PV Cell

Millinet Solar

Claimed to secure 1 GW-scale solar cell manufacturing capacity by 2013, Millinet Solar will expand current production output of 100 MW solar cell production line to another 100 MW by the first half of 2010, then 100 MW more by the latter half of 2010, bringing the total production scale to 300 MW in 2010.

This past March, Millinet Solar signed the contract with Spain’s Eurener worth about US$80 million until 2012, gaining a reputation as a company who has singed supply deal of solar cell worth US$193 million to Spanish companies alone, including US$7 million with Solaria, US$ 106 million with Siliken, plus others.

Samsung Electronics

Since 2009, Samsung Electronics is running its R&D line for crystalline solar cell of 30 MW annually, within the company’s Giheung Business Center. The company will construct production line for 100 MW crystalline solar cell at Giheung Business Center in Gyeonggi Province by 2010 and immediately begin their aggresive sales activities.

Shinsung Holdings

Having constructed its 50 MW solar cell production plant at Jeungpyeong, Chungbuk, in 2008, Shinsung Holdings has expanded its annual 100 MW production ability by additional 50% to 150 MW and will expand it further to 500 MW by 2012 and 1 GW by 2015.

alti-solar

Having established its 25 MW thin-film solar cell production plant inside Jeonju Science and Industrial Complex, altisolar added another 25 MW production line to current 50 MW output for thin-film solar cell. Upon its full-running capacity, the company will produce up to 60 MW in 2010.

STX Solar

STX Solar constructed monocrystalline solar cell production plant at Gumi, Gyeongbuk, in 2009, with an annual output of 50 MW. With an influx of over US$200 million in investment capital, the company will focus on technical development of next generation including thin-film solar cell with future output of 300 MW monocrystalline solar cell by 2014 boosting the revenue up to over US$500 million annually.

LG Electronics

In order to construct solar light value chain, LG Group decided to focus on R&D of polysilicon and other key elements at LG CHEM, cell effectiveness and improvement of producing numbers at LG Electronics, respectively. In addition, LG Electronics and LG Display will be focusing on the development of high-efficiency thin-film solar cell, which turns solar energy into electrical energy.

LG Electronics, in particular, has completed the construction of 120 MW crystalline solar cell production line at Gumi, Gyeongbuk, in 2010, capable of making 520,000 1 m x 1.6 m size solar modules annually. By 2011, another production line will be added to provide the output of 240 MW for solar cells.

KPE

KPE was established in 2000 as Photon Semiconductor Energy. KPE constructed its first plant at Changwon, Gyeongnam, in 2002, capable of producing 6 MW annually. In 2006, the company added second production line producing 30 MW annually then added the newest third production line in 2009 to bring the entire output to 100 MW annually. KPE was the first company to produce and export solar cell and is aiming at producing over 300 MW by 2013 through various new investments.

KISCO

KISCO was the first Korean company to start thin-film solar cell business enterprise, securing over 20 MW production ability annually since 2008. KISCO has announced it has signed a deal for a joint venture corporation with the State of California, U.S.A., this past April, for 100 MW-scale solar cell energy business for the next five years, making it the world’s largest as a singular power plant. Accordingly, we expect additional construction of production lines among other investments to be made.

Hanhwa Chemical

Having completed the construction of solar cell plant in Ulsan in 2009 capable of producing 30 MW annually, Hanhwa Chemical (formerly known as Hanhwa Petroleum) introduced its first product beginning in January 2010 according to its supply contract of solar cell worth US$14 million. The company will expand its solar power related business to include polysilicon and solar module and more, with production expansion of solar cells to 2 GW by 2020, producing the revenue of over US$200 million.

Hyundai Heavy Industries

Hyundai Heavy Industries began its solar power business since 2004, producing 30 MW crystalline solar cells annually since 2007. With completion of 2nd plant in 2009, the company now has an annual 330 MW-scale production ability.

With its second plant expected to run in full capacity by 2010, Hyundai Heavy industries forecasts the revenue over US$100 million this year.

Hyosung

Officially announcing its entering of solar cell business in October, 2008, Hyosung has actively taken its steps ever since including ordering crystalline solar cell production facilities. The company has decided to expand its production ability to 240 MW annually in the long term and, as its first step, and will construct production line capable of handling 60 MW.

Other Players

In addition to above companies, TELIO SOLAR established a pilot line in Pyeongtaek, Gyeonggi Province, in 2010, with LG Micron, capable of massproducing 30 MW thin-film solar cells with further R&D taking places between two companies. In dye-sensitized solar cell field, Dongjin Semichem, which constructed 5 MW-scale pilot line in 2009; Dyesoltimo, which expects annual DSSC production of 11 MW in 2010; Samsung SDI, Eagon Industrial, TG Energy and other companies are planning to construct mass production lines after the year 2010.

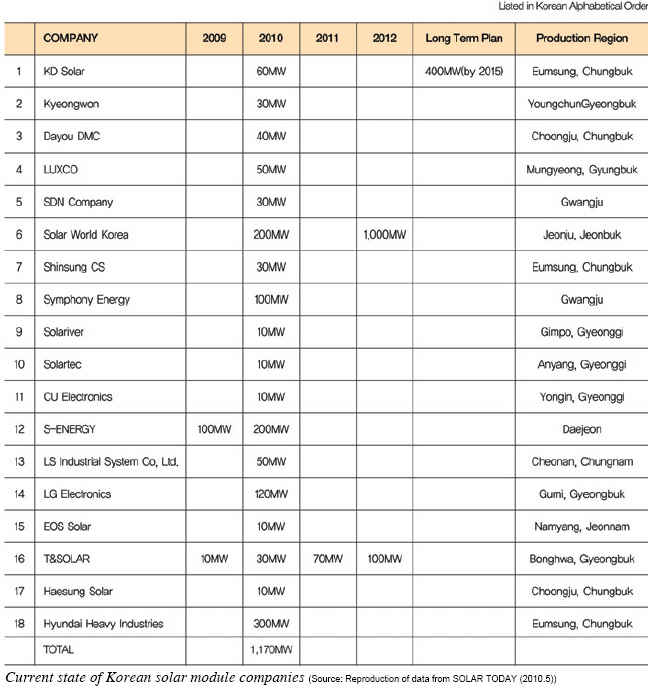

PV Module

KD Solar

KD Solar completed its annual 60 MW capacity plant at Eumseong, Chungbuk, in March 2009, and has been rapidly expanding its overseas sales promotion to Europe, Southeast Asia, Australia and other regions. KD Solar will produce solar modules of over 200 MW from now on and will expand its output to 400 MW by 2015 to become the world’s top 10 module maker. Having established in 2004 with discovery of new growth engine at Kyungdong Gas and its diverse business strategy, the company increased its revenue to US$62 million in 2009 from US$2.2 million in 2005, an increase of over 30 times during the past 4 years.

Kyeongwon

Established in October 2006, Kyeongwon has doubled its previous 15 MW production capacity to current 30 MW.

SDN Company Ltd.

SDN Company supplies solar cell parts and total solution for solar cell energy, having completed its state-of-the-art plant in Gwangju in April, 2010, with full automation to produce high-efficiency crystalline solar modules (over 15.05% higher) to 30 MW capacity.

Symphony Energy

Symphony Energy constructed annual 10 MW-scale solar module production line in November 2004, then additionally constructed production lines of 30 MW in 2005, 50 MW in 2006, and 100 MW in 2008. The company will have a revenue of over US$130 million through its exports. Its plan is to focus on targeting solar cell markets in the EU region, centering on Germany and other nations including Italy, Spain, Belgium and Czech Republic, all in an effort to expand its export coverage from last year’s 40% to 70% this year.

S-ENERGY

S-ENERGY completed its construction of plant No. 2 at Daedeok Valley in Daejeon, in 2009, securing the production line capable of 100 MW per year. Through its recent facility investment in the second plant in Daejeon, the company established additional production capability of 100 MW solar module, bringing the total annual production output to 200 MW and began its active operation. This year, S-ENERGY is estimating over US$180 million in revenues.

LS Industrial System Co., Ltd.

LS Industrial System Co., Ltd. is Korea’s first-ever company to start solar energy business in 1986. Based on its diverse business experiences and know-how’s, the company succeeded in making domestication of solar module in 1993, acquiring R&D patent on building-integrated solar technology in 2001 and installing Korea’s first-ever solar energy system at the airport, all in an effort to lead solar energy industry. The company expanded its solar-cell production facility at its Cheongju Plant to the output of 50 MW in 2009.

T&SOLAR

T&SOLAR was established in July, 2008, and began producing prototype solar light module in April 2009, upon the completion of its facility, including Korea’s first-ever ‘3 bus-bar type‘ modules. The company is preparing for the rapid expansion of new energy market after 2010 by expanding its current 30 MW production scale to 70 MW by 2011 and up to 100 MW by 2012. Recently, T&SOLAR exported its product to Enneplu, an Italian company based in Milan. Based on this first overseas export, the company is planning to export and supply its outstanding products to E.U., Japan and the U.S.A.

Polysilicon

OCI

OCI is the only company in Korea that developed polysilicon production technology on its own, which established its second plant in September 2009, which is capable of producing 10,000 t annually, making the company’s total polysilicon output to 16,500 t per year. Its second plant in Gunsan is the world’s largest unit factory for polysilicon. Therefore, OCI now has become the world’s second largest polysilicon company after Hemlock of the U.S.A.

Woongjin Polysilicon

Woongjin Polysilicon began its active plant establishment with a groundbreaking ceremony on January 20, 2009. After the completion of the third plant, the company is able to mass produce 5000 t of ‘Eleven Nine‘ polysilicon possessing the world’s highest quality.

Woongjin Polysilicon signed a long-term contract worth US$690 million with Hyundai Heavy Industries in January 2009, with contract period running for 5 years beginning in 2011 and receiving part of contracted money in the beginning. This is a remarkable achievement as it signed a long-term contract after being established for less than 5 months.

KCC

Upon entering the polysilicon business, KCC established the co-op venture corporation KAM with Hyundai Heavy Industries and agreed upon mandatory supply and purchase of polysilicon by one another. KCC is planning to expand its annual output to above 18,000 t. The company successfully produced organic silicon polymer for the first time in Korea in 2004, and is the only company in Korea that possesses the integrated production system from silicon material to 2nd value-added products.

Han Kook Silicon

Hankook Silicon will expand the production scale at its Yeosu plant from current 3,200 t to 4,800 t in 2011 and enter the semiconductor-use polysilicon market that requires high purity in the future. The company was established in 2008 through the co-op investment venture between Osung LST, a wafer production company, and Shinsung Holdings, a solar cell production company, to create vertical affiliation. It was the 2nd company, after OCI, to be successful in mass production of polysilicon in Korea.

Ingot & Wafer

GLOSIL, Inc.

GLOSIL announced its plan to expand production capability for polycrystalline solar cell-use ingot and wafer to 100 MW and 30 MW each, respectively. The company’s current production capability is 20 MW for ingot and 15 MW for wafer and, with its investment of US$20 million, it is constructing the second plant at Industrial Complex No. 2 located in Dalsung, Daegu. The second plant was completed by the end of July 2010 and is now in full operation. The facilities in its current Ansung plant will be relocated to the Daegu plant as the Ansung plant will be used as an R&D facility.

REXOR

REXOR is a professional company that focuses on solar energy, producing solar energy-use silicon and wafer, supplying its products not only to Korea but to Japan as well, currently taking up 5% market share in Japan alone. The company is investing US$ 7.1 million to relocate its Hwaseong plant in Gyeonggi to Chungju in Chungbuk, a 12,460m2 area within the Chungju Industrial Complex, by 2013.

SILTRON, Inc.

SILTRON is investing US$8 million to expand its single crystal solar cell-use wafer production capability at its Gyeongbuk Gumi plant to 50 MW from its current 30 MW. In order to accomplish this, the company is currently placing its existing equipment to a new production line with 50 MW production capacity, while bringing in other facility parts from overseas. The expansion was completed by June 2010 with its active operation beginning during the second part of 2010.

SILTRON is planning to secure 150 MW production capacity by placing additional 100 MW by the end of 2011.

OSUNG LST CO. LTD.

OSUNG LST is a manufacturer of solar cell-use wafer, who announced its investment of over US$13 million to expand its solar cell wafer production line in Asan, Chungnam, from 40 MW to 100 MW annually. Additional 110 MW production capacity will be added by the end of 2010 for the total of 210 MW and by 2011, 410 MW production.

Woongjin Energy

Woongjin Energy has expanded its production capability for monocrystalline solar cell-use ingot to 1,100 MW by investing US$270 million to 2011, while newly creating 500 MW-scale wafer production plant. The company is also expanding its current 350 MW per year ingot production capability to 530 MW by placing additional production facilities by monthly basis. The rest of 570 MW will be secured by the end of 2011. Wafer production facility in particular, which will be installed in plant No. 2, will feature for the first time in Korea the diamond wire sawer equipment. Its equipment will be installed in the 140 MW line this year then expanded to 500 MW scale by the end of next year.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2010 www.interpv.net All rights reserved.

|