The recession, an obstructive financing environment and policy and incentive uncertainty have crimped the photovoltaic industry during the latest quarter. We’re seeing a definite need to create new sustainable markets to weather through these difficulties.

Set against many troubles, Germany remains overwhelmingly dominant in the PV market, accounting for 60% of global demand. The next-largest PV installation destination is now Italy. Experts also view France as one of the most promising PV markets with strong increases in PV demand predicted.

By Eric Prinet

The Emergence of a New PV Market The Emergence of a New PV Market

France’s position on the energy market has been specific for the last decades. As the 2nd biggest nuclear energy producer in the world, the Government of France has never given a strong priority to renewable energies in comparison with other European countries. Until recently, these energies have only been promoted by a small ideological part of the population. As a consequence, France’s PV capacity today is far below its European neighbors. At the end of 2009, Germany reached 9.8 GW, Spain 3.5 GW, Italy 1.1 GW and France... only 0.27 GW.

If France had been following the same trend as its neighbors, then its PV Market--in relation to the GDP or population--would have been about 6 GW today. How do we explain this delay and should we expect a closing of this gap?

A Late Take-off

With the setting up of high-level Feed-in Tariffs (FiT) in 2006, the French PV market has begun growing at a fast rate. Despite a disturbed international economic context, it tripled in 2008 to gain 175 MW of installed capacity and then reached 269 MW at the end of 2009. This take-off was confirmed during the summer of 2009. This key period for the French PV Market saw the emergence of a significant ‘ecological’ political force in the European election of that year (16% of votes). This emergence caused the government to clarify its position on renewable energies and pass an ambitious bill in September 2009 (Known as the ‘Grenelle’ bill).

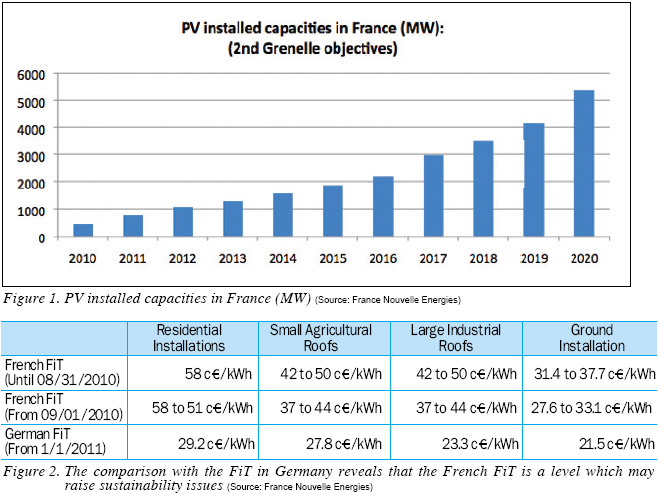

This bill resulted in the announcement of new ambitious objectives for France, such as the installation of 5400 MW by 2020, and the desire to set up an industrial and commercial PV sector. This would require an investment of EUR 10 to 20 billion over the 2010-2020 period.

Strong Government Incentives

Among the subsidies and invitation to tender available, the most appealing incentives are the FiT, which are still currently the highest in the world. The level of the FiT and their prerequisites are defined by decree and indexed upon several indicators checked yearly. Yet there are stressed regional differences. Indeed, the south of France benefits from a good level of sun radiation and strong support from most regions. It, therefore, represents almost two thirds of the installed power. In order to promote large ground installations in northern regions, the decree of 12th 2010 issued a regional coefficient ‘R’ which boosts the FiT in less sunny regions. Those tariffs are available for installations that will not be operating for more than 1,500 hours in continental France. This limit for modules mounted on trackers will be 2,200 hours in mainland. Electricity beyond those limits will be bought at a price of 5 c/kWh.

The French FiT is 75% to 35% higher than in Germany and benefit from higher solar radiation.

Structuring French PV Market

Following these announcements, the French PV market quickly structured itself. It is divided into three segments, which are residential installations, industrial and agricultural installations and ground installations.

Residential integrated installations (also called BIPV: Building Integrated Photovoltaic) smaller than 3 kWp represent 90% of the installations and 45% of the installed capacity. They offer one of the most appealing alternatives for investors in terms of their profitability with FiT which range from 58 c/kWh to 44 c/kWh. Crystalline and silicon based modules are leaders in this segment. Indeed, with higher conversion yields, small surfaces need to maximize their production capacity per square meter. BIPV as defined by the DGEC (General Direction for Energy and Climate) and the CSBT (Scientific and Technical Center for Building) refers to systems and concepts producing electricity, which also takes on the role of a building element. Electricity power equipments are eligible to the BIPV tariff only if they also have a technical or essential architectural function in the construction.

Those equipments must be in this list which is attached into the Decree of January 2010:

-Roofing, slates or tiles industrially designed with or without brackets

-Sun protection

-Lighter or siding

-Curtain wall

-Glass window with unprotected rear

-Guard rails of window balcony or terrace

The definitions, however, lack of precision. We assumed that it excludes plants which are independent of the building such as panels mounted on supports fixed or laid on rooftops or and whose sole function is the production of electricity. These solutions account for largest PV surfaces currently installed. Since the new law decree of the 12th January 2010, plants related to urban and transport structures (independent canopies, vehicle shelters, structures for sports or games, bus stops, etc.) are no longer eligible to the highest FiT but can still benefit from the BIPV tariff at 44 c/ kWh.

Industrial and agricultural installations--from 250 kWp to 1 MW--represent 6% of the installations and 46% of the installed capacity. They can benefit from a new tariff dedicated to superimposed installations of 37 c/kWh which make them a good compromise between their nature of superimposed installations--which have criteria less strict than BIPV ones--and the cost of their installation--assumed to be lower than BIPV ones. Beyond FiT, companies or farmers choosing to generate electricity in addition to their core business can benefit from several tax incentives. The key point for developing these projects is to secure surfaces. Indeed, it is currently easier to find investors, loans rather than owners ready to rent their roofs/surfaces. This market segment will grow if project developers can convince surface owners to rent their roofs at a decent price--not too high as it creates too much speculation. Recommended prices for renting such roof are close to 2,000 /ha, but some project developers have reserved surfaces with more than 10,000 /ha, with the possibility to pay cash the 20 years of rent.

Ground installations represent 2% of the installations. Their installed capacity represents 10% of the total and they, therefore, also have an important role to play in reaching national objectives. They certainly have the lowest tariff but the conditions for developing projects are very controllable. The major hindrance lies more in its administrative procedures which take much longer than for rooftop projects rather than in searching interesting surfaces. If the objective to reach 5.4 GW was realized only with ground PV plants, this would represent 0.03% of the surface of France. Indeed, 15,000 ha are needed for reaching a total capacity of 5400 MW. In France, one counts about 100,000 ha of polluted surfaces, 233,000 ha of forest that has been seriously damaged by the Klaus storm in 1999, 30,000 ha of forsaken agricultural surfaces each year. Ground installations are reserved to actors that can provide very strong financial assets due to the high level of investments. However, the reduction of prices and the use of thin films for these projects make an economic optimum reachable in a few years.

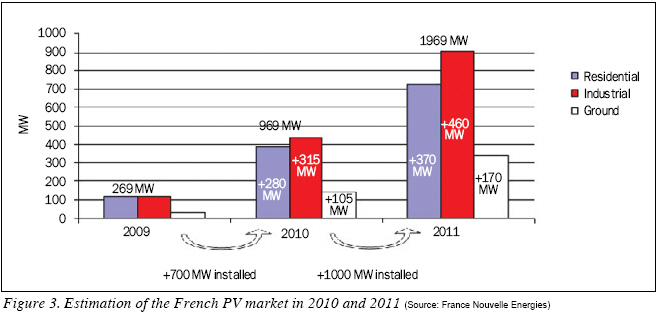

The share of each market segment has remained very constant since 2006. On the basis of this observation and our synthesis of the estimations for the PV sector, we can propose these estimation market figures for 2010 and 2011.

The Slow Down from the Government

Unfortunately this strong supportive context has led to the development of an uncontrolled situation and has, therefore, created an unexpected and speculative demand for PV installations. According to the SER (Renewable Energy Syndicates) ,the installed capacity will reach 850 MW by the end of 2010, almost twice as much as expected by the government. To meet this demand, the French downstream--comprising developers and installers--has grown very quickly and is now split with more than 5,500 small market players. Most of them are former roofers, electricians or are already experienced with heat pumps, thermal panels and geothermal energy. Even though some of these professionals can claim some PV know-how, many of them do not have the qualifications for high quality installations.

In the meantime, considering the delayed take-off of the French PV industry, France is facing difficulties meeting these challenges without using large-scale foreign know-how and products. This delay combined with the situation in other markets--such as the maturity of the German PV market--is generating massive investments by foreign investors. As a consequence, France currently imports more than 60% of its needs. Crystalline and silicon based modules are leaders on residential and small industrial installations. Indeed, with higher conversion yields, small surfaces need to maximize their production capacity per square feet. Thin film technologies are now being used at a faster rate. At the edge of the market, several products could also have a strong potential like PV shade canopies for carparks, PV red roof tiles or even agricultural friendly PV projects.

As a consequence, the objectives set by the government for 2020 could be reached in only a few years (between 2012 and 2014) but this speculation could have had two main undesired consequences:

-The development of a national and professional industry could be affected.

-The financial impact of the incentives granted by the government could reach undesired levels.

Facing the potential for this situation, the French government has had to implement some adjustments. One of the most visible initiatives taken to organize the sector--although still to be improved--was the creation of QualiPV, a quality label for installers to help final customers with their choice. In the meantime, product certification has emerged to help prevent low quality products from entering the market.

To complement these decisions, the FiT level is also being reevaluated and was lowered in September 2010 (Figure 2). It is expected to be redefined again in the near future as the government wants to control the weight of the PV sector on public finances.

These decisions resulted in many complaints by PV investors who deplore the lack of visibility in the PV market. In the context of a possible new cut in the FiT for 2011, the market now seems to be immobilized and many investments are frozen and waiting for the government’s next move.

What’s Next?

Two main scenarios can be considered for the following months.

The first one would be a significant step back by the government in terms of renewable energies with a strong reduction of the FiT and of the tax incentives. This scenario recently occurred in Spain with devastating consequences for PV actors. However, this scenario is very unlikely to happen in France. On one hand, many national companies have already invested a lot of money in the PV industry and many jobs are directly connected to the evolution of the PV market. On the other hand, public opinion is still demanding of some adaptation of the energy policy. With major elections planned for the beginning of 2012, undoubtedly the present government will not risk upsetting a more and more significant part of the voters.

The second and most likely scenario is an adaptation of certain rules to contain speculation and give the market time to be structured. This would allow time for competitors to prepare for the second part of the game and make the most of this promising opportunity.

Eric Prinet is the North American Managing Director for France Nouvelle Energies (FNE) (www.francenouvellesenergies.com). FNE is specialized in the French renewable energy market and provides operational support and independent consulting services to companies that want to develop their business in France. Every year FNE conducts the most comprehensive and data driven study of the French PV Market (500 installers contacted).

For more information, please send your e-mails to pved@infothe.com.

ⓒ2010 www.interpv.net All rights reserved. |