BY Jack Calderon, Chaim Lubin

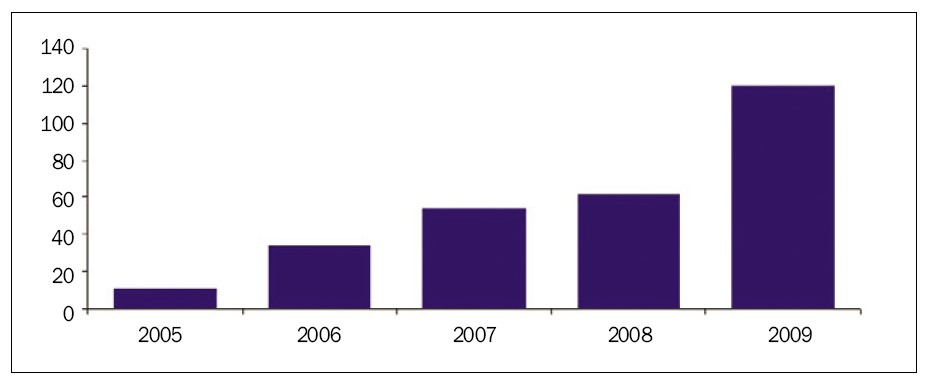

In 2009, 120 solar energy M&A transactions were completed--nearly twice as many as the 62 recorded in 2008, four times the total deals recorded in 2006 and more than ten times the number of deals completed in 2005. A ten-fold increase in five years has not been seen since the technology boom of the late 1990s.

This increase demonstrates the significant, growing interest in solar companies. A high level of transaction activity will continue as large established companies across many market sectors determine that solar should be included in their overall business portfolio.

Transaction Activity Across Multiple Sectors

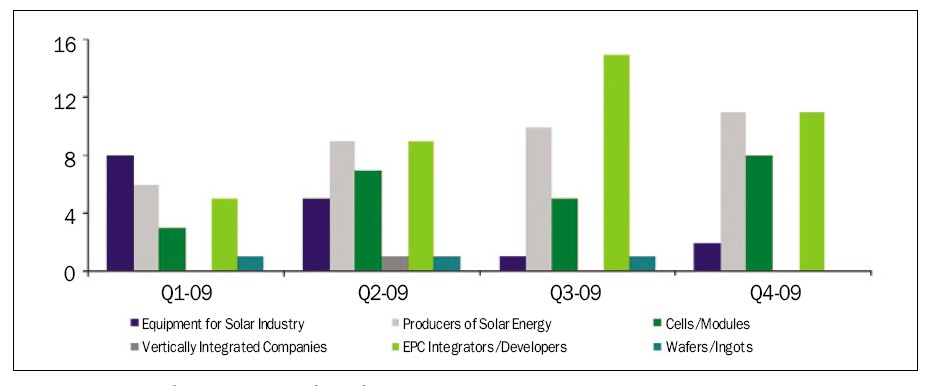

To better classify these M&A transactions, it is helpful to understand where the activity has taken place. When discussing M&A activity, the category of the transaction is based on the target, or the company being acquired. We group these sectors into six different categories:

● Equipment for the solar industry (“equipment providers”): Companies that produce equipment that support or manufacture items throughout the solar supply chain

● Manufacturers of wafers and ingots for solar cells (“wafers/ingots”): Companies that make the basic material from which Photovoltaic (“PV”) cells are made

● Cell and module manufacturers (“cells/modules”: Companies that make PV cells or assemble cells into panels/modules, or serve both functions

● Engineering Procurement & Construction integrators and developers (“EPC integrators/developers”): Companies that offer services such as the installation and construction of solar projects, as well as companies that are developing these projects (i.e., securing financing, designing solar projects, organizing the construction effort and completing overall solar projects)

● Vertically-integrated companies: Companies that provide products and/or services across the value chain and typically span the manufacturing of solar products and systems, as well as companies that pursue the completion of solar projects

● Producers of solar energy (“producers”: Companies that own and operate solar projects, which includes solar plants and projects that are being sold. Producers also operate solar installations and sell energy

Figure 1. Annual solar industry M&A activity--total number of deals (Source: Lincoln International)

Concentrating in EPC Integrators/Developers

The majority of solar M&A activity was concentrated among EPC Integrators/Developers in 2009. 40 acquisitions were completed in this category, compared to only 18 during 2008 (a 122% increase). This highlights the market’s overall interest in pursuing the completion of solar projects and the increased availability of potential projects throughout the industry.

One of the main factors driving the completion of solar projects is the availability of incentive structures across the globe, including the United States’s Renewable Portfolio Standards (RPS) that are expected to come to a head in California in 2010. The RPS standards require utilities to buy a certain percentage of their power from renewable sources. As the RPS deadlines approach or become apparent in other states across the United States, this activity will increase even more, further expanding the market for solar projects.

With this in mind, companies within the EPC Integrators/Developers category are utilizing different strategies and business models to position themselves for success. Some companies are narrowing their focus on the EPC or installation aspect of projects, while others are moving toward the development side. On the other end, some companies have taken a more integrated approach within this sector and are establishing platforms that combine the capabilities of being an EPC provider with development expertise. It is still to be determined which of these models will be the most successful, but while the market momentum continues to grow, many EPC Integrators/Developers companies--irrespective of business model--will continue to see activity.

Figure 2. Quarterly M&A activity by industry sector (Source: Lincoln International)

Producers

The next largest sector category of acquisitions was for companies categorized as producers, with 36 transactions or 30% of all solar transactions in 2009. This is a more than three-fold increase from the 10 transactions recorded in this sector during 2008. The focus within this sector has been to expand the ownership of solar electricity production capacity, with the majority of these transactions representing the sale of projects or solar plants. Many of these sales are being completed to transfer projects to those willing to own and operate solar plants, since the business model used to build a solar project differs significantly from owning and operating a solar project. For example, the monitoring, maintenance and security required by a solar plant or project requires a number of capabilities beyond the ability to develop or construct a project. Additionally, owning a solar project is a much longer-term proposition, with the economic benefit spread across power purchase agreements that typically range from 20 to 25 years. While some companies are evolving to take on the development and ownership of projects, this diminishes the ability of these companies to focus on core strengths and could weaken the company’s business model. A more focused approach to being an owner/operator or an EPC Integrator/Developer seems to be preferred, as it allows a company to focus its capital and capabilities where it excels.

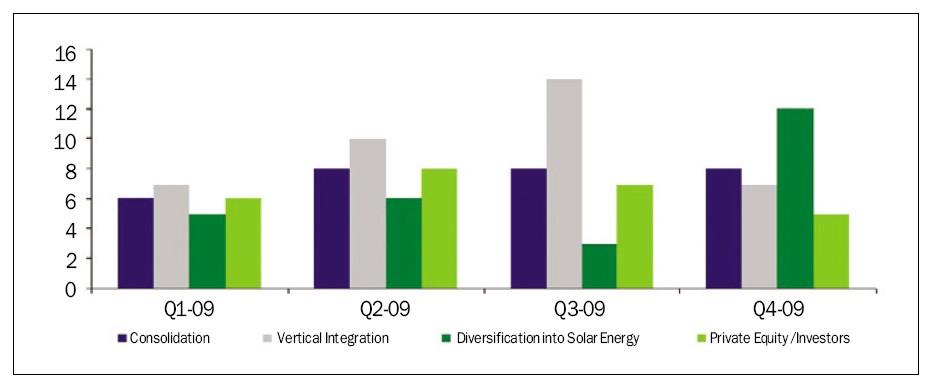

Figure 3. Quarterly M&A activity by transaction type (Source: Lincoln International)

Different Strategies with Caution

There exists a tremendous opportunity for companies with solar projects to realize immediate value in today’s market. Companies in geographic regions across the globe have differing risk profiles and, therefore, have varying levels of willingness to take ownership of projects. For example, as the United States’s solar market develops, the dynamics of developing projects has become increasingly complicated and requires significant resources. This decreases the ability of EPC Integrators/Developers in the United States to retain ownership of their projects, as it requires additional resources and capital that many companies have already dedicated to construction and development activities. However, a company in Europe or China that has the resources and capital available, or a company in the United States that focuses all resources and capital purely on project ownership, is far more capable of being able to own and operate solar sites. Therefore, both companies can be more successful by transitioning the ownership of the project through an acquisition. However, companies must proceed with caution when executing these transactions. In order to maximize the value from the sale of a project, companies must be able to reach the global set of potential buyers. Without having relationships in multiple geographies and, therefore, divergent risk profiles, a company might not find a buyer willing to pay a premium for a project. The valuations of projects will differ significantly by region, as some companies may value entry into a new market far greater than those that already have a foothold (and vice versa). This phenomenon will lead to further transaction activity on a global scale.

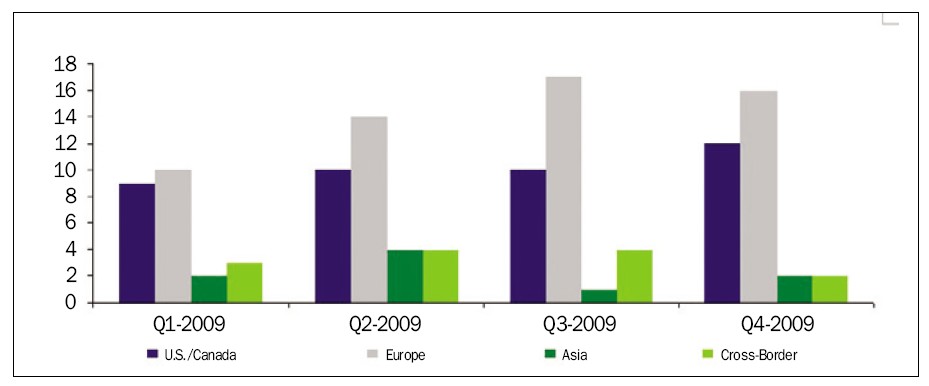

Figure 4. Quarterly M&A activity by geography (Source: Lincoln International)

Other Categories

Beyond producers and EPC integrators/developers, companies categorized as cells/modules manufacturers accounted for 23 transactions or 19% of the deal total in 2009, and companies categorized as equipment providers conducted 16 transactions or 13% of the annual total. Finally, companies categorized as vertically integrated or wafers/ingots represented only one and three transactions, respectively. The activity in these sectors has been lower, as the industry is still immature and has many varying technologies and several different business models at the manufacturing level. This leads to more differentiation between firms and lower desire for consolidation or integration. However, the extent that these companies have a proven technology or platform is important, as they can garner significant value through a sale, given the desire for entry into the solar market.

Transaction Rationales

To further understand the significance of the transaction activity experienced, transactions are categorized by four different types--consolidation, diversification into the solar industry, private investment and vertical integration.

Vertical Integration

The hottest area of transaction activity in 2009 was vertical integration with 38 deals completed or 32% of the total transactions. Vertical integration is an existing company within the solar value chain that purchases capabilities outside of its current core activities to integrate up or down the value chain. The increase in this type of activity highlights the trend of companies trying to build on their existing business models with additional capabilities in an effort to capture scale and a breadth of expertise.

Consolidation

At the other end of the spectrum, consolidation represented a consistently high level of activity during 2009. Consolidation represents a company already involved in a particular sector of the solar industry acquiring another company within that same sector of the solar industry. During 2009, there were 30 consolidations, which accounted for 25% of all transactions. This represents the other train of thought within the industry: that purely scaling up within a specific core sector is the key to developing a successful solar business.

Consolidations are expected to remain at a fairly high level and eventually increase as the solar industry goes through the early consolidation phase that most blossoming industries experience as the market matures. One form of consolidation will come from vertically-integrated companies shedding some of the non-core capabilities within their models. However, more significantly, consolidation occurs as companies realize that, in order to separate themselves, they must grow, and making an acquisition is the quickest way to achieve this objective. This provides a unique opportunity for companies that may be contemplating a sale or other exit opportunity. More likely than not, a company will capture more present value if it sells in the first wave of consolidation in an up-and-coming industry such as solar, as purchase multiples tend to be higher and the overall market desire is greater.

Private Investors/Diversification into Solar

Another interesting phenomenon that occurred in 2009 is the increase in transactions completed by private investors, as well as acquisitions made by companies outside of the solar industry (“diversification into solar”). Each of these transaction types accounted for 26 transactions in 2009 or 22% of overall activity. More notably, these two transaction types experienced the highest level of growth, with each type more than doubling their 2008 totals. This signifies a very positive sign for the solar industry, as it shows that private investment is returning and that solar is capturing the attention of the general market. This activity will continue with the return of the capital markets and the increased profitability with an improvement in the economy. Again, this interest creates an active market for solar companies with proven business models that wish to capture value through a sale.

Global Transaction Activity

The solar industry is certainly global, highlighted by the spread of M&A activity across various geographies. Europe remains the leading market for solar M&A, with 48% of 2009 transactions coming from the region. Markets like Germany and Spain are far more mature than most other international geographies and therefore, seeing more transaction activity. However, transaction activity within the United States and Canada has increased significantly, reaching 41 deals or 34% of the total in 2009. This compares to only 17 transactions that were completed in this region in 2008. Asia has remained relatively stable with regard to the number of transactions, completing nine deals in 2009 compared to seven in 2008.

One geographic transaction type that surprisingly has not been significantly active is the cross-border transaction (i.e., a deal completed between two different geographies). In 2009, cross-border deals accounted for only 11% of the total, which is a 4% decline from the percentage of 2008 transactions that were classified as cross-border. The reason behind the lack of growth in cross-border deals may be that many sellers and buyers lack the necessary global network that facilitates the completion of a cross-border transaction. Companies must be able to access the appropriate contacts in multiple geographies while being cognizant of cultural biases and norms that can make or break the ability to consummate a transaction. In order to maximize value for the sale of a business or to find the best acquisition target, having global reach is critical.

The overall transaction landscape of 2009 highlights the trend among solar companies to establish scale by integrating up and down the value chain, as well as consolidating operations. Transactions in 2009 also reinforced the popularity of EPC Integrators/Developers as acquisition targets and the increased interest from companies outside of the solar space to seek entry through acquisition. Moreover, it is interesting to note that in the fourth quarter alone, at least four transactions valued at greater than $100 million took place, potentially a sign of the overall economic recovery and the renewed availability of capital for well-positioned solar business models.

The Market Landscape

2010 has gotten off to a fast-paced start with M&A activity picking up around the solar industry, as well as the general economy. As mentioned, one of the most significant areas pushing growth in the United States 2010 is the pending RPS requirements in California. The public utility companies have been pushing to bring many significant projects to meet their renewable energy sourcing requirements. The expected increase in solar installations will position California as one of the largest solar markets in the world, which presents significant opportunities for solar companies across the globe to increase business across the value chain and achieve greater levels of profitability. The increase in projects has also brought about additional opportunity for those contemplating the construction of larger solar systems to capture current value through the sale of their projects. With the capital markets recovering slowly, some project owners are facing significant barriers to accessing financing to construct their systems. While funds are becoming more available, we see an opportunity for owners to sell their project to acquire the necessary financing to complete the project while also recognizing some immediate value.

In addition to the RPS requirements, the current administration in the United States has encouraged many items that will potentially benefit the solar industry through additional funding. For example, there is the contemplation to seek a federal level RPS, which would change the dynamic of the entire market as a significant amount of solar would be pushed to come to the surface. However, even without some of these regulatory improvements, the United States’ solar market still looks poised to be the fastest growing in the world.

The key for companies as they look to be successful in this upcoming year and in the long term is to contemplate, refine and build on their overall business strategy. Every company must know whether they are going to grow organically or grow through acquisition or exit the market. No matter what, all companies must take the time to analyze the various strategic alternatives available to maximize value for their stakeholders.

Jack Calderon is a Managing Director of Lincoln International (www.lincolninternational.com), a global mid-market investment bank. Chaim Lubin is an Associate of Lincoln International, a global mid-market investment bank.

For more information, please send your e-mails to pved@infothe.com.

© www.interpv.net All rights reserved

|