By Mercom Capital Group

.jpg)

VC investments alone do not give a good picture of the financing activity in the sector, making it important to note other types of funding activity. We tracked over US$4 billion in large-scale project funding in 2010--these are only from disclosed deals, but the trend is clear--more projects are getting funded. There were 32 different banks and financial institutions that financed solar projects and some of the funding instruments we saw included equity, loans, tax equity and bonds, among others.

There was a spike in the number of debt and other forms of financing in 2010, primarily due to credit provided by Chinese Government Banks (national and regional) to the tune of US$34 billion to seven different Chinese companies. Even without the Chinese credit transactions, activity was still healthy in terms of lending.

Overall, including Chinese credit, we tracked over US$40 billion flowing into the sector in 2010.

.jpg)

2010 Solar Funding and M&A Activity by Quarter

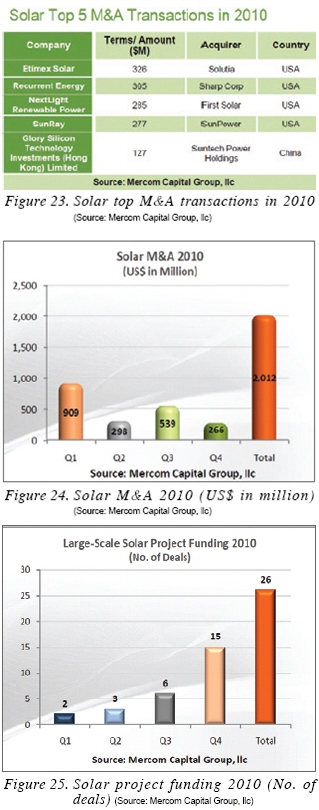

Vertical integration and acquisition of project pipelines were two key trends in solar M&A activity in 2010. A lot of project developers, including Recurrent Energy, NextLight and Sunray were acquired by panel producers making a move downstream. There were a total of US$2 billion in M&A transactions in 2010. With IPO’s few and far between, solar M&A activity has been the go-to exit strategy.

VC/PE1) Funding 2007- 2010

VC funding in solar was up marginally by 18% in 2010 compared to 2009, but nowhere near the 2008 high. This still makes the second best year for solar in terms of VC funding dollars. VC funding in solar was up marginally by 18% in 2010 compared to 2009, but nowhere near the 2008 high. This still makes the second best year for solar in terms of VC funding dollars.

Interestingly, the number of VC deals was the lowest since 2007, dropping almost 23% compared to the 84 deals in 2009.

VC Funding by Quarter

VC investments in solar peaked in Q2 of 2010 with US$948 m raised. Q2 transactions which included BrightSource Energy (US$176 m), Solyndra (US$175 m), and Amonix (US$129 m) made Q2 the strongest quarter in 2010. Investments in Q3 and Q4 tapered off from there.

The decline in VC deals is a developing trend as exits for VCs have been tough and the results from some of the larger VC investments in the past have been less than great.

The capital intensive nature of solar is requiring other sources of funding to step up, especially for companies in the expansion mode.

VC Funding by Stage

Series A investments averaged US$5.7 million compared to the Series D average of US$75 million. The average deal size for all stages of VC investments was about US$25 million, much higher compared to the US$6.3 million average deal size for 2009 VC deals in all sectors according to NVCA. This demonstrates the capital intensive nature of solar sector, requiring higher investments than we see in other technologies.

Top 5 VC Funding

Four of the top five VC deals in solar in 2010 were for over US$100 million each. The top five deals accounted for almost 40% of all VC deals in 2010.

Good Energies and New Enterprise Associates topped the VC investors list with five deals each, followed by Applied Ventures, Draper Fisher Jurvetson Investments and Polaris Venture Partners. With 22 deals, the top five investors accounted for about a third of all VC deals.

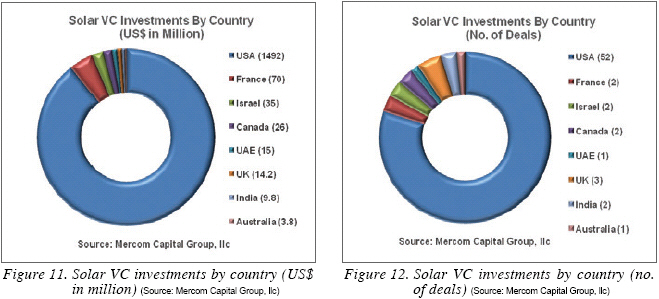

VC Funding Activity by Country

USA topped the countries in VC investments both in terms of amounts invested and the number of deals. France came in second in terms of the amounts invested followed by Israel and Canada.

VC Funding Transactions

There were 148 different investors that participated in 63 disclosed transactions averaging 2.35 investors per deal. Twenty-seven investors participated in multiple deals.

The solar sector also saw a lot of activity from the venture capital arms (corporate venture capital) of companies like Applied, GE, BP, Mitsui, Samsung and Intel Capital, as well as direct participation from companies like Hanwha Chemical, Iberdrola, Alstom, Foxconn, TSMC, Texas Instruments alongside VCs in various rounds.

Large-Scale Project Funding

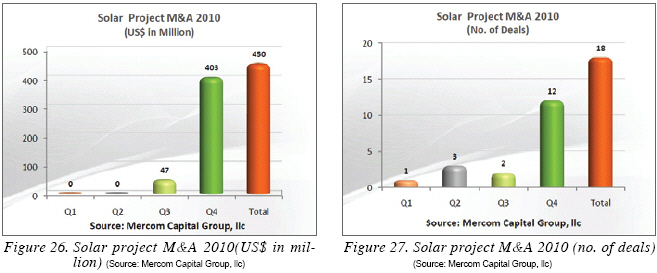

There was a spectacular increase in disclosed large-scale project funding activity in the fourth quarter of 2010. The amounts funded in Q4 were more than the three previous quarters put together.

The number of deals in project funding was also significant in the fourth quarter. There has been a very consistent and steady rise in the deals throughout the quarters this year.

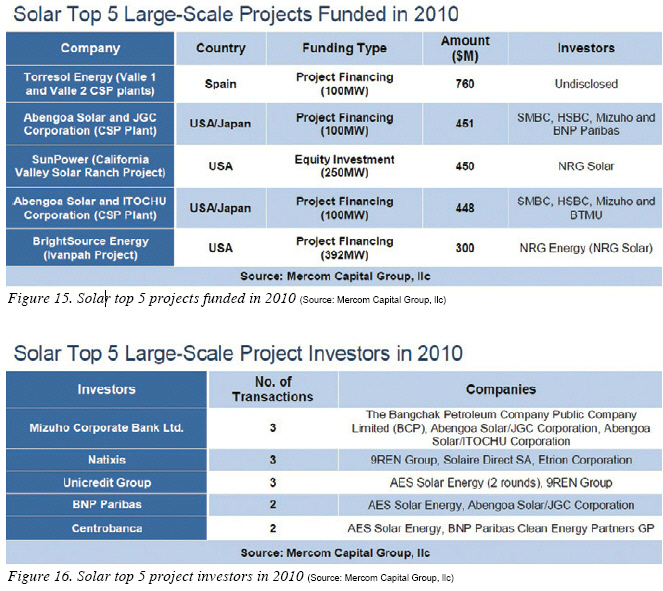

Top 5 Large-Scale Project Funding

Disclosed large-scale project funding activity in 2010 picked up in the second half of the year, showing strong signs of credit becoming available for bankable projects with attractive returns. Funding instruments included equity investment, loans, tax equity and SunPower’s first publicly rated bond issue for a solar project.

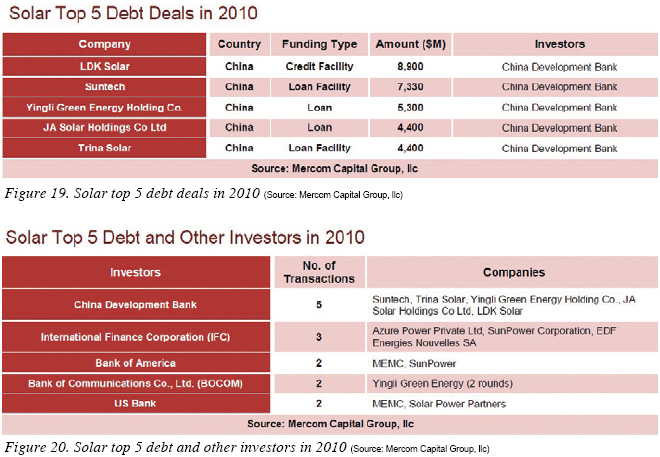

Debt and Other Funding

There was a huge influx of debt into the solar sector mainly led by Chinese banks accounting for US$33.7 billion. Excluding Chinese funding, the US$2.2 billion debt/financing announced by solar companies in 2010 shows improved financial health resulting in the availability of credit in this sector. There has also been a steady and consistent growth in the number of deals throughout the quarters. There was a huge influx of debt into the solar sector mainly led by Chinese banks accounting for US$33.7 billion. Excluding Chinese funding, the US$2.2 billion debt/financing announced by solar companies in 2010 shows improved financial health resulting in the availability of credit in this sector. There has also been a steady and consistent growth in the number of deals throughout the quarters.

Top 5 Debt and Other Funding

Out of almost US$36 billion debt and other funding announced, Chinese banks provided most of it with approximately US$34 billion in credit. The largest single transaction was the US$8.9 billion credit facility to LDK Solar by China Development Bank. The largest credit transactions outside of China were a US$350 million credit facility for Suntech, followed by a US$300 million credit facility for First Solar.

The top five transactions involving LDK, Suntech, Yingli, JA and Trina Solar amounted to US$30 billion. These Chinese companies had combined revenues of about US$5 billion in 2009.

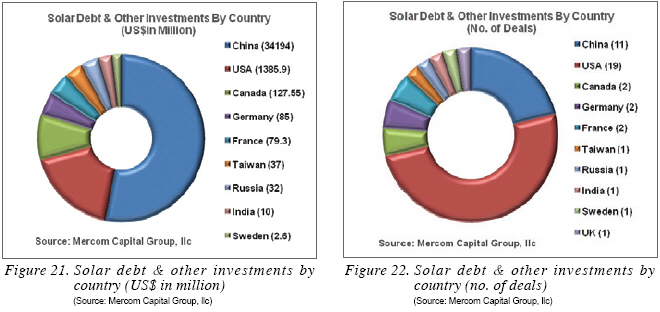

Debt and Other Funding Activity by Country

U.S. led the debt activity in terms of number of transactions but the amounts dwarfed in comparison to Chinese banks which provided US$34 billion credit to Chinese solar manufacturers.

Mergers and Acqusition (M&A)

Out of the 44 solar M&A deals announced in 2010, only about half of them disclosed details. The total disclosed M&A transactions amounted to about US$2 billion. Three of the five top M&A deals involving Recurrent Energy/Sharp, Nextlight/First Solar and Sunray/SunPower, were all moves downstream by manufacturers buying up project pipelines.

Project (M&A)

Activity in solar project M&A started to pickup in the second half of 2010. Significant transactions were the recently announced Tessera Solar Calico Project acquired by K Road Sun and First Solar’s 290 MW Aqua Caliente Solar Project acquired by NRG Energy.

Mercom Capital Group, llc (www.mercomcapital.com) is a global clean energy market intelligence, consulting and communications firm with offices in the U.S. and India. Mercom delivers highly respected industry market intelligence reports covering Solar Energy, Wind Energy and Smart Grid.

REFERENCES

1) The VC section includes both venture capital and private equity transactions. Other types of organizations that invested in VC rounds are also included under VC transactions.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2010 www.interpv.net All rights reserved.

|