2011 and the beginning of 2012 mark a very difficult time in the solar industry as the industry continues to face extreme market pressures. In the first quarter of 2012, the index of solar companies tracked by Lincoln International (the ‘Solar Stock Index’) underperformed the S&P 500 slightly, with the Solar Stock Index declining 2% while the S&P 500 increased almost 12%. Within the aggregated index, however, all sectors of the value chain increased stock prices except for cells/modules companies.

By Jack Calderon, Chaim Lubin

.jpg)

.jpg) For the fourth straight quarter, stocks in the solar industry were outpaced by the S&P 500 as the industry continues to face extreme market pressures resulting in further declines. 2011 and the beginning of 2012 mark a very difficult time in the solar industry, resulting from significant price competition among cell and module manufacturers, the reduction or elimination of solar programs, incentives in several geographies and an overall industry image marred by bankruptcies and unsuccessful ventures. However, in spite of this, some solar industry companies have begun to rebound slightly and there seems to be positive dynamics being exhibited throughout the value chain. With key political elections on the horizon internationally, the industry still faces some uncertainty and companies must be ever vigilant to protect and build their businesses to compete successfully. For the fourth straight quarter, stocks in the solar industry were outpaced by the S&P 500 as the industry continues to face extreme market pressures resulting in further declines. 2011 and the beginning of 2012 mark a very difficult time in the solar industry, resulting from significant price competition among cell and module manufacturers, the reduction or elimination of solar programs, incentives in several geographies and an overall industry image marred by bankruptcies and unsuccessful ventures. However, in spite of this, some solar industry companies have begun to rebound slightly and there seems to be positive dynamics being exhibited throughout the value chain. With key political elections on the horizon internationally, the industry still faces some uncertainty and companies must be ever vigilant to protect and build their businesses to compete successfully.

.jpg)

In the first quarter of 2012, the index of solar companies tracked by Lincoln International (the ‘Solar Stock Index’) underperformed the S&P 500 slightly, with the Solar Stock Index declining 2% while the S&P 500 increased almost 12%. Within the aggregated index, however, all sectors of the value chain increased stock prices except for cells/modules companies. The strongest of all was the Wafers/Ingots sector at the very front of the solar industry value chain, which exhibited an increase of more than 12%, even outpacing the S&P 500. EPC Integrators/Developers exhibited the next largest increase with a 3% improvement. This modest increase is significant though, as it marks the first time this sector of the market has improved since the third quarter of 2009. This could indicate positive momentum on the project side of the solar industry as more projects are completed and companies roll out more robust integration and development efforts. The sector of companies that are vertically integrated remained flat, while cells/modules declined close to 6%. The intense pricing pressure has adversely affected the cells/modules companies resulting in this continued decline in stock prices.

.jpg)

Despite the declines in stock prices of companies within the Solar Stock Index, valuation multiples have increased. The cells/modules sector is displaying the highest multiple levels of any other sector in the value chain with EBITDA multiples at 10.7x on average. This seems to have occurred because EBITDA amid this group remains depressed, but some companies’ stock prices have started to rebound. Wafers/Ingots companies had the next highest multiple levels with EBITDA multiples of 9.5x times on average. Vertically integrated company EBITDA multiples also climbed reaching 7.3x on average, while EBITDA multiples of the EPC Integrators/Developers sector where the only ones to decline from the previous quarter, as they are displaying an average of 8.2x currently.

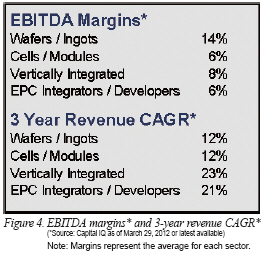

Additionally, the operating performance of solar companies has declined significantly over the course of 2011 and is at some of the lowest levels the industry has seen in years. Revenue growth has slowed across all sectors with only two sectors maintaining a three-year growth rate above 20%. Profitability is significantly lower as EBITDA margins have declined with all but one sector in single digits. At the front of the supply chain, the EBITDA margins of Wafers/Ingots still remain the strongest at approximately 14%, however, this is one of the lowest levels exhibited for this sector in history. cells/modules companies’ EBITDA margins have also declined to their lowest levels at approximately 6%. This is expected given the price competition and other difficulties facing the cell and module manufacturing sector. Vertically integrated companies experienced the most significant decrease in margins declining to nearly 8% toward the end of the first quarter of 2012. There still remain bright spots among this group with some companies exhibiting higher margins, but overall the vertically integrated model has not been able to fully withstand the market difficulties. The EPC Integrators/Developers sector’s EBITDA margins held relatively consistent with previous quarters and declined to approximately 6% on average. Companies in this sector are benefiting from the completion of projects as well as the sale of projects, which has helped some developers sustain higher levels of EBITDA. Additionally, the operating performance of solar companies has declined significantly over the course of 2011 and is at some of the lowest levels the industry has seen in years. Revenue growth has slowed across all sectors with only two sectors maintaining a three-year growth rate above 20%. Profitability is significantly lower as EBITDA margins have declined with all but one sector in single digits. At the front of the supply chain, the EBITDA margins of Wafers/Ingots still remain the strongest at approximately 14%, however, this is one of the lowest levels exhibited for this sector in history. cells/modules companies’ EBITDA margins have also declined to their lowest levels at approximately 6%. This is expected given the price competition and other difficulties facing the cell and module manufacturing sector. Vertically integrated companies experienced the most significant decrease in margins declining to nearly 8% toward the end of the first quarter of 2012. There still remain bright spots among this group with some companies exhibiting higher margins, but overall the vertically integrated model has not been able to fully withstand the market difficulties. The EPC Integrators/Developers sector’s EBITDA margins held relatively consistent with previous quarters and declined to approximately 6% on average. Companies in this sector are benefiting from the completion of projects as well as the sale of projects, which has helped some developers sustain higher levels of EBITDA.

The current market environment is not a positive one and represents a low period in the history of the solar industry. As uncertainty looms in many geographies around tariff regimes and other incentives benefiting solar, companies will continue to face difficulties and a further industry shakeout may result. This could open the opportunity for companies to capture market share or grow geographically as competitors falter or are forced out of the market due to financial difficulties. Additionally, as the first quarter of 2012 progressed, the solar industry began to see pockets of positive momentum within several sectors of the value chain potentially signaling a sign of better days to come. These dynamics should be a positive for the maturity of the industry as the companies that remain diligently focused and implement proactive strategies to help remain viable in the market should emerge stronger overall.

Jack Calderon is Managing Director at Lincoln International (www.lincolninternational.com) and co-heads the firm’s Renewable Energy Group.

Chaim Lubin is Vice President at Lincoln International and a part of the Renewable Energy Group.

For more information, please send your e-mails to pved@infothe.com.

ⓒ2011 www.interpv.net All rights reserved.

|