By EuPD Research

.jpg)

The Private Rooftop Segment?Efficiency’s Impact

All rooftop systems share a common trait; there is only a limited amount of space available for the PV system. This is predominantly true for small rooftop systems. Efficiency, therefore, plays a particularly important role here as maximum power output has to be achieved on limited space. The rate of efficiency is an indication of how much irradiation the module actually converts into usable energy.

The impact which the rate of efficiency can have is made even clearer by the following comparison. Where highly efficient monocrystalline modules can generate up to 195 watt of electricity per square meter under Standard Test Conditions (STC), a-Si modules sometimes generate only 63 watt. If a rooftop of 30 square meters is assumed, the difference would amount to almost 4 kWp.

The lower rate of efficiency is often one of the main reasons why crystalline modules are frequently installed in rooftop systems up to 10 kWp in size. Over 21,000 PV systems in this category with a total installed capacity of 473 MWp were installed in Germany in 2009. However, only a fraction of the aforementioned consisted of thin-film technology. The latest findings from the EuPD SalesMonitor paint an even clearer picture. This index of offers which was set up in cooperation with the online platform, Photovoltaic Forum, shows that of the 1,080 offers registered for PV systems up to 10 kWp, only 17 were for thin-film modules.

It is also worth noting that 16 of these 17 offers addressed CIGS modules. There are a multitude of reasons for this. On the one hand CIGS technology has, as previously mentioned, an advantage in terms of efficiency within the thin-film technology and benefits from its advantageous appearance. On the other hand, First Solar, the most relevant thin-film supplier, has focused so far on other market segments.

In order to somewhat escape the race on the degree of efficiency, some thin-film providers have already positioned themselves in niches which could become more attractive as market saturation increases. This includes badly positioned or shadowed rooftops where thin film, owing to its low light behavior, can perform much better than crystalline modules.

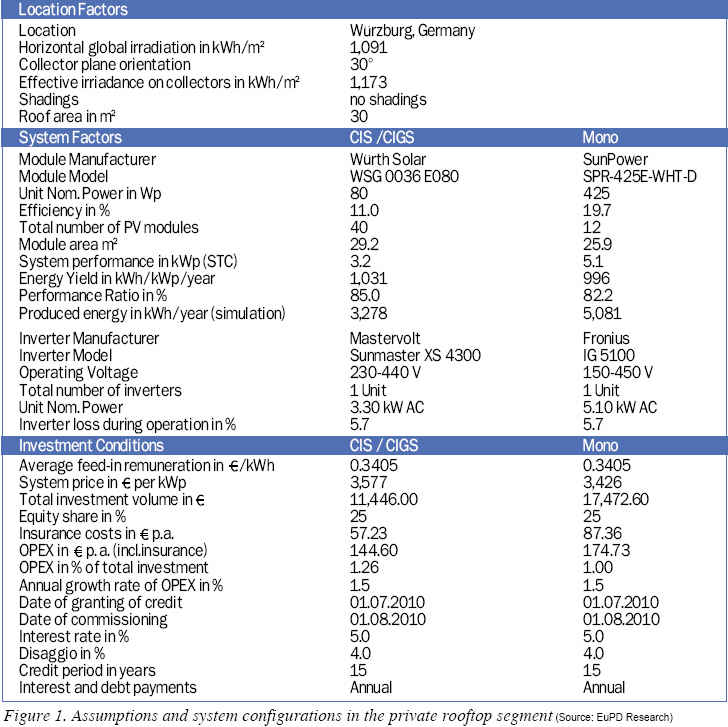

CIGS on Private Rooftops?--Comparison of Simulations

Although currently not of great relevance, efficiency, performance and design do not generally seem to speak against the use of CIGS modules in private rooftops. What has to be achieved in order to position CIGS as a veritable alternative to crystalline? The following simulation which compares two alternate systems on a fictitious rooftop should offer a solution. The system and data used are based on the simulation tool ‘PVsyst 5.20’ which was developed by the University of Geneva. The underlying system configuration as well as the main assumptions can be found in the following graph.

No Surprises in the First Instance

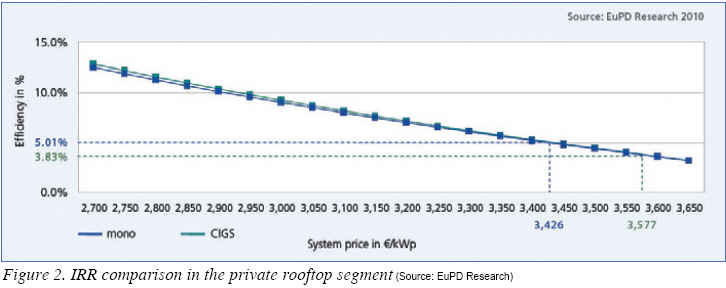

As Figure 2 demonstrates, returns are almost identical when identical kWp prices are assumed. However, realistic system prices are required in order to comment on the actual cost effectiveness of both systems. Based on 55 offers, the EuPD SalesMonitor shows, for SunPower, an average price of 3,426 per kWp for an average system size of 9.5 kWp. From a total of 21 offers for CIGS modules, a price of 3,577 kWp was calculated for mid size systems of approximately 8.7 kWp.

A comparison of returns based on the Internal Rate of Return (IRR) shows that monocrystalline modules are, under these assumptions, more lucrative. A result that was of no surprise, in fact it was to be expected due to the significance of the rate of efficiency.

CIGS Can Be Competitive

With regard to the objectives set in this article, the question concerning from what price or degree of efficiency a CIGS system can be deemed economically competitive now has to be addressed. The sensitivity analysis carried out on this issue has come to astounding results. A consistent degree of efficiency of 11% along with a system price of 3,435 per kWp would suffice to guarantee an internal interest rate of 5.01%. If the price was assumed to be fixed and the required degree of efficiency calculated in order to ascertain an indifference between both alternatives, then a result of 11.43% is reached. Both price level as well as degree of efficiency can be realized with current CIGS systems.

The aforementioned sensitivity analysis is, of course, only a projection and does not consider any future cost reductions or increases in efficiency on the part of monocrystalline modules. There are, however, two main reasons which suggest that the future development of CIGS in terms of price level and degree of efficiency will, at least, be in line with that of monocrystalline technology. The first of which is the fact that, compared to other technologies, CIGS has the greatest potential in terms of increased efficiency. Secondly, with respect to mass production, CIGS technology is still in its infancy which is why learning curve effects in production are comparably large and can be swiftly realized.

Commercial Rooftops--Between Rate of Return and Efficiency

System sizes in the commercial segment span a wide range from approximately 20 kWp up to sizes in megawatt. In addition to warehouses and factories, agriculturally used buildings, in particular in Germany, have played an important role. According to estimations from EuPD Research, commercial rooftops contributed to almost 60% of the German market in 2009 with over 2.2 GW of installed capacity. Commercial rooftop systems are also key market drivers in other countries. They make up 40 to 50% of the market in Italy, the U.S.A. and Belgium, and about a third of the French market.

Thus far, both thin-film and traditional crystalline modules have been used on commercially used rooftops. This can be attributed not only to the greater availability of space but also to the greater emphasis many operators place on the rate of return. Several polycrystalline producers, particularly from Asia have recently started to offer products with an adequate degree of efficiency at a lower price, thus providing them a strong competitive position in the commercial rooftop segment. The largest rooftop system to date equipped with CIGS modules and a capacity of 820 kWp was installed in Italy in 2010.

CIGS in the Commercial Rooftop Segment?

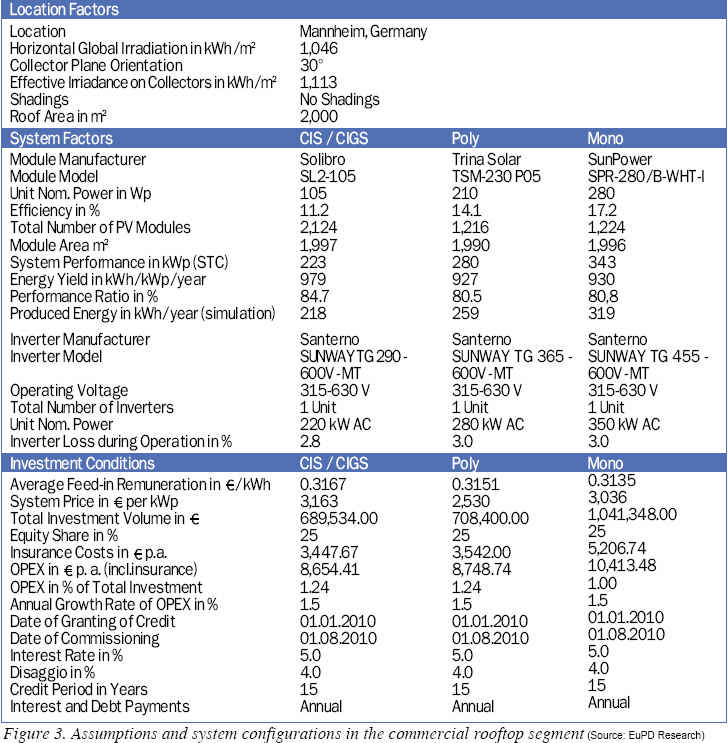

The simulation comparison of the commercial rooftop segment was carried out using three different systems; CIS modules from Solibro, polycrystalline modules from Trina Solar and monocrystalline modules from SunPower. The fictitious rooftop space was limited to 2,000 square meters and is located in sunny Mannheim, Germany. The data used for both the system and returns is based on ‘PVsyst 5.20’.

Major Opportunities for CIGS

Based on a total of 17 offers, the EuPD SalesMonitor shows an average system price of 2,530 per kWp for larger rooftop systems with modules from branded manufacturers sited in the Far East. Small rooftop systems up to 10 kWp in size averaged, from 130 offers, a price of 2,852 per kWp. If each price difference, in percent, for the segment up to 10 kWp is applied to the segment for larger rooftop systems, the results are as follows: highly efficient monocrystalline modules (SunPower) 3,036 per kWp (+20%) and 3,163/kWp for systems with CIGS modules (+25%).

A profitability analysis, based on these system prices, shows that economically motivated decisions would favor polycrystalline technology.

What requirements need to be met so that CIGS technology can compete with polycrystalline modules from the Far East? This question is examined in Figure 5. At a constant efficiency of 11%, the system price should not exceed 2,683 per kWp whereby a consistent system price of 3,163/kWp needs a rate of efficiency of 13.25% to be able to compete with polycrystalline system. The prospects of meeting these demands are fair. Modules produced by Wrth Solar, for example, have already achieved an average aperture efficiency of 12.8%--and further improvements have been announced for summer 2010.

The Open Space Segment--Impact of Rate of Return

The availability of space for large solar parks on land previously used for military or industrial purposes or in desert areas plays a lesser role than for rooftop systems. The minimization of the Levelized Cost of Electricity (LCOE) is the crucial point here. The cheaper it is to produce a kilowatt of electricity, the higher the return for those investors who have, in most cases, financially supported the undertaking. It is, therefore, of no surprise that several projects have exercised a preference for modules produced either by the cost leader First Solar or cheaper crystalline modules from Asian producers.

CIGS has only played a minor role so far. Plants such as the 3.26 MWp solar park constructed by Wrth Solergy in 2008, in Spain, remain an exception. Similar to previous processes, the following analysis calculates the threshold values with regard to price and rate of efficiency from which CIGS systems can successfully compete with the open space segment.

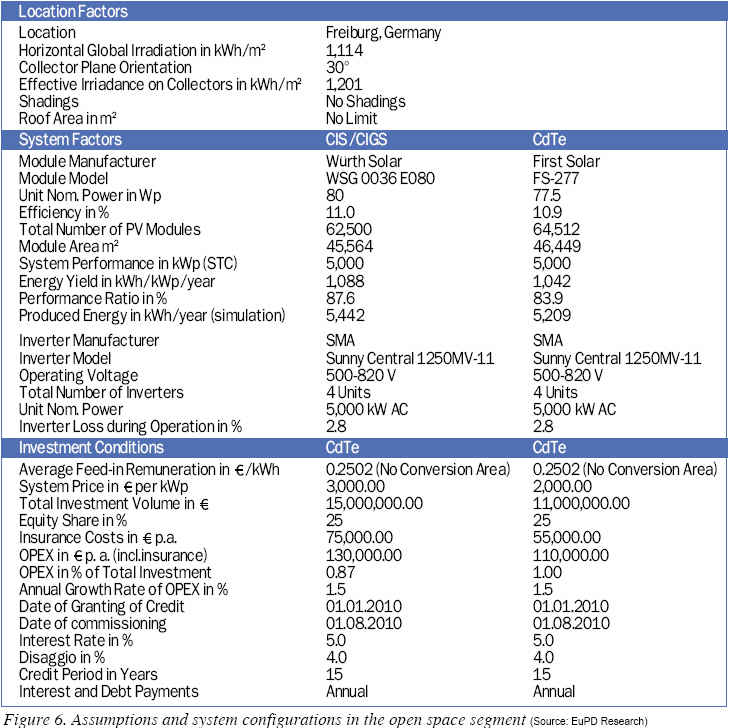

Is CIGS an Alternative to First Solar?

On completion of a number of comparisons with crystalline systems, it can be clearly seen that CdTe modules produced by First Solar set the benchmark. The data from ‘PVsyst 5.20’ was used once again, this time for a system 5 MWp in size in the Freiburg region in Germany.

CdTe Lies Ahead in the Open Space Segment--But for How Long?

A comparison of the net present value of both investment alternatives where prices are the same reveals an advantage for CIGS technology. This can be ascribed to the better efficiency rate of Wrth Solar modules which is 3.7 percentage points higher and lies at 87.6%, thus generating 46 kilowatt hours more per kilowatt peak.

However, when more realistic pricing scenarios are examined, the advantageous position of CdTe systems becomes more obvious. Under the assumption that the system price per kilowatt peak for First Solar modules is 2,200, and 3,000 for Wrth Solar CIGS modules, a calculation with an interest rate of 8% results in a net present value of 0.99 million euros for CdTe modules and -2.21 million euros for CIGS.

Competitiveness of CIGS in the Open Space Segment--Ambitious but Possible

Costs to the amount of 672 per kWp would still have to be saved for the above mentioned modules with an efficiency rate of 11% in spite of their advantageous performance ratio. Should prices remain at 3,000 per kWp, this would entail a necessary increase in efficiency of more than 23% to a level of 13.5%. Conversely, an increased efficiency rate of one percentage point has, on a system level, a value of approximately 269 per kWp.

These are the levers that manufacturers have to use. However, although everybody is striving for, it is unlikely that the majority of the producers are able to fulfill these criteria in near future. But, the general proof of concept has been delivered by CIGS technology leaders which, with reference to the announcements of an efficiency level of 13 to 14% in mass production, find themselves more and more on equal footing.

Performance Ratios in Other Regions and Climate Zones

All three simulation comparisons are based on one location in Germany, a choice which can be justified by the major role currently played by the German market in the global PV industry. However, it is to be assumed that the relative importance of Germany as a PV market will decline.

Thus the question of whether these results can also be transferred to other regions in the world with similar climatic conditions is raised. Here, the central factors are the temperature coefficients as well as the low light behavior which are both reflected in the performance ratio of the PV modules. In order to investigate this possibility, further simulations were carried out on the fictitious 5 MW CIGS open space system in various locations around the world.

Indeed, the result indicated the highest performance ratio for Freiburg. Nevertheless, the other findings were also comparatively high. The lowest value of 84.5% was given for Peru. However, this result is still higher than that achieved by a CdTe system (84.0%) at this location. Consequently, it can be stated that the CIGS technology is able to achieve a high energy yield under various climatic conditions, what makes it a suitable technology for the deployment in future PV markets.

What Is BIPV? What Is Its Market Potential?

BIPV stands for building integrated photovoltaic. It substitutes building components with PV systems. Generally speaking, a distinction is made between its use on rooftops, the facade, and other parts of the building.

Thus far, BIPV is still a niche market. The year 2009 saw installations totaling 250 MW in the U.S., Germany, Italy, France and Spain. This corresponds to a share of less than 5% of their total volume. It is to be noted that BIPV market share varies greatly according to the regulatory framework conditions of each national market. While BIPV made up less than one percent of the total German market in 2009, it constituted more than half of all PV systems in France.

Projections for the future expect the share of BIPV to increase as a result of falling costs and a closer cooperation with the construction industry. This is predominantly predicted for more mature markets with a substantial share of rooftops. Furthermore, the findings suggest that the BIPV markets likely to play a vital role in the future are those which are largest at the moment.

Apart from CdTe, all technologies commercially available at this moment in time can be found in the BIPV segment. Nonetheless, it is to be assumed that, as a result of the wide distribution of in-roof solutions in key BIPV markets such as France or Italy, as well as the still dominating market position of UNI-Solar in flexible laminates, crystalline and amorphous silicon modules make up the greatest share of installed capacity to date.

The amount of companies currently active in the field of BIPV leads to the conclusion that this will change in the future particularly with respect to flexible substrates. Suppliers of CIGS solutions are also making progress here, similar to that in the field of non-transparent faade solutions. Their greatest advantage over the already established a-Si suppliers is, as previously shown, their rates of efficiency. In contrast to crystalline system solutions in the roof and facade sector, CIGS primarily benefits from the better temperature coefficients and low light performance.

Outlook

The technological as well as technical production features of CIGS undoubtedly equip this technology with the potential to prevail in the current technology race. Nothing new so far.

However, the simulation comparison indicated at which point CIGS is currently situated compared to each competing technology. The findings may be somewhat surprising as the competitiveness of CIGS systems with regard to certain applications is already given e.g., in the private rooftop segment. The fact that CIGS modules can deliver another argument in their favour, namely their attractive appearance, supports their position in this segment further.

However, a boom in CIGS fuelled alone by the rooftop segment seems unlikely as worldwide volume is limited and the competition is fierce. It is, therefore, of necessity to also establish a foothold in those customer segments that are more focused on the rate of return which in this case is the commercial rooftop and open space segment. Currently, competing thin-film technologies and crystalline producers from the Far East are setting the standards here. Competitiveness requires that ambitious roadmaps concerning increased efficiency rates and a reduction in production costs, both of which are key leverage points, are implemented without delay.

The question of, if and when these roadmaps will actually be implemented can only be answered by the manufacturers themselves. The developments of the past months have clearly improved the conditions required for their successful realization. The attainment of a dimension crucial for mass production coupled with the supply of tried and tested production equipment should enable established stakeholders as well as newcomers to put promising lab results into practice on an industrial level and, moreover, should bring about the required cost-cutting steps. Thus, an essential milestone would be within reach, and, CIGS technology could assume its role as the main driver in furthering the development of thin-film PV.

EuPD Research (www.eupd-research.com) is a B2B market researcher for public and private companies and the media. As an international service provider, EuPD Research offers a wide range of qualitative and quantitative research services based on many years of experience, particularly on global PV markets. For more information, please contact Daniel Pohl at d.pohl@eupd-research.com.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2010 www.interpv.net All rights reserved. |