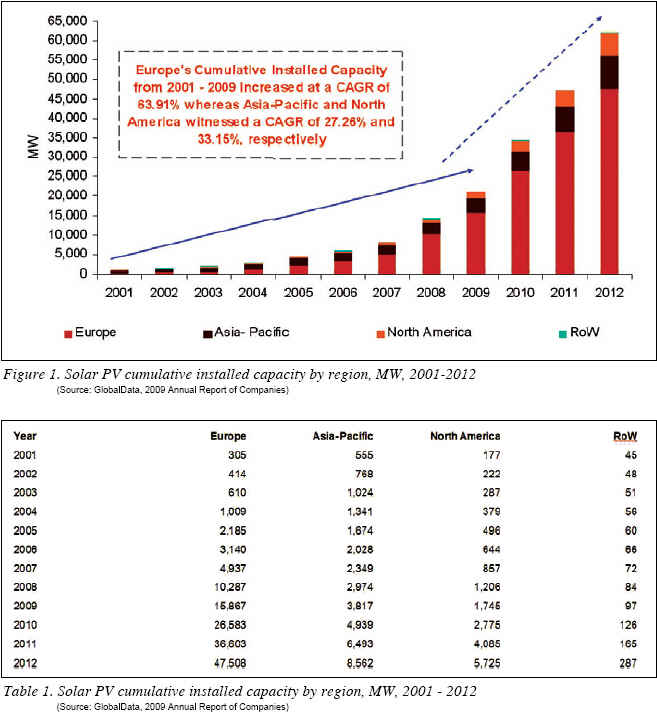

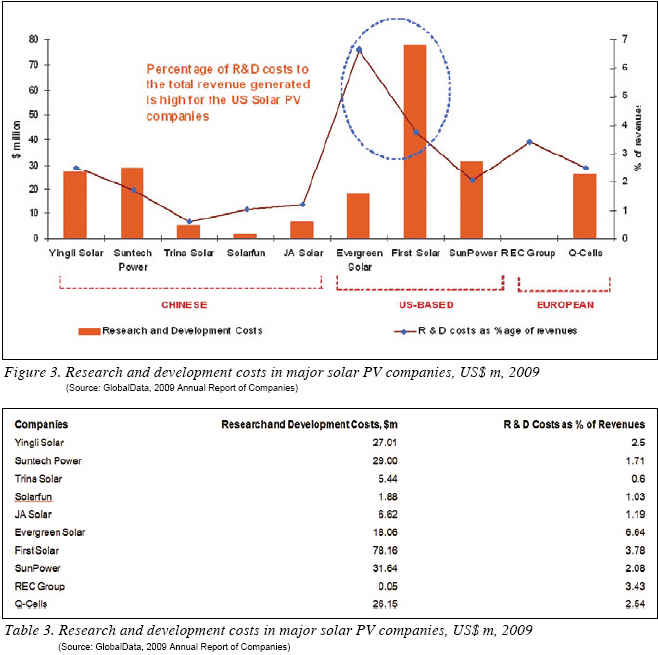

The global solar PV market is experiencing varied trends in different regions. The rising number of installations in Europe is being matched by new technological developments in the U.S.A. and rise in the manufacturing base in Asia. The policy-driven European market increased its cumulative solar PV installations at a CAGR of 63.91% from 2001 to 2009. Concurrently, in 2009, U.S. companies Evergreen Solar and First Solar invested 6.64% and 3.78% of their total revenues respectively, into new technological developments; which is a much higher percentage than their Chinese and European competitors. The Asian region is emerging as an important destination for solar PV manufacturers, owing to the low production costs. In this market scenario, the companies outside Asia are diversifying their production portfolio to attain cost efficiencies in the global solar PV market.

By GlobalData

European Solar PV Installations on the Rise

In 2009, the European region accounted for 68% of the global cumulative installed solar PV capacity, with approximately 15.87 GW of capacity. In comparison, Asia Pacific and North America accounted for 16% and 7% of the global capacity, respectively. Europe’s demand for PV installations has clearly increased in the recent years, with its cumulative solar PV installed capacity increasing at a CAGR of 63.91%, much higher than both Asia Pacific and North America.

The top three countries for solar PV installations are Germany, Spain, and Italy. In 2009, they cumulatively accounted for 90.65% of cumulative solar PV installations in Europe. Although Spain did not experience high market growth rates in 2009 due to a decrease in its subsidies, it still remained the second largest solar PV market in Europe. With guaranteed Feed-in Tariff (FiT) plans, Germany leads the world in solar PV installations. Even though the FiT rates are reduced, the country is expected to maintain its demand in the near future due to reductions in the installation costs of solar PV.

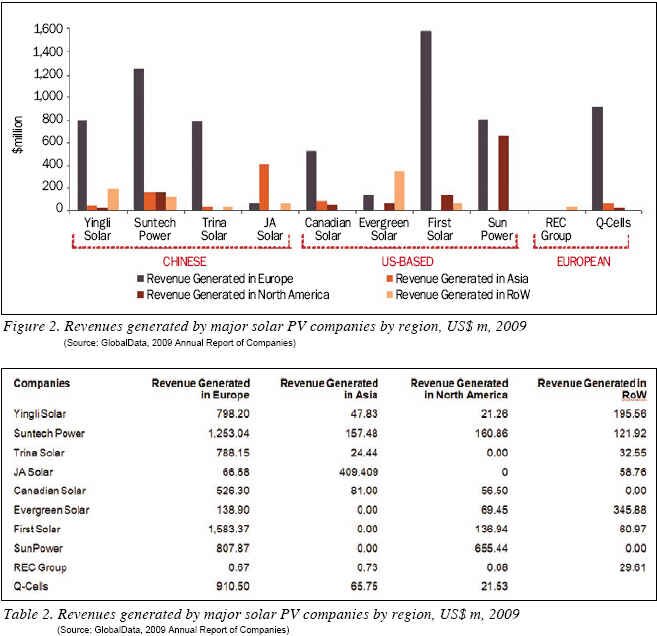

Figure 2 illustrates the split of revenue generated by major solar PV companies in the world, by region, from 2001-2012. Due to the rising demand for solar PV in Europe, a high percentage of the companies’ total sales had come from the sales to the European solar PV market. In 2009, the major Chinese solar PV manufacturers Yingli Solar, Suntech Power and Trina Solar, generated US$798.20 m, US$1.2 billion, and US$788.15 m respectively in revenues, through their sales in Europe. Their European solar PV sales account for around 75%, 74% and 93% of their total respective revenues generated in 2009. Similarly, the sales of U.S. companies such as Canadian Solar, Evergreen Solar, First Solar and SunPower, in the European market are 79.3%, 52%, 76.63% and 53% respectively. Against this backdrop, the rise in Europe’s demand for solar PV installations has been an opportunity for the market development of solar PV firms globally.

Rapid Solar PV Technology Developments in the U.S.

The key driver for the U.S. solar PV market growth is its technological development. First Solar’s CdTe thin film has reduced the manufacturing cost of panels to less than US$1/watt. Along with this, SunPower has achieved efficiency levels of 24%. There have been a number of research collaborations in the U.S. between universities and venture capital start-ups.

Figure 3 represents R&D costs incurred by major solar PV companies in the world in 2009. As the figure demonstrates, in 2009 U.S. companies had a higher percentage of R&D costs against total revenues, compared to other regions. The major Chinese solar PV manufacturers, such as Yingli Solar, Suntech Power and Trina Solar, incurred R&D costs of US$27.01 m, US$29 m and US$5.44 m respectively, in 2009. Their R&D costs accounted for around 2.5%, 1.7% and 0.6% of their total revenues generated. The percentage of R&D costs to revenues of the U.S.-based companies were 6.64%, 3.78% and 2.08%, respectively.

In comparing the technology development scenarios of China, the U.S. and Europe, we have used the comparative examples of the Chinese solar PV firm Yingli Solar, the U.S.-based solar PV firm First Solar, and Q-Cells, a solar PV firm based in Europe. Figure 3 demonstrates that First Solar spent 3.78% of its total revenues in 2009 on R&D costs in comparison with Yingli Solar and Q-Cells, which had spent 2.5% and 2.54% of their respective revenues on R&D. Thus, in 2009, the U.S.-based firms invested a higher percentage of their revenues into new technology development.

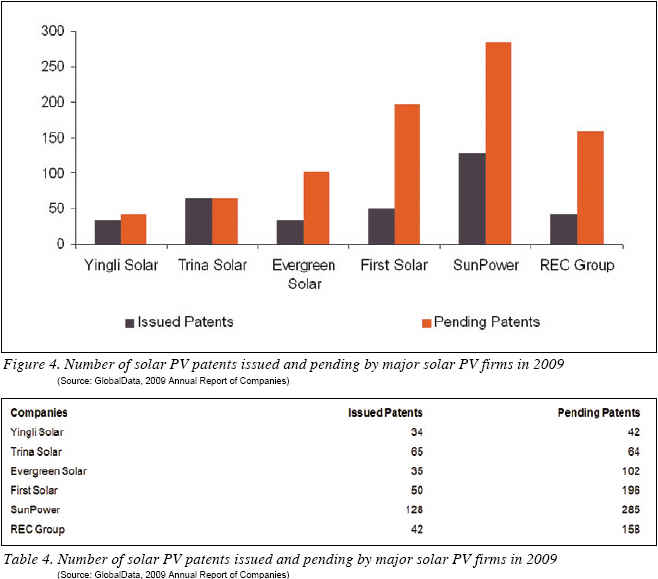

Also, as Figure 4 shows, in 2009, First Solar had 50 issued and 196 pending patents, comparatively higher than Yingli Solar and REC Group (a Europe-based solar PV firm). The spending in R&D and the number of patents (both issued and pending) U.S.-based major solar PV firms illustrates that these companies are more focused towards developing technological expertise in the solar PV market. Therefore, it can be concluded that the U.S.-based companies will in future have an edge over their European and Asian competitors in terms of increased efficiency and reduced operating costs.

Asia’s Increasing Manufacturing Base of Solar PV Equipments

With the rising level of installations in Europe and major technological advancements in the U.S.A., solar PV manufacturers are targeting Asian countries as places in which to diversify their manufacturing base. Asian solar PV manufacturers, such as Yingli Solar, Suntech Power and Trina Solar, have emerged as major solar PV players, globally. Due to the low manufacturing costs, China has become an attractive option for investments for solar PV manufacturers. Low labor costs and less costly materials such as glass and aluminum are the major drivers for the reduction of solar PV manufacturing costs in China. Project financing is also much easier in China, compared to European and North American countries.

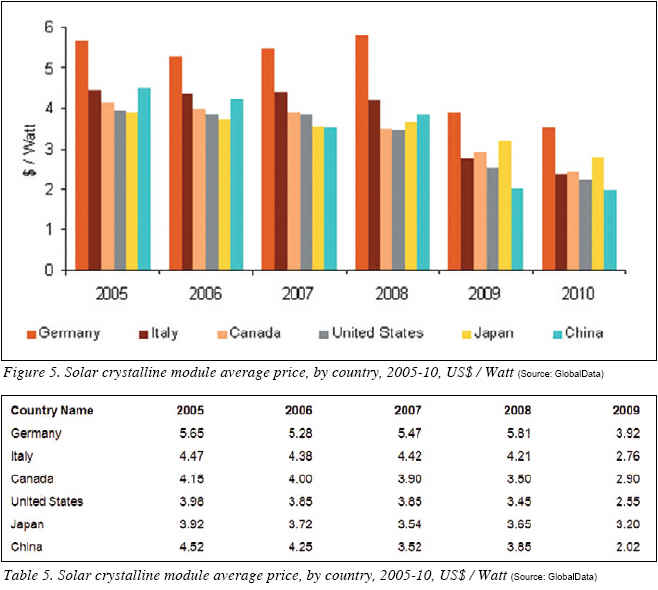

In 2009, the average price of solid crystalline modules in China was US$2.02/ watt, whereas the average prices in Germany, Italy and the U.S. were US$3.92/ watt, US$2.76/watt and US$2.55/watt, respectively. The low price means Chinese manufacturers have a competitive edge on other solar PV market players, globally. Those companies dealing in the manufacturing of thin-film modules are also affected by the significantly lower price of Chinese crystalline modules.

In 2009, despite the reduction of module prices in Italy, the price difference in comparison to Chinese solar modules grew from US$0.36/watt in 2008 to US$0.74/ watt in 2009. Such low material costs, supported by the easy availability of state bank loans and China’s government policies to increase investments in renewable power, encourage manufacturers to scale up their production facilities. While European and the U.S. companies are facing tough cost and margin pressures, the Asian companies are benefiting locally from their low production and financing costs.

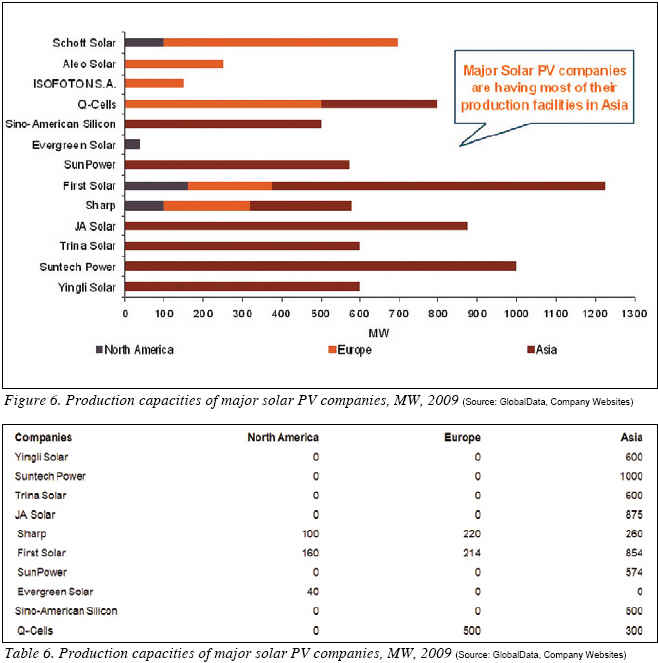

Figure 6 presents solar PV production capacities of major solar PV companies, by region, in 2009. It illustrates that the companies are having most of their production capacity in the Asian region. Around four Chinese companies have been major solar PV manufacturers in 2009. Besides these domestic players setting up their manufacturing bases in the Asian region, major international players such as Q-Cells, Sino-American Silicon, SunPower and First Solar are all diversifying their manufacturing portfolio into the Asian region. Q-Cells and First Solar have, respectively, set up 300 MW and 854 MW production facilities in Malaysia. Thus, against this backdrop, production capacities in Asia will increase, owing to the increased investments of domestic players and the strategic integration of Asia into the solar PV supply chain by international players.

The rising European demand for solar PV will force the solar PV manufacturers based outside China to lower their average modules prices and margins to compete with the Chinese players. Although China has announced the flexibility in exchange rates of its currency, its expected increase in labor costs will not significantly affect its solar PV manufacturing costs. Thus, China will remain the highest priority for investment for solar PV manufacturers, globally.

Future Outlook

In 2010, the European solar PV market was dominated by the impending FiT reductions in Germany, as well as the declining trend of module prices that began in 2009. As the European solar PV market is quite saturated, governments there are tightening their policies to reduce the economic burden of their incentive plans, creating additional pressure on solar PV firms besides the continued reduction of module prices.

The global solar PV market competition will be driven by production-based module price reductions. The Asian solar PV market will be an emerging market, owing to their low production and financing costs. In order to reduce the risks, the European and North American players will strategize to expand their global portfolio to balance their manufacturing costs, as well as to cater to the high demand of solar PV markets globally. Asian governments are setting up programs to explore the potential of solar PV as a resource for their countries. In 2009, the Japanese government re-launched its residential tariff program and introduced a FiT program to incentivize its solar PV market. Also, through utilizing Green Power Funds, more than 400 regional governments announced residential solar PV support programs and utility buy-back schemes to support the country’s solar PV market developments.

China’s solar PV market is also expected to experience high growth rates, owing to the Building Integrated Photovoltaic Program (BIPV) and the Golden Sun Initiative. Furthermore, the low cost of manufacturing solar PV components in the country will support the growth of this sector. It is expected that solar PV FiT will be implemented alongside existing subsidies to support solar PV power projects. These tariffs will drive investments into the sector, thereby encouraging solar PV capacity installations to reach the proposed solar PV targets (as per its national policy) by 2020.

India and Australia are the emerging solar PV markets in Asia Pacific. The Indian government has launched the National Solar Mission to reach a target of a 20-22 GW domestic solar PV market by 2022. The Australian government is supporting its solar PV market through the revised Solar Flagships program and its plan to implement regional FiT rates or net-metering policy by 2010. Against this backdrop, the Asia Pacific solar PV market are expected to make significant contributions to the global solar PV market owing to the improving policy scenario in the major countries.

The U.S. has emerged as the fourth largest solar PV power market in the world after Germany, Spain and Japan, and is one of the fastest growing markets in the world. The country’s cumulative solar PV power installed capacity increased from 167.8 MW in 2001 to 1,650 MW in 2009, increasing at a CAGR of 33%. The growth of PV installations in the U.S. market has been largely facilitated by support mechanisms provided by the federal and state governments, as well as by technological developments by solar PV manufacturers. California leads the market with the highest level of PV installations in the country, and was the first to initiate the FiT system in the U.S.A. The state has grown its market rapidly due to its ambitious subsidy policies for the development of solar PV. California will remain a leading state in the U.S. solar PV market in the coming years, due to proactive policies supporting solar PV development from the state government.

In 2008-09, the U.S. government extended Production Tax Credit (PTC) and Investment Tax Credit (ITC) as part of the stimulus plan for PV development. The PTC offers a 30% tax rebate for manufacturing facilities producing renewable energy products. The ITC provides tax credit to commercial and residential solar PV installers. It has eliminated the US$2,000 cap to allow the credit to be claimed against the Alternative Minimum Tax. The act has created a staggered credit system, where the size of the credit that can be claimed increases based on the electricity generated by the solar panels and its contribution to the average monthly electricity usage by the individual. Against the backdrop of supportive policies from the federal and state governments, the cumulative solar PV installed capacity is expected to grow from 1,650 MW in 2009 to reach 9,499.2 MW by 2015, growing at a CAGR of 34%.

Thus, in the policy-driven global solar PV market, there are various market trends in different regions. The upcoming major solar PV players cannot be predicted due to the continuous introduction of policy programs by different countries, as well as increasing competitiveness among market players in terms of cost efficiencies, technological advancements and market demand. In order to survive in the developing solar PV market, companies should strategize to diversify their operational and sales portfolio, while increasing their margins and market share.

GlobalData is a leading business information company providing global business information reports and services. Its highly qualified team of analysts, researchers, and solution consultants use proprietary data sources and various tools and techniques to gather, analyze and represent the latest and the most reliable information essential for businesses to sustain a competitive edge (http://www.globaldata.com/).

For more information, please send your e-mails to pved@infothe.com.

ⓒ2010 www.interpv.net All rights reserved. |