By Jack Calderon, Chaim Lubin

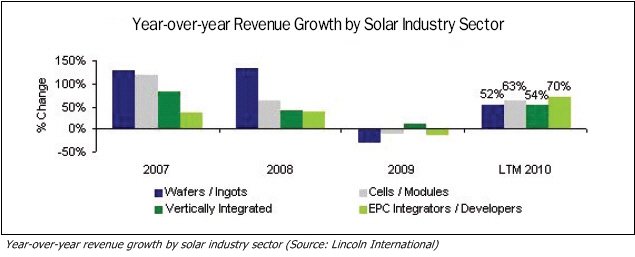

Revenue for all industry sectors was at its highest level since 2008 and greater than any year since Lincoln International began tracking this data. During the Last Twelve Months (‘LTM’), as of September 30, 2010, all categories of the solar industry produced a revenue increase of more than 60% compared to the same period a year ago and growth in the PV industry is expected to exhibit a five year CAGR of 33.0% from 2009 to 2014 (source: European Photovoltaic Industry Association). This significant growth has spurred many developments throughout the industry, including further advancement of Merger and Acquisition (M&A) activity. Revenue for all industry sectors was at its highest level since 2008 and greater than any year since Lincoln International began tracking this data. During the Last Twelve Months (‘LTM’), as of September 30, 2010, all categories of the solar industry produced a revenue increase of more than 60% compared to the same period a year ago and growth in the PV industry is expected to exhibit a five year CAGR of 33.0% from 2009 to 2014 (source: European Photovoltaic Industry Association). This significant growth has spurred many developments throughout the industry, including further advancement of Merger and Acquisition (M&A) activity.

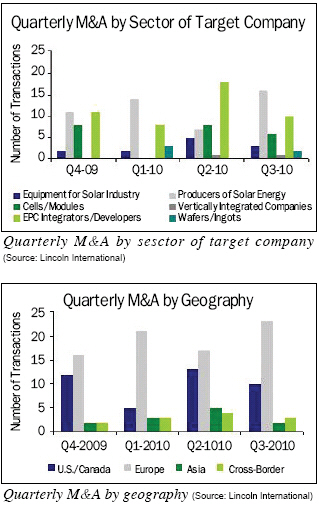

As measured in Lincoln International’s quarterly published ‘Solar Energy Deal Reader’, 38 solar energy transactions were completed in the third quarter of 2010. This level is on par with the 39 transactions that occurred in the second quarter of 2010 and is the second highest number of transactions in a quarter since Lincoln International began tracking solar industry M&A activity. From a transaction perspective, 2010 is on track to be another record year.

Much of the recent M&A activity has been categorized as consolidations, which represented 58% of transactions, or 22 deals in the third quarter of 2010. The next largest transaction category was diversification into the solar energy industry by corporations and investors. This accounted for six transactions, or 16% of transactions in the third quarter of 2010. Vertical integration and acquisitions by private equity/investors accounted for five transactions each, or 13% during the quarter.

2010 has exhibited a significant increase in consolidation activity, which through September 30, is almost double the amount of consolidations completed in 2009. While there have been consolidations of companies within the industry’s value chain, the largest area for consolidation has been within the solar project pipeline. Companies continue to acquire projects in early stages of development, as well as projects that are already in operation, thereby increasing acquirers’ share of the growing global PV installation market. This has been accomplished through the acquisition of individual projects and the merger or acquisition of EPC Integrators/Developers that have built up pipelines of solar projects for future development.

Beyond solar projects, the next most active sector for M&A in the third quarter of 2010 was within the Cells/Modules sector, with six transactions, or 16% of the third quarter total. This is a decrease from the second quarter of 2010, which had eight transactions in this sector. Three transactions involved companies categorized as solar equipment providers and two transactions were within the Wafers/Ingots sector, or 8% and 5% of the third quarter total, respectively. The least active sector for M&A during the third quarter of 2010 was with Vertically Integrated companies, which continues to be a minimally active sector for transactions with only five completed transactions in the last three years.

From a geographic perspective, Lincoln International classifies transactions based on the location of the target company or solar project as compared to the purchasing entity. If a transaction is completed with both target and purchaser in the same geographic region, the transaction is classified as such, otherwise the transaction is considered to be ‘Cross-Border’ During the third quarter of 2010, the majority of transaction activity was generated within Europe with 23 transactions, or 61% of the quarterly total. The next largest area for transactions was within the United States and Canada with 10 transactions completed, or 26% of the third quarter total. While there is significant global interest in making acquisitions in the solar industry, only three transactions, or 8% of the third quarter total, were classified as Cross-Border. This particular statistic highlights the opportunity to increase interest for a particular company or solar project by accessing potential purchasers on a global scale. Transactions in Asia rounded out the geographic classifications with two transactions completed, or 5% of the third quarter total. From a geographic perspective, Lincoln International classifies transactions based on the location of the target company or solar project as compared to the purchasing entity. If a transaction is completed with both target and purchaser in the same geographic region, the transaction is classified as such, otherwise the transaction is considered to be ‘Cross-Border’ During the third quarter of 2010, the majority of transaction activity was generated within Europe with 23 transactions, or 61% of the quarterly total. The next largest area for transactions was within the United States and Canada with 10 transactions completed, or 26% of the third quarter total. While there is significant global interest in making acquisitions in the solar industry, only three transactions, or 8% of the third quarter total, were classified as Cross-Border. This particular statistic highlights the opportunity to increase interest for a particular company or solar project by accessing potential purchasers on a global scale. Transactions in Asia rounded out the geographic classifications with two transactions completed, or 5% of the third quarter total.

Transaction activity in the solar industry has reached historical heights and has continued to trend upward during the first nine months of 2010. In addition, consolidation activity has reached record levels, with 56 transactions through September. Phases like this are often seen in rapidly growing young industries and present unique opportunities for companies to potentially sell at premium valuations, benefiting from overall market momentum. Companies across the solar industry should take this opportunity to evaluate the trade-offs of a merger or acquisition and the benefits that can be garnered given the current global market dynamic.

Jack Calderon is Managing Director at Lincoln International (www.lincolninternational.com) and co-heads the firm’s Renewable Energy Group. Chaim Lubin is an associate at Lincoln International and a part of the Renewable Energy Group.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2010 www.interpv.net All rights reserved.

|