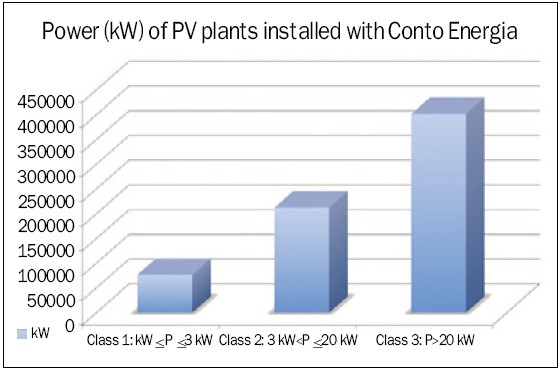

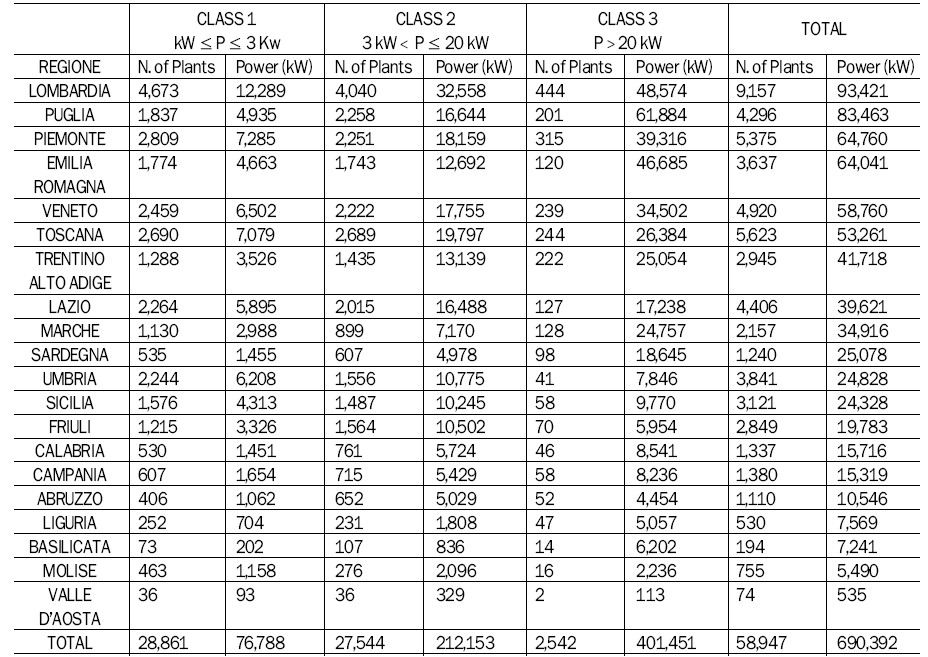

The outcome of such complex variability is reflected in the distribution of PV projects across the peninsula. According to preliminary data published by GSE at the end of 2009, the Italian region with the highest PV power installed is Puglia with more than 103 MW, followed by Lombardia with 94 MW, and Emilia Romagna with 71 MW. Notably, all three regions have adopted fast-track authorization processes that have allured several domestic and international investors.

Lombardia is also the first Italian region for number of implemented PV projects with over 9,300 plants, followed by Emilia Romagna and Veneto. On the other hand, Trentino Alto Adige, located in the north-eastern area of the peninsula, holds the record of installed power per capita with 50.5 Wp for each resident, followed by Basilicata, Umbria, Marche and Puglia. Overall, the national average per capita is currently 13.3 Wp.

Figure 2. Number of working PV plants in Italy instaaled with Conto Energia distributed by FiT class

Next Stop: Grid Parity

Regardless of the tariff cuts that may take place in 2010, the Italian PV market retains interesting opportunities for investors, both in the short and long run. In the short term, the investment frenzy phenomenon experienced in 2009 will probably intensify in 2010 as additional big players will enter the Italian arena.

In the long run, although the Italian market is already more sustainable and competitive in terms of photovoltaic energy output, the current race to new investments and technological improvements will most likely drive a few Italian regions to realize grid parity within the next 6 to 8 years. Indeed, traditionally high energy costs, exceptional sun irradiation levels and steadily decreasing costs of technology will be just the key elements that will enable Italy to finally reach grid parity before any other European country, as solar PV power will be able to compete with electricity from the grid without subsidies.

Supporting this scenario is a study conducted by the Department of Electrical Engineering (DIE) at University of Padova which suggests that the Italian road to PV sustainability is closer than one could expect. According to the study, if in 2009 a PV plant in Italy cost about 4,200 euros per kW, the same cost is expected to drop to 3,733 euros in 2010 and to 2,178 euros by 2020. A figure exactly half of the current price.

Figure 3. PV power installed in Italy with Conto energia distributed by FiT class

Italian PV Solar Farms

On average, the photovoltaic KWh cost in Italy can currently range from a maximum of 0.513 euros for small plants of 1-6 kWp and with an insolation intensity of northern Italian regions, to a minimum of 0.236 euros for megawatts plants installed in high average sun radiation regions typical of insular Italy. But, as most PV veterans may testify, sun insolation alone does not necessarily turn a solar PV project into a profitable enterprise.

In theory, a productive PV power plant requires the right combination of good quality components, possibly including smart solar trackers, and the know-how of an experienced EPC contractor. Yet, in practice, the task of integrating and connecting these variables involves more technological fine-tuning than mere project management--in approach to business especially relevant in a highly productive but also extremely diverse territory such as the Italian Peninsula.

For instance, a good PV plant should always be the outcome of a delicate exercise to ensure minimal electrical losses due to wiring, connectors, fuses, switches, and inverters. Calibrating reliable, high-quality solar trackers is also crucial to attain performances that transcend south-bound orientation of 30 degrees. This is precisely why the experience of a seasoned EPC contractor that knows the ropes of the territory where the plant will be built can make all the difference in the world in the long-term efficiency of the plant.

In this regard, consider the significance of long-term productivity conventionally attributed to PV projects. In the current volatile market economy, nominal power is typically the benchmark that defines the productivity of a photovoltaic plant (i.e., kilowatt peak). In reality, the profitability of PV plants can be effectively appreciated only by considering the overall output capacity during the entire life cycle--that is, productivity lies in average cost per kWh rather than mere nominal power. In fact, following this very logic, the Italian government energy incentives plan funds the long-term energy output of each new system installed during its first 20 years of activity.

Incidentally, long-term efficiency and productivity are the operative mantras driving the philosophy of Silfab Spa, a company founded in 2007 currently engaged in building a broad network of 1-6 MW solar farms in Italy and Central Europe. With the technological and business support of Silfab’s partners, a Taiwanese SAS and the multinational PanAsia Solar, at the end of 2009, Silfab’s team completed the first seven next-generation solar farms near Bari and Taranto. Earlier 2010, the company completed two additional solar farms in the same areas of Puglia for an overall investment of almost 40 million euros. A new set of solar farms, scheduled to be completed by the end of 2010, will reach an overall capacity exceeding 60 MW by 2010. All Silfab’s plants are optimized by monoaxial solar trackers that deliver an output capacity up to 25%-30% higher than conventional fixed PV systems. This is a benefit that significantly enhances both long-term performances and ROI for the entire life cycle of a plant (typically beyond 30 years).

The fine-tuning care Silfab adopts to install its PV projects has been recently certified in a Due Diligence Report issued by the Department of Electrical Engineering (DIE) at University of Padova. The report, based on the performances of a PV farm Silfab installed in Acquaviva delle Fonti in Bari, shows that its 1 MW plants in Puglia are currently producing 1,819 kWh for every kW installed. A result that outperforms by almost 35% the data provided for the same area by PVGIS, the Photovoltaic Geographical Information System that assesses solar energy resources in the context of integrated management of distributed energy generation in Europe. Moreover, in comparison to PVGIS official data that indicate an average PV plant productivity of 75% of the nominal rated power for the same area, Silfab plants have been certified to provide an average output of over 80%.

Table 1. Regional distribution of working PV solar plants installed with Conto Energia

In other words, the ultimate message to potential investors looking at Italy is fairly clear: investing in the Italian PV market has never been this convenient.

Franco Traverso is President and CEO of Silfab S.p.A. (www.silfab.eu). Traverso developed several international patents and technology platforms, opened a number of small and large PV systems, launched a production line of CZ ingots and wafers, and performed technology transfers in India, Sweden and South Africa. Traverso is currently developing a 60 MW PV solar farm network in Italy and Europe and is planning to launch the first ‘green-to-green’ integrated PV Value Chain in North America.

For more information, please send your e-mails to pved@infothe.com.

ⓒ www.interpv.net All rights reserved

|