According to a new report from IMS Research, inverter capacity will be ramped past 30 GW this year and inverter production may exceed actual demand by more than 2 GW in Q4’10 leading to large inventory build. This effect reverses the earlier inverter shortage seen in the first half of 2010 and is set to impact the industry as it heads for a major slowdown in demand in Q1.

According to IMS Research, inverter production capacity has more than doubled in 2010 and by the end of the year will exceed 30 GW. Based on the expansion plans of more than 30 top suppliers, capacity is set to grow another 40% in 2011. However, significant double-ordering occurred in H1’10 as customers panicked to secure inverters as the German market boomed. Now that German demand is slowing, these additional orders are starting to be cancelled as warehouses fill up with unwanted inverters.

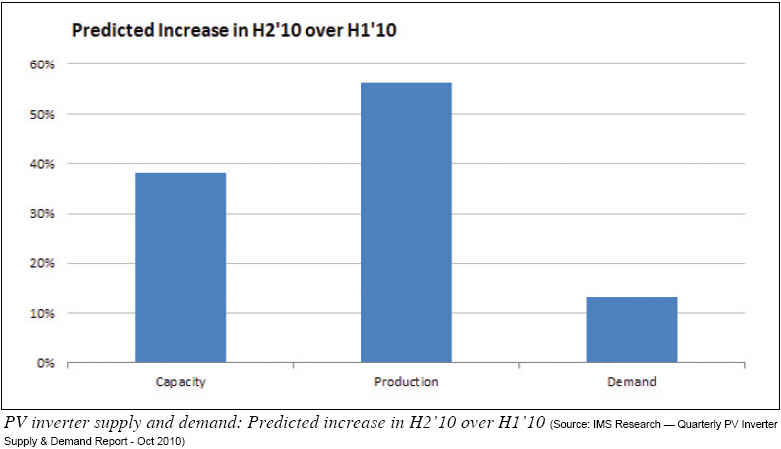

PV Research Director Ash Sharma commented, “Although inverter shortages were evident in the first half of this year due to a bottleneck in component supply, an oversupply of inverters is now very possible and inventory is starting to build at customers. Suppliers continue to ramp capacity and production at an alarming rate given market demand is now starting to wane. Installation demand is predicted to be 13% higher in the second half of the year compared to this first half. However, planned inverter production is forecast to be 56% higher.”

Looking past Q4, the picture for inverter companies looks bleak in the short term. Production capacity has been massively increased, with all leading suppliers expanding facilities and many new entrants to the market. This increasing supply, however, is likely to meet falling, or at best, stable demand in 2011 and a large fall in prices seems likely as a result.

As such, inverter suppliers will need to brace themselves for a sharp fall in profits in Q1’11, with IMS Research predicting the lowest level in seven quarters. A major fall in demand, coupled with intense pricing pressure and additional costs of expanding capacity will undoubtedly see a slide in supplier gross margins.

Further Information: IMS Research (http://www.pvmarketresearch.com/)

For more information, please send your e-mails to pved@infothe.com.

ⓒ2010 www.interpv.net All rights reserved. |