BY Henning Wicht, Greg Sheppard

Demand Back on Track but not Profits

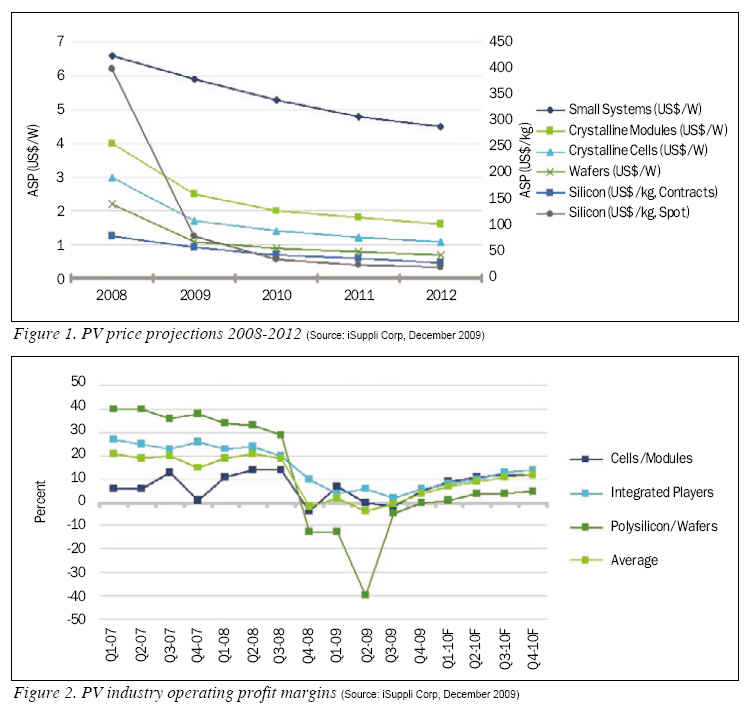

iSuppli is forecasting that installed watts of PV systems will grow 68% in 2010 and reach 8.6 GW globally. This represents a return to pre-fall 2008 growth as the global recession recedes and as new geographies and segments of demand emerge. But 2009 witnessed tremendous price erosion, with average crystalline module prices down 38%, solar wafer prices down 50%, and polysilicon spot prices down 80% (See Figure 1). We believe this represents a permanent ratcheting down of price structures that will transform the industry into a very competitive marketplace with weaker players dropping out and a select few aggregating larger pieces of the market.

One of the major implications is that industry players will need to continue to accelerate cost-down roadmaps in an effort to keep up with the price declines and to repair compressing profit margins. Figure 2 shows operating profit margins for polysilicon, cell/module players, and the so-called integrated players that combine at least four nodes in the chain. After suffering a loss for much of 2009, our analysis suggests that profits will move into the positive in Q4 2009 and continue to improve during 2010. We are projecting that the average will pop back above 10% by Q4 2010 with the oversupplied polysilicon area lagging behind in profit strengthening. Our major underlying assumption behind the improvement in the profit picture is due to cost-down programs catching up with the rate of price declines.

PV System Prices

In 2009, the price of an average PV system declined about 11% while the price of an average crystalline module declined 38%. For 2010, iSuppli is predicting that system prices will fall another 10% while modules will drop another 20%. There appears to be three drivers for this divergence. One is that prices for the Balance-Of-System (BOS) elements and installation-related costs (Engineering, Procurement, and Construction (EPC)) are declining more slowly. Another reason lay in the fractured nature of the installation node, where there is less motivation to pass along the cost savings. The third, which is related to the second, concerns the very act of providing incentives for PV electricity projects (FiTs, rebates, tax credits, etc,) that helps keep system prices higher.

The thinking behind this last point is that project developers and installers just need to show the system owner sufficient ROI and payback periods--not necessarily the lowest price--to make the deal. This is made possible by the fragmentation of the installation node of the PV value chain. There are literally thousands of project developers and installers in the world, most of them not subjected to the intense commodity-like competition that their supply chain faces.

This is both a drag on the development of the industry as well as an opportunity for the best margins in the business.

FiTs Causing a Fit

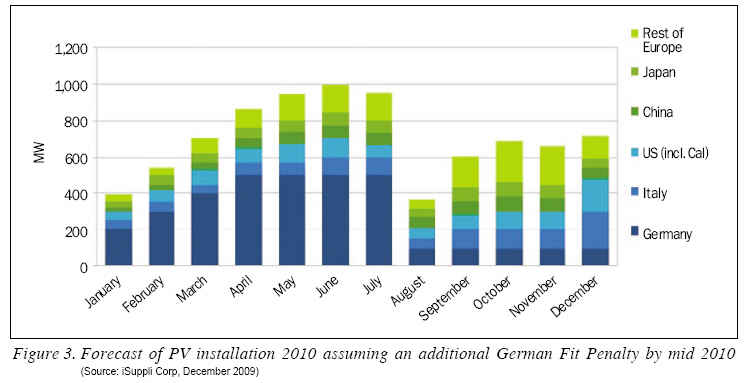

A great deal of uncertainty has been injected into the market from the world¡¯s largest market, Germany. Like Spain last year, the threat of a potential ¡®additional¡¯ reduction in the Feed-in Tariff (FiT) has created a spike in German market demand for PV systems. Germany will account for 50% of total worldwide PV installations in 2009.

The new government in Germany is assessing the burden posed by the current FiT regime on rate payers and electricity utilities. Current speculation is that by mid-year, an extra lowering of the FiT is will have been in the works. This would extend the demand bubble seen in the last few months of 2009 into the first half of 2010. The main implication is continuing tight conditions with regard to supply and firm pricing--for a while. Then, depending on how ¡®orderly¡¯ the PV industry reacts, there is the potential of another supply glut returning in the second half of 2010. Only the best managed companies will be able to profitably navigate this uncertainty.

Price Gap between Crystalline and Thin Film

It¡¯s not by accident that the world¡¯s largest solar panel maker, First Solar, is also the lowest-cost high-volume producer. First Solar is a producer of thin-film modules based on CdTe technology. iSuppli predicts the average price gap between thin-film and crystalline technologies will narrow to US$0.60/W in 2010 after averaging US$0.80/W in 2009. The narrowing gap is a reflection not only of a lot of pain and suffering in the crystalline supply chain but also of essentially zero profit collectively for those producers. In 2010, iSuppli predicts crystalline module prices will drop by another 20% to US$2.00 and thin film by 18% to US$1.40. The major implication of this outcome is that if companies aren¡¯t meeting or beating these percentage take-downs, they stand to lose market share in 2010.

Time Horizon Stretches for New Silicon Technologies: Siemens Alternatives?

2009 was not kind to new polysilicon technologies like FBR and UMG. In an era of US$400/kg pricing, their potential loomed greatly in 2008. But now that we are entering an era of sub-US$50 poly, the reward/risk of these technologies has diminished their near-term commercial potential. For the foreseeable future, FBR and UMG penetration growth of the market will be curtailed given that the challenges these technologies present in getting untracked overwhelms their now greatly reduced cost advantages.

Expect the modified Siemens method for poly manufacturing to continue to dominate as numerous capacity expansions become available in the coming two years and as various FBR and UMG projects get delayed or even cancelled. MEMC stands alone as the company that has mastered FBR, while REC is backing away from it. As to UMG poly, different players have resorted to mixing it with higher-priced, higher-purity poly in order to raise its efficiency to more marketable levels. This has contributed to its pricing being even closer to the Siemens-method poly. Of additional note, many cell manufacturers are restructuring and focusing on core competencies and do not have the time or money to follow a new polysilicon path.

Enter Even More Players

Expect more players to enter the PV space in 2010 as they try to leverage potential competitive advantages from other industries. Top of the list are Samsung and LG Electronics (largest shareholder of LG Displays), already the world¡¯s largest LCD panel makers. These companies have vast experience in bringing down costs, raising quality, and ramping to high volumes. Both these companies can potentially benefit by the procurement leverage of items like glass, wafers, polysilicon, and manufacturing equipment. They are also well versed at moving into areas after they have been established and then eventually dominating them.

-LG Electronics has already announced it will start large-scale production in both cells and modules (thin film and crystalline) from its new 120-MW capacity plant in January 2010. It claims its thin-film technology has 11.1% efficiency.

-TSMC, one of the world largest manufactures of chips and buyers of electronic-grade wafers, has begun to diversify into PV. Its most significant move to date is taking a 20% stake in cell maker Motech. TSMC is experienced in large-scale manufacturing and cost-reduction programs, and also has an existing footprint in China. Look for them to bring to the party similar advantages as the Korean giants.

-Bechtel, the large EPC firm with more than US$31 billion in revenues, has officially entered the solar industry. The company has been contracted to design and install 440 MW of CSP in southern California. Bechtel, a huge private company famous for building airports, dams, and transportation systems, could become a significant player in project development and an entity that everyone could want to partner with.

The major implication of these new entrants on current industry players is that the latter group needs to ¡®watch out.¡¯ Don¡¯t get caught thinking, ¡°They¡¯ll never make it; we¡¯re too far down the learning curve to get hurt.¡± It is simply amazing how hiring the right handful of people and bundling with deep pocketed capital can change things.

Efficiency to a Proper Price Premium

More efficient solar modules will continue to command price premiums, but suppliers will have less success in getting these prices to stick than in the past. For applications where space is limited or expensive, efficiency will continue to be valued and a premium to be paid. But this premium will be fleeting as buyer/plant owner expectations are shaped by payback times, initial out-of-pocket expense, and FiT incentives that are ratcheting down in key countries. The latter point means that upfront costs will become a larger factor in decision making. A major implication of this is that companies and their investors will find greater acceptance of new technology as well as manufacturing breakthroughs that can demonstrate lower, and at least comparable, costs per watt.

Too Much Capacity for an Industry

Even though the industry has done a good job of reducing its inventories, the improvement is tenuous because of big swings in utilization rates on existing capacity. It is very hard to plan--given all the lumpy FiT demand bubbles hitting the industry--with the German market being the latest.

From polysilicon to modules, companies have curtailed production by idling lines and running fewer shifts. iSuppli estimates that average capacity utilization across all nodes was 70% in 2009. Some companies were sold out all year, while others where swimming in excess. In addition, there were many capacity expansions during the year. And while there is a lot of debate on how to measure capacity, our definition assumes 24/7 utilization of lines/equipment that is already in place.

We believe excess capacity in 2010 will keep prices flattened (at least, not raising them).

Enter the Dragon, the Eagle, the Tiger, and EMS Provider...

For 2010, we expect several significant new geographic growth markets to be fought for. Most significant are China, the United States, and Italy, which iSuppli is predicting will collectively account for 50% of the growth that takes place in 2010. Germany will remain the biggest market, but these other countries will rise in importance during the year. China is the latecomer as it races to inject more renewable content into its energy portfolio.

Companies positioned strategically in these markets now stand the greatest chance of grabbing share over the next years. Even though local manufacturing can help provide competitive advantage, it is not as crucial as before as module prices have dropped precipitously. So far, the reduction of shipping and other logistics-related charges, as well as the availability government incentives, has not proven motivation enough for setting up local production for many firms. In the meantime, some companies are using electronics EMS providers to build modules. In two to three years, however, the ¡®landed costs¡¯ of logistics and localization incentives will become larger decision factors. Markets that pass the 500-MW annual total market shipment level should see more investment in module production in the coming years.

Going Fishing Downstream

Continuing the trend begun in earnest during 2009, iSuppli expects more PV industry companies to shift closer to adding value for the users of PV electricity. PV supply chain companies are investing directly into long-term and development-time ownership of solar installations as well as taking control of EPC or installation services. Prime examples are MEMC buying SunEdison and LDK investing in solar farms in China. One company, Conergy, has returned from being a supply chain player to being a project developer. There are multiple benefits to this downstream focus, including creating more developed sales channels, creating your own customer, and in some cases (but not all), improving profitability.

This is an excerpt of the iSuppli Market Tracker report ¡®The Business of Photovoltaics in 2010¡¯ (www.isuppli.com).

For more information, please send your e-mails to pved@infothe.com.

¨Ï2010 www.interpv.net All rights reserved.

|